Zetwerk 🚀

Call ChatGPT, Cement merger, and Space alliance.

☀️ Morning!

🗓️ The last "real" Friday of 2024, and investors are busy booking profits.

📈 The Sensex dropped 1.2%, falling below 80K.

💰 The rupee is also feeling the heat, now over 85 against the dollar.

Call your NRI friends.

1 Big Thing: Zetwerk’s $90 million round 💰

Venture market is giving 2021 vibes.

Zetwerk, the marketplace for precision components and bespoke manufacturing, raised $90 million at a $3.5 billion valuation, from Khosla and some big funds.

$70 million of that was new money, $20 million was wired in March this year.

Zetwerk links up small manufacturers of specialized products with large corporations seeking industrial parts. It vets manufacturers, provides working capital and delivery, and takes a cut for the service.

Quick look at the numbers:

Annual gross volumes of $2.5 billion, up 35% YoY

Nearly 20% of GMV is from the U.S., mostly from customers shifting production from China to India

Fresh capital will go to make global roughly 40-50% of the business. An IPO is also on the cards.

Big picture: manufacturing exports are a $450 billion annual market in India. The opportunity to become India’s Alibaba for this space is up for grabs.

2. Hello, CHAT calling ☎️

Open AI is keen to get boomers to use AI, and will launch a voice-calling functionality for Chat GPT.

Users anywhere, starting with the US, will be able to call the service at 1-800-CHATGPT (1-800-242-8478).

This solves two problems for Open AI:

Gives the company a direct line to users, bypassing the toll seeking platforms “Google” and “IOS”

Allows the company to drive voice-usage, which is believed to be a key interface for AI

And of course, access to a user-base that still prefers old school calling.

While we’re on voice AI,

Vapi, a platform that allows developers to integrate Gen AI based voice-bots into any application, raised $20 million a few days back as the AI calling infrastructure market heats up.

AI agents linked to a phone are disrupting markets like customer service, outbound sales, and many more. Here’s a quick primer on the state of the industry.

3. Adani’s Cement Merger 🏗️

Adani Group is streamlining its cement portfolio by merging Ambuja Cements with two other companies it owns—Sanghi Industries and Penna Cement.

Context: Adani entered the cement sector in 2022 with the acquisition of Ambuja Cements. In 2023, Ambuja acquired Sanghi Industries for just under $600 million, followed by Penna Cement in 2024 for over $1 billion.

Once the deal is completed, all three brands will operate under the Ambuja name.

The consolidation is expected to streamline operations, reduce costs, and sharpen market focus.

Bottomline: the move solidifies Ambuja’s position as India’s second-largest cement player, helping the firm compete against cut-throat competition.

4. Stock moves worth watching 🚀

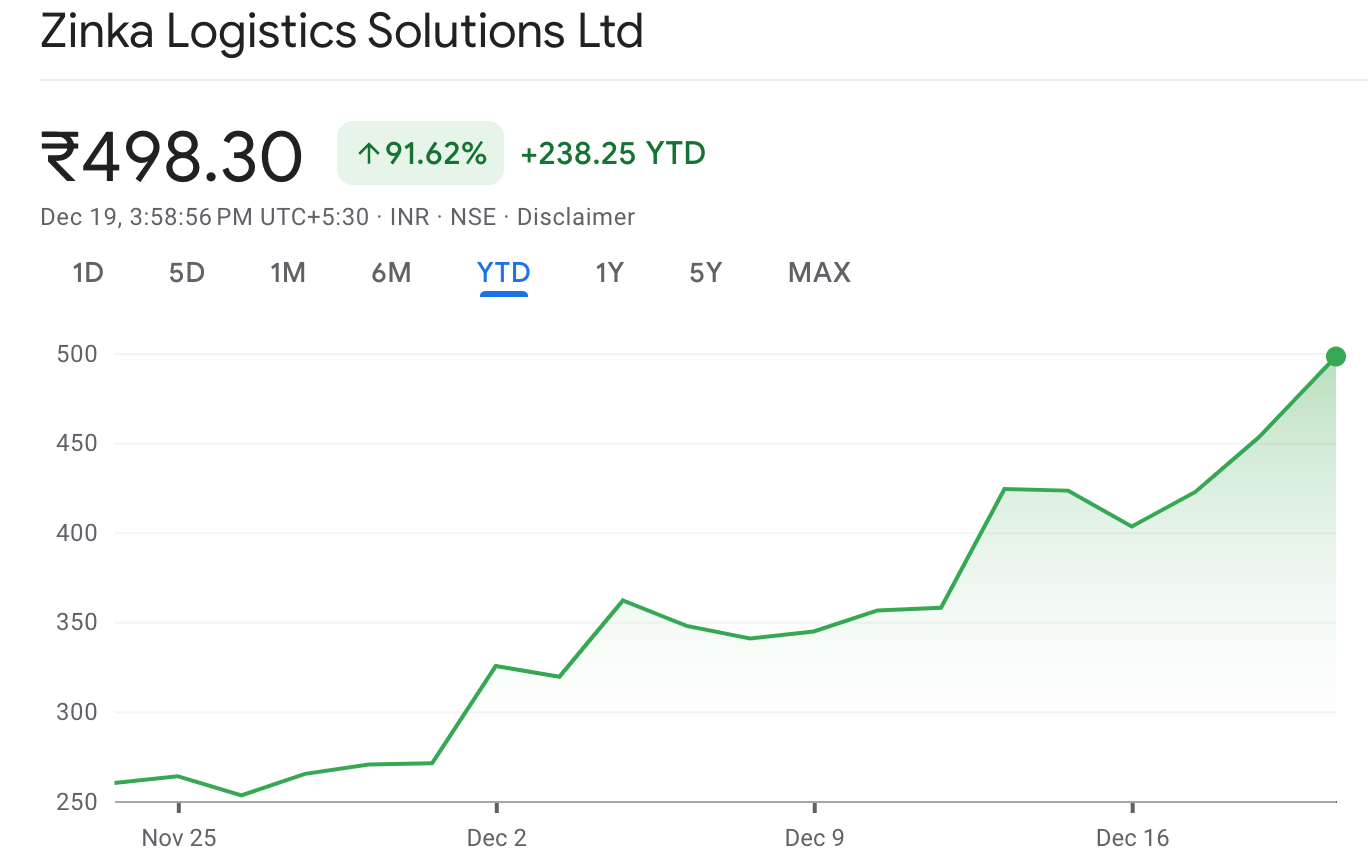

Blackbuck, the logistics services provider, popped 10% yesterday hitting upper circuit.

The trucking aggregator, which provides logistics and freight services, had IPO’d mid-November, and has since seen stock nearly double.

Also, the company’s quarterly earnings report which came a few days back has further energized the trade.

Revenues were seen growing nearly 54% YoY to ₹104 crores, with nearly 7 lakh truckers using the platform on a monthly basis, which grew 22% YoY.

Persistent’s stock hit a 52-week high on the back of a general belief that the consulting giants are going to the next beneficiaries of AI.

As Fortune 500 companies ramp up AI investments, they’re expected to heavily rely on Infosys, Accenture and the Persistent’s of the world.

By the numbers: stock has delivered 85%+ over the past year, significantly outpacing the Sensex’s 11.06%.

What is also helping is that the company has shown strong and improving sales growth, topping 20% YoY levels as of most recent quarter.

What else are we snackin’ 🍿

🚀 Space alliance: Pixxel, SatSure, and Dhruva Space are teaming up to bid for a ₹1,500-crore mega constellation of earth observation satellites.

🤖 AI arms race: Microsoft bought 485,000 Nvidia Hopper chips in 2024 to supercharge its AI infrastructure.

💳 Trade now, pay later: Paytm Money launched "Pay Later," allowing investors to trade 1,000+ stocks with low upfront capital and a 1% monthly interest.

👋 Amazon’s retail exit: Amazon sold its 4% stake in Shoppers Stop for ₹276 crore, selling nearly 44 lakh shares.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.