Jensen tried 📈

Tata's dominance, more IPOs, and Bitcoin outta hands.

☀️ Happy Thursday.

We’re back at it. If you’re surprised, here’s a note from yesterday.

🗳️ Maharashtra headed to the polls yesterday with 65% turnout—most exit polls suggest a status quo or an indecisive mandate.

Markets were closed yesterday, but a few things worth going over from the $ world.

Let’s hit it.

1 Big Thing: Tata buys Pegatron in India 📱

Tata Electronics will buy 60% stake of Taiwanese contract manufacturer Pegatron’s iPhone plant in Chennai.

Why it matters: the Taiwanese had stepped in to help Apple move its manufacturing away from China after COVID. But working in India likely came with a caveat: it would ultimately require close collaboration with local partners.

This acquisition will make Tata the only company besides Terry Gou’s Foxconn to assemble iPhones in India.

The Chennai plant under Tata will employ 10,000 workers and produce ~5 million iPhones annually.

Worth noting: Tata already runs an iPhone assembly plant in Karnataka, acquired from Wistron last year, and is constructing another facility in Hosur, Tamil Nadu.

Big picture: India will make nearly 20-25% of all iPhones sold this year, more than double of last year.

Which begs the question—if India can do this for Apple, masters of precision and quality, what’s stopping us from doing it for others?

2: Nvidia falls flat 👎

In all honesty, it could’ve gone worse. Nvidia’s quarterly earnings report failed to get Wall Street too excited.

Jensen Huang did his best. Revenues grew 97% YoY to $35 billion, as big tech giants continue to pour money on AI chips. Profits are through the roof—at $20 billion for the quarter, up 100%+ YoY.

🤯 In the numbers:

In 2 years, Nvidia’s data center segment grew revenue from $3.8 billion to $30.8 billion this quarter—a 700% increase since ChatGPT launched. Such growth doesn’t happen often.

Despite a solid report overall, stock was down 2% in after-hours trading—a sign of high expectations and already sky-high valuations.

What’s ahead: markets are counting on Nvidia’s newest chip, the Blackwell platform, to drive a replacement cycle in 2025. Jensen says orders are booked out for next 12 months.

Quick fact: the biggest GPU cluster in the world was developed by Elon Musk’s xAI, utilizing 100,000 Nvidia GPUs, in just 122 days few months back.

3: Retail IPO that could dazzle 👗

Vishal Mega Mart will go public in an ₹8,000-crore IPO in mid-December.

Previously planned for November-end, the deal was pushed back due to volatility in the markets.

What matters: VMM is the king of organized small-town retail, running nearly 626 low-cost departmental stores catering to an expanding lower-middle class, which has tremendous appeal for growth investors.

In addition to aggregating the merch, the company also sells its own brands, with nearly 19 of such self-owned brands reporting over ₹100 crores in sales.

For FY24, the company reported over $1 billion in revenues, with decent profitability.

Revenues grew roughly 18-19% YoY, displaying respectable momentum despite e-commerce headwinds.

Zoom out: BCG says India’s retail market could top $2 trillion over the next decade. E-commerce is growing, but large majority of the country continues to embrace offline.

4. Who got the bag? 💰

Ritesh Agarwal will inject more cash into Oyo through his investment vehicle Redsprig Innovation Partners. The round aims to raise $65.1 million, valuing Oyo at $3.8 billion, which is up 38% from June 2024. Oyo had recently acquired US-based Motel 6 for $525 million and plans to file for IPO within two months, marking its third attempt to go public.

Rapid food delivery startup Swish raised $2 million in seed funding led by Accel. Founded in 2024, and quite active on X, Swish applies the fast-food model with integrated delivery. They’re currently live in BLR and plan on scaling to 150+ kitchens in the city by March 2025.

What else are we snackin’ 🍿

🥊 Copyright showdown: ANI will sue OpenAI for using its copyrighted content without permission to train Chat GPT.

🚀 Bitcoin x Trump: Bitcoin crossed $94,000 for the first time, as the new U.S. administration plans on revamping digital asset policies.

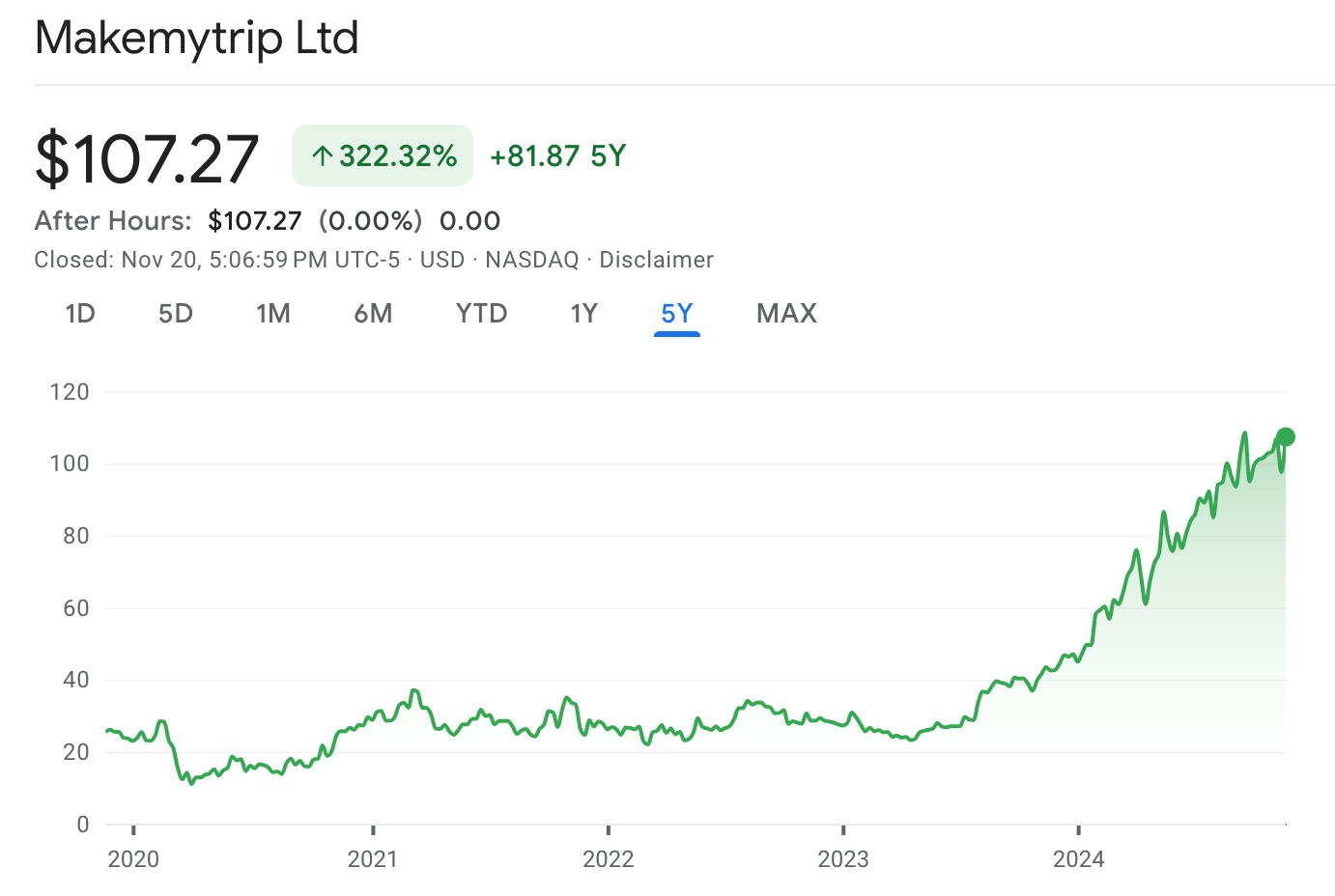

📈 Silent mover: MakeMyTrip will buy expense management platform Happay from CRED, possibly using it as a hook to get into business and corporate travel. MakeMyTrip stock has been on a tear.

That’s all for today.

Don’t be shy, hit that 💚 if you liked today’s issue.

Feel free to forward this email or share FC on social media using the button below. Thanks and ciao! 😀

Welcome Back Filter Coffee team!! You've been missed thoroughly.

I'd missed this for so long. All the best..hope you get lots of ad revenue