What exactly is SaaSpocalypse?

Climate-tech gets funding boost, M&M's biggest export deal, and India's maritime push.

🗓️ Morning, folks! ☀️

Indian markets kept the momentum going on Wednesday, finishing in the green and logging a three-week closing high.

Heavyweights led the charge and the broader market held up well, even as IT stocks took a sharp knock.

The Indian rupee’s two-day winning streak came to an end today, pulled lower by weakness in other Asian currencies and a fresh rise in commodity prices.

💡 Spotlight: India’s services sector kicks off 2026 strong 💪

India’s services PMI touched a two-month high of 58.5 in January, up from 58 in December.

Services PMI is a key indicator of activity in sectors like IT, banking, hotels and transport.

Why this matters: December had marked the weakest expansion in 15 months, so January’s pickup signals that things are improving. That said, the number is still slightly below the 2025 average of 59.4.

Let’s hit it!

1 Big thing: IT stocks slide on fresh AI fears 🌐

Shares of major Indian IT companies fell sharply on Wednesday, tracking a heavy sell-off in US software stocks overnight. Companies such as Infosys, TCS, Wipro, Persistent Systems and Coforge saw their stocks drop by as much as 8% during the day.

Together, these five IT stocks wiped out nearly ₹2 lakh crore in market value within the first half of the trading session.

What triggered the sell-off: the trouble began in the US markets, where software and technology stocks came under intense pressure after Anthropic, an AI company, launched a new set of AI-powered tools.

Anthropic introduced multiple new plug-ins for its AI assistant, Claude, that can independently carry out tasks such as document review, compliance checks and drafting legal briefs.

Indian IT firms earn a large part of their revenue by providing software services to US and global companies. They help build, manage and maintain systems used by banks, law firms, insurers and large enterprises.

Now what: this signals a shift in investor perception. Analysts now see traditional software and IT services as vulnerable to rapid AI-driven disruption.

A US-based brokerage firm even called the situation a “SaaSpocalypse” - a term used to describe widespread panic selling in software-as-a-service stocks.

2. Fresh capital flows into climate-tech 🌳

Climate-tech startup Varaha bagged $45 million from WestBridge Capital to fuel expansion.

What it does: Varaha develops projects that reduce and remove carbon emissions. These efforts are converted into carbon credits that companies buy to offset their pollution.

The why: the company aims to expand into new regions, improve how it measures and tracks carbon removal, and build partnerships with industrial companies. Varaha already has long-term carbon purchase deals with Google, Microsoft and a major US aviation firm.

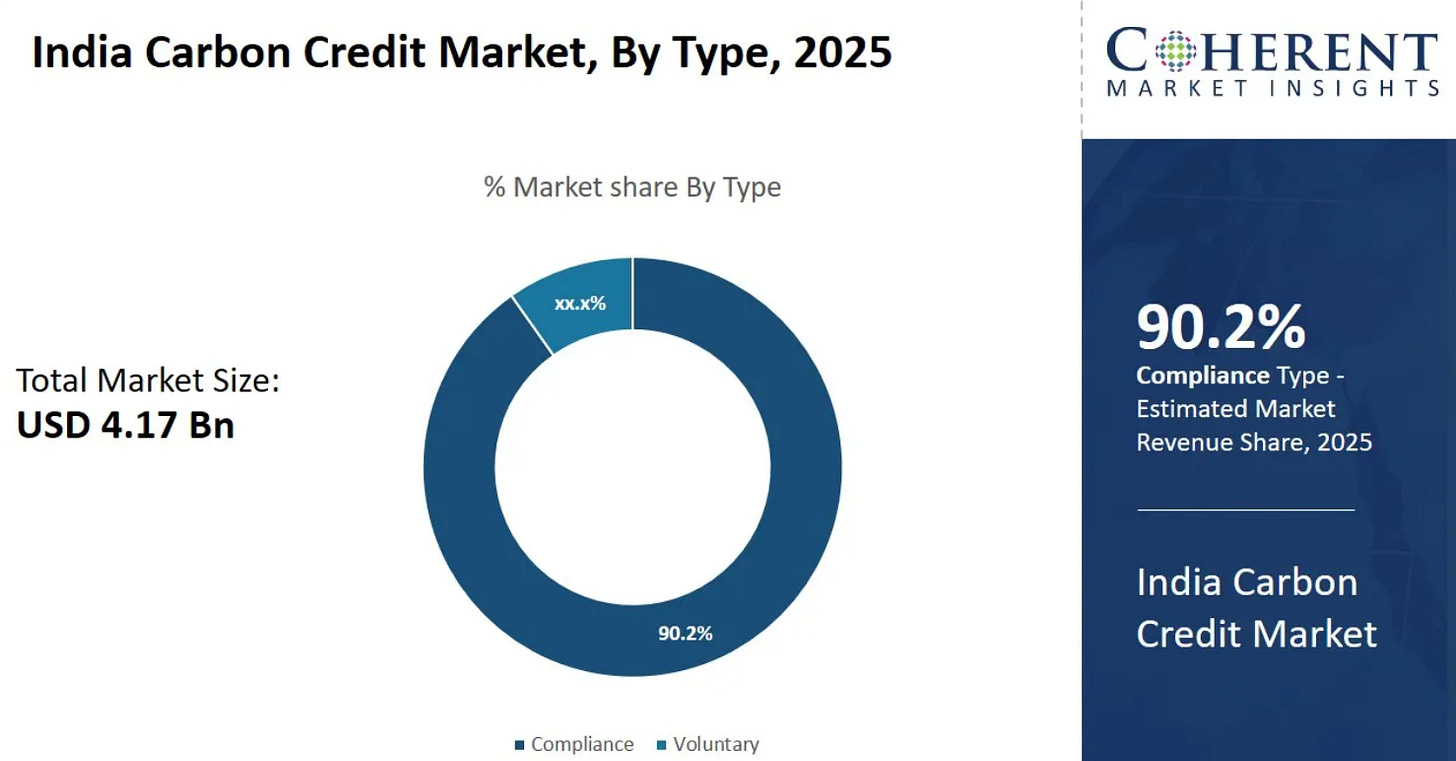

Zoom out: India already hosts nearly one in four carbon projects globally and is building a formal carbon market through its 2024 Carbon Credit Trading Scheme.

Fundraises like this can help scale credible carbon projects and verification systems, boosting India’s bid to become a carbon trading hub.

While we are on fundraises 💰,

Enterprise AI platform Loop AI has raised $14 million in Series A funding led by Nyca Partners.

Loop AI offers AI-powered software that helps restaurants and retailers run back-office operations, from deliveries to finance and marketing.

The why: the funds will support product expansion and hiring across New York, San Francisco, Tampa and Bengaluru, while deepening AI tools for profitable delivery.

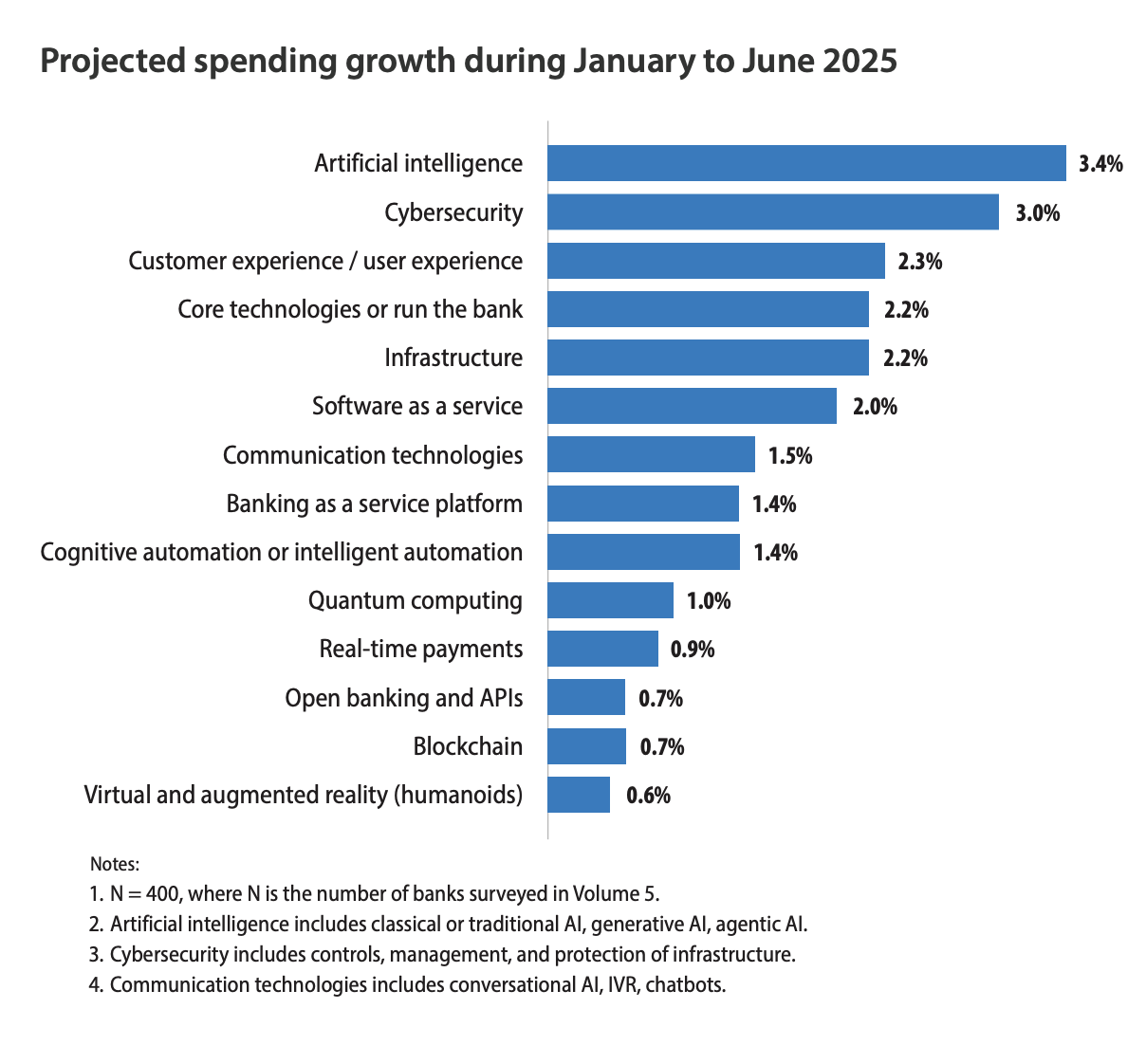

3. Infosys helps Citizens go AI-first 🥇

Infosys has announced a partnership with the U.S.-based financial company Citizens to launch an AI-first innovation hub in Bengaluru.

What’s the idea: help the bank use artificial intelligence more deeply across how it works, builds products, and serves customers.

Citizens is a full-service bank, offering retail and commercial banking, loans, credit cards, mortgages, and wealth management for both individuals and businesses.

So, why Infosys: the tech giant will bring its expertise in artificial intelligence, cloud computing, and cybersecurity to the table. It will help Citizens build scalable, AI-enabled systems that make it easier and quicker to roll out new financial products and digital services.

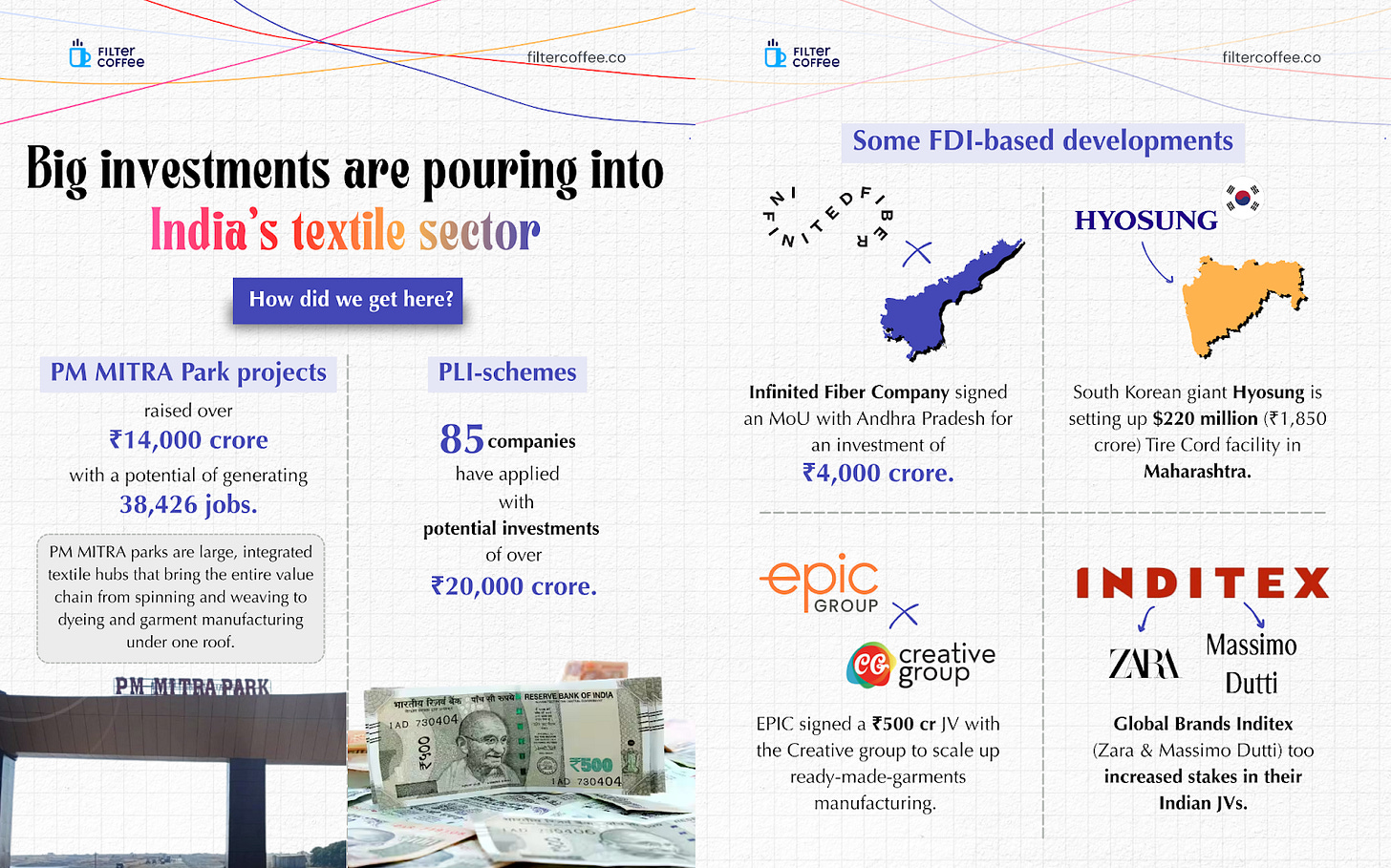

4. How India became a magnet for textile investments? 🧵

Big money is flowing into India’s textile sector, driven by policy push and global interest.

Government initiatives like PM MITRA Parks have already attracted over ₹14,000 crore, with the potential to create 38,000+ jobs. Meanwhile, PLI schemes have seen 85 companies apply with proposed investments of ₹20,000 crore.

The idea is to build large, integrated textile hubs that strengthen India’s competitiveness end-to-end from fibre to fashion.

At the same time, foreign investors and global brands are doubling down, backing the sector with fresh capital and bigger commitments.

5. Stocks that kept us interested 🚀

1. Why BHEL’s ₹1,500 cr order matters 🔌

Bharat Heavy Electricals (BHEL) has bagged a ₹1,200-1,500 crore order from Hindalco Industries for Aditya Expansion Project Phase II in Odisha. The stock ended more than 1% higher reacting to the update.

What’s the deal: the order covers end-to-end operation and performance acceptance testing of a 2 × 150 MW Boiler Turbine Generator (BTG) package.

The project will supply its own reliable electricity to the Aditya Aluminium plant, so it doesn’t have to depend on outside power.

What it means: this helps reliable power to keep factories running & prices stable. When a big plant makes its own electricity, it avoids power cuts and delays.

2. M&M gets export order boost 🚀

Mahindra & Mahindra gave the markets something solid to cheer about, with its shares jumping after the automaker announced its biggest export deal.

What’s happening: it has secured a deal to supply 35,000 units of its Scorpio Pik-Up to Indonesia’s Agrinas Pangan Nusantara, a state-owned Indonesian enterprise focused on agriculture and food security.

Why it matters: Mahindra said the order is larger than its entire export volume for FY25, marking a big boost to its global business. This also comes at a time when Mahindra’s broader auto business is in strong shape.

In January, the company reported total auto sales of 1,04,309 vehicles, up 24% YoY. Exports for the month also inched up 5% to 3,577 units.

What else are we snackin’ 🍿

✈️ MRO digitisation: HCLTech won a deal to help Hong Kong Aero Engine Services run its aircraft maintenance work on a modern digital system.

🚢 Shipping line: the government has signed an MoU to set up the Bharat Container Shipping Line, to keep India’s container trade in Indian hands and boost its global maritime presence.

₿ Bitcoin slides: Bitcoin fell to its lowest level of 2025, dropping below $74,424.95, extending its nearly four-month decline since Trump’s election win.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.