Waaree shines bright with record Q2

China claps back, F&B funding, and Gujarat’s green energy bet.

🗓 Morning, folks! It’s a new week.

💡 Spotlight: China hits back with port fees on U.S. ships

China on Friday clapped back at Washington with a “you charge, we charge” move.

Starting October 14, China will charge U.S. ships about $56 for every ton of cargo they carry when they dock at Chinese ports. This is roughly the same fee the U.S. recently imposed on Chinese ships.

The fee hike could raise shipping costs, squeeze U.S. shippers’ profits, and even bump up prices for American consumers.

This port fee clash could ripple into India in subtle ways. Higher global shipping costs may pinch Indian exporters in the short term. But the silver lining is as U.S. firms look to reduce dependence on China, India could attract more manufacturing and export orders, boosting its ports and trade flows.

Let’s hit it!

1 Big thing: Waaree shines bright with record Q2 profit ☀️

Waaree Renewables lit up the September quarter with its best-ever performance, thanks to sizzling project execution and fatter margins. The stock ended more than 2% on Friday.

By the numbers:

Revenue up nearly 48% YoY at ₹774.8 crore.

Profit jumped 117% YoY at ₹116.3 crore.

Order book saw a solid 3.48 GWp of solar projects waiting to be executed in the next 12–15 months.

The company also bagged 1.25 GWp of fresh solar orders this quarter and cleared plans for new solar power plants in Maharashtra and Rajasthan.

Why it matters: the result is not a one-quarter wonder, it’s part of a steady climb. The company has been consistently bagging and delivering large solar EPC projects, proving its ability to scale without losing efficiency.

With India’s renewable capacity racing toward the 500 GW mark by 2030, Waaree is positioning itself not just as a contractor, but as a long-term partner in India’s clean energy transition.

2. Lloyds Engineering partners with Poland’s FlyFocus for defence drones 🤝

Lloyds Engineering Works has signed a deal with Poland-based FlyFocus to co-develop the Defender SIGINT UAV. The stock gained more than 1% following the update.

FlyFocus is a European UAV specialist that develops unmanned aerial vehicles, avionics integration systems, and passive radar technologies for advanced intelligence and surveillance applications.

A SIGINT UAV is basically a drone designed to pick up and analyse electronic signals, like communications or radar to help with security.

The deets: FlyFocus brings its UAV design and avionics radar smarts. Lloyds Engineering will lead the localisation and manufacturing under the Make in India framework.

The Defender UAV will serve defence needs including border and coastal security to VIP protection and electronic threat detection.

Zoom out: India’s defence output now tops ₹1.27 trillion and exports have surged past ₹23,000 crore.

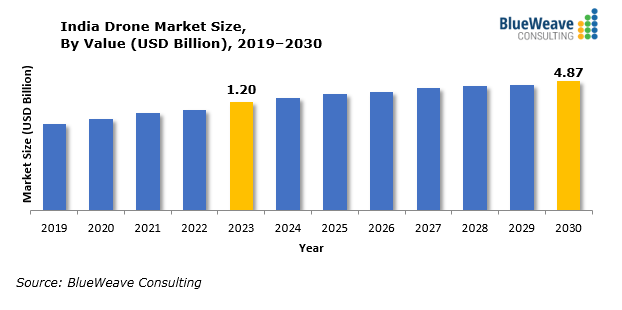

The drone industry has moved from niche to mainstream in just a few years. The market is currently valued at around $1.2-1.5 billion and is projected to grow to over $13 billion by 2030.

While we are on deals,

Sona BLW Precision signed a deal with Germany’s NEURA Robotics GmbH to co-develop advanced automation and humanoid robots for India and global markets. The stock jumped 4% intraday on the announcement.

Sona BLW Precision (Sona Comstar) makes auto parts and EV components used in cars and electric vehicles worldwide. NEURA Robotics builds cognitive robots and humanoids capable of learning autonomously for industrial and service use.

Note: the partnership marks the company’s first big leap beyond automotive into intelligent automation.

The deets: both companies will jointly develop robotics technologies, components, and sub-assemblies aimed at transforming industrial and service automation.

3. NTPC’s Gujarat pact to power India’s green leap 🌱

NTPC Renewable Energy has partnered with the Gujarat government to develop large scale renewable energy projects. Shares of NTPC Green Energy gained on the back of this news.

What’s happening: under the MoU, the company will develop solar parks and projects with a cumulative capacity of 10 GW and wind projects with a capacity of 5 GW.

Why it matters: for NTPC, this partnership marks a big leap in expanding its green energy portfolio and reinforces its role as a key player in India’s clean energy transition.

For Gujarat, the deal brings major investment and strengthens its position as one of India’s leading renewable energy hubs, powered by the state’s rich solar and wind potential.

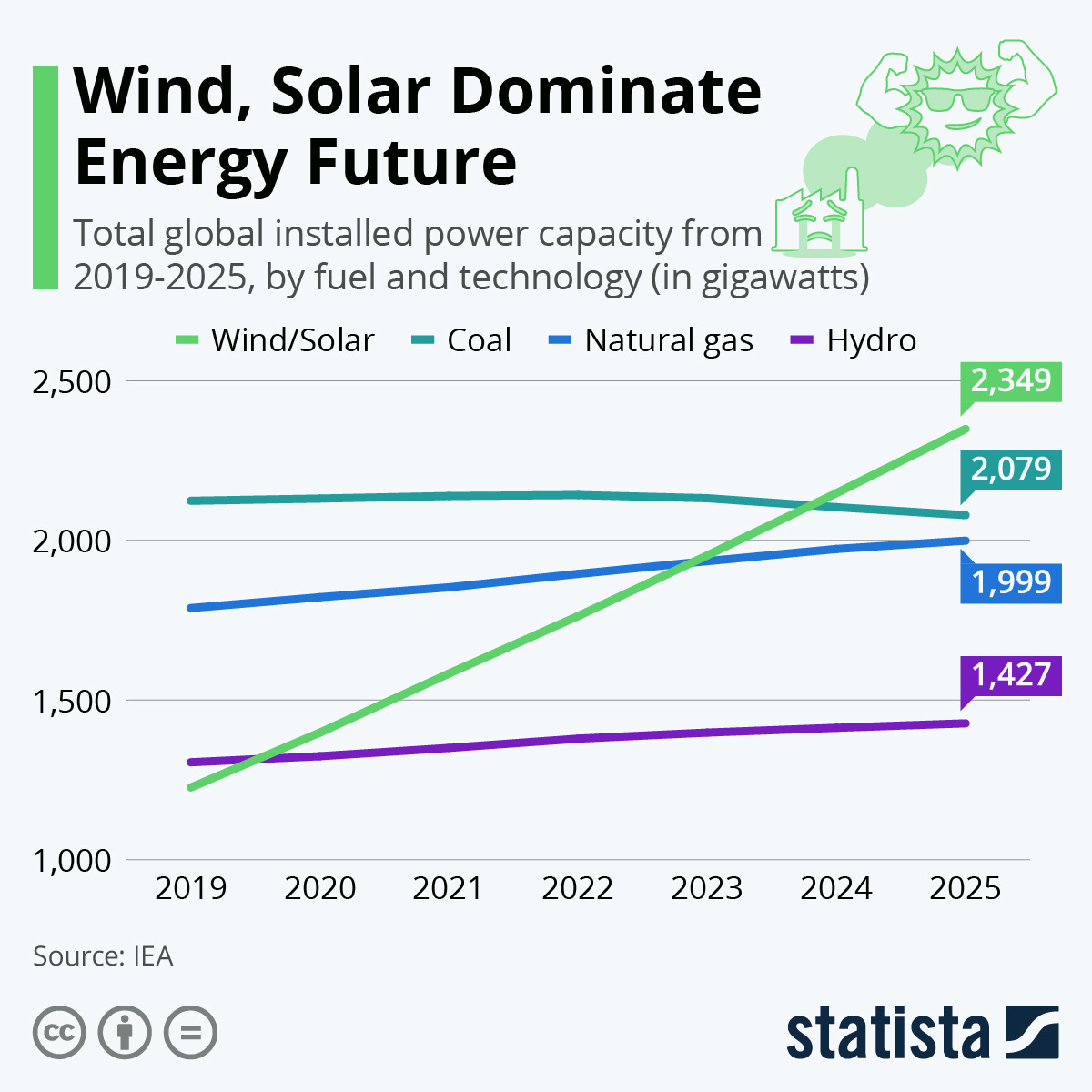

Big theme: wind and solar power are set to dominate the world’s energy mix by 2025, surpassing coal and gas in total capacity.

India has reached a major milestone in its energy transition, with 50% of its installed electricity capacity now coming from non-fossil fuel sources. Such large-scale initiatives bring India closer to its 500 GW clean energy target by 2030.

While we are on investments,

Avaada Group will invest ₹36,000 crore in Gujarat for solar, wind and battery energy storage system (BESS) projects.

Breaking it down: the green energy company will establish 5 gigawatt solar power capacity, 1 GW wind energy capacity and 5 GW hour capacity of BESS Projects in Kutch, Banaskantha and Surendrangar districts.

4. Bombay Sweet Shop’s parent gets a ₹215 cr boost 💰

Hunger Inc, the parent company behind Bombay Sweet Shop, The Bombay Canteen, Veronica’s, OPedro, and Papa’s, just got a sweet pre-Diwali boost, raising ₹215 crore in fresh funding.

What’s brewing: the capital will primarily be used for Bombay Sweet Shop, and they will not go aggressive on expanding the Bombay Canteen and O Pedro brands for now.

Currently present in Mumbai, Hunger Inc is planning to expand to Delhi and set up a flagship Bombay Sweet Shop there over the next 12-18 months.

At present, the brand operates five retail outlets and 18 dark stores.

Hunger Inc is cooking up big expansion plans, scaling its B2B and institutional sales. The company already supplies to Starbucks and Oberoi Hotels, and its Bombay Sweet Shop brand has now taken off with IndiGo, serving in-flight treats to international business class passengers.

5. Stocks that kept us interested 🚀

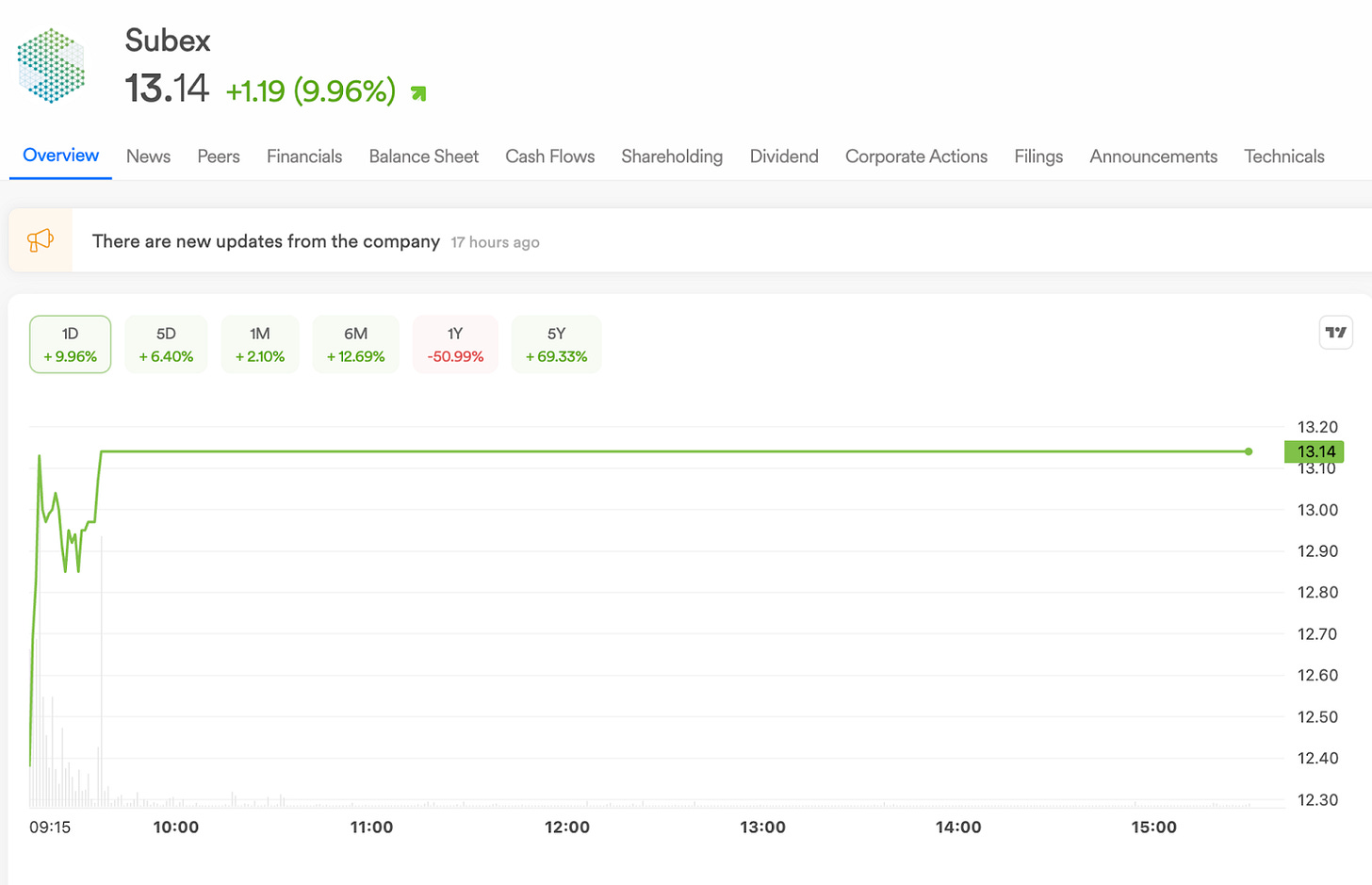

1. Subex partners with Netherlands for a $6.6 million telecom contract ☎️

Bengaluru-based Subex shares zoomed nearly 10% after it announced partnership with a major telecom provider in the Netherlands.

Subex is a leading telecom services provider that provides AI-based communication solutions to clients globally.

The deets: under the contract valued at $6.62 million, Subex would provide their client a platform for MVNO billing.

MVNO billing refers to a system a mobile network operator uses to process and track service usage and generate invoices. All this is done to ensure accurate billing.

Subex will provide end-to-end services from its UK datacenter and combine all the billings, ratings, and reporting from a single platform to improve efficiency and cut down costs.

Why this matters: India is the second largest telecommunications and IT services exporter in the world. Partnerships like this can help the country expand its global footprint and reach the top spot.

2. KPI Green Energy bumps up after power trade license 💡

Shares of KPI Green Energy surged nearly 5% after the company received ‘Category A’ power trading license.

Surat-based KPI Energy is a solar EPC solutions provider that builds, operates and maintains solar power plants.

What’s happening: the company has received the license from Gujarat Electricity Regulatory Commission. This will enable KPI Green Energy to trade power on the markets.

Power trading refers to buying and selling of electricity contracts just like any other commodity in the short-term energy market.

Why it matters: for a company like KPI that provides solar energy solutions, this could help them maximise their profit as the company can supply products when demand is high.

Big picture: India is the world’s third largest power market in terms of installed capacity and is growing at the rate of 8.8%. This capacity is expected to reach 817.5 gigawatt by 2030.

What else are we snackin’ 🍿

💉 Capacity boost: Jubilant Pharmova’s US arm will invest $300 million by FY28 to double sterile injectable capacity amid rising global demand-supply gap.

📊 Flow slowdown: equity inflows slip 9% to ₹30,422 crore in September as overall mutual fund flows turn negative this fiscal.

🌍 Voice of peace: Venezuela’s María Corina Machado won the 2025 Nobel Peace Prize for uniting the opposition and pushing for democratic change.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.