☀️ Morning, it’s Wednesday.

🔫 South Korea spooked the world by imposing martial law, which thankfully lasted only 2 hours, before lawmakers voted against it in a 190-0 vote.

💸 The S&P, rocked by that news, ended the day flat. The Sensex added 0.75%.

Let’s hit it!

1 Big Thing: More money, more problems 💰

The GST on "sin goods" like tobacco, cigarettes, and aerated beverages could rise to 35% starting December—marking the first major GST rate restructuring since its introduction seven years ago.

The deets: a panel of ministers responsible to make the recommendation proposed the hike and will present their suggestion to the GST Council, which meets on December 21 to decide on the changes.

The increase targets "sin goods," raising their tax rate from the current highest slab of 28%

The proposal also suggests rates hikes for products like readymade garments, cosmetics, and luxury items

Zoom out: GOI’s goal is to simply collect the most possible revenue on price-insensitive products like luxury and leisure consumables.

But: critics fear that the move could deter consumption, potentially weakening economic activity. Over-taxation is also likely to turn the over-spenders cautious, potentially shifting behaviors permanently.

Worth noting: the panel did recommend lower tax-rates to a few items, such as common use items, as well as exemptions related to buys like insurance. And the sin-goods increase is meant to make up for that revenue shortfall.

2. Meds in Minutes 💊

Flipkart is launching a rapid medicine delivery service, that will deliver prescription medication in under 10 minutes. This service will be part of ‘Flipkart Minutes,’ the company’s quick-commerce product.

What matters: Flipkart will partner with local pharmacies in metro areas to supply the meds, ensuring no licensing or regulatory hoops need to be jumped, while itself handling last-mile delivery.

Context: This isn’t their first pharma-rodeo. Flipkart had bought a funny-named player, SastaSundar in 2021 to build an online pharmacy operation, but like other centralized players (think Netmeds, Tata 1mg, etc) the model is simply not suitable for the localized, quick-commerce playbook.

Zoom out: India’s online pharmacy penetration is under 7% as of 2024, making the addressable opportunity quite attractive.

Big picture: quick commerce is rapidly heating up. Zomato recently raised $1 billion, Amazon is launching Tez, Zepto closed a new round recently, and Swiggy’s Instamart is loaded up on IPO $. Bring on the fights!

3. Big money goes to the AI chip party 🤝

Jeff Bezos and Samsung invested $700 million in an AI-chip company called Tenstorrent, valuing the project at $2.6 billion.

What matters: as the AI training chip market grows, Tenstorrent aims to offer cost-effective alternatives to competitors like Nvidia, while also building an open-source AI software stack aimed to enhance chip efficiency.

The company will launch a new processor every two years, and currently boasts client contracts worth $150 million.

Macro theme: Nvidia supplied over $90 billion worth of GPUs to AI data centers in the last 12 months. The unbelievable spend volumes, and thick margins, is attracting a broad range of competitors.

Meanwhile back home💰

Agrileaf, biodegradable dinnerware maker, raised ₹16 crore in a growth round, co-led by Capital-A and Samarsh Capital.

Agrileaf plans on using these funds to scale its operation to the US and Europe, build a consumer-facing brand from India.

4. SpaceX Takes Off 🚀

SpaceX is in talks for a secondary share sale that could push its valuation to an eye-popping $350 billion.

That would make the rocket company the world’s most valuable private startup, edging out TikTok owner Bytedance, valued at $300 billion.

What matters: as of October 2024, SpaceX had launched 105 missions this year, with projections for 40 more by the end of 2024. Falcon 9 rockets have run 96 of those missions—an unbelievable scale.

The tender offer will enable employees and early investors to cash out shares.

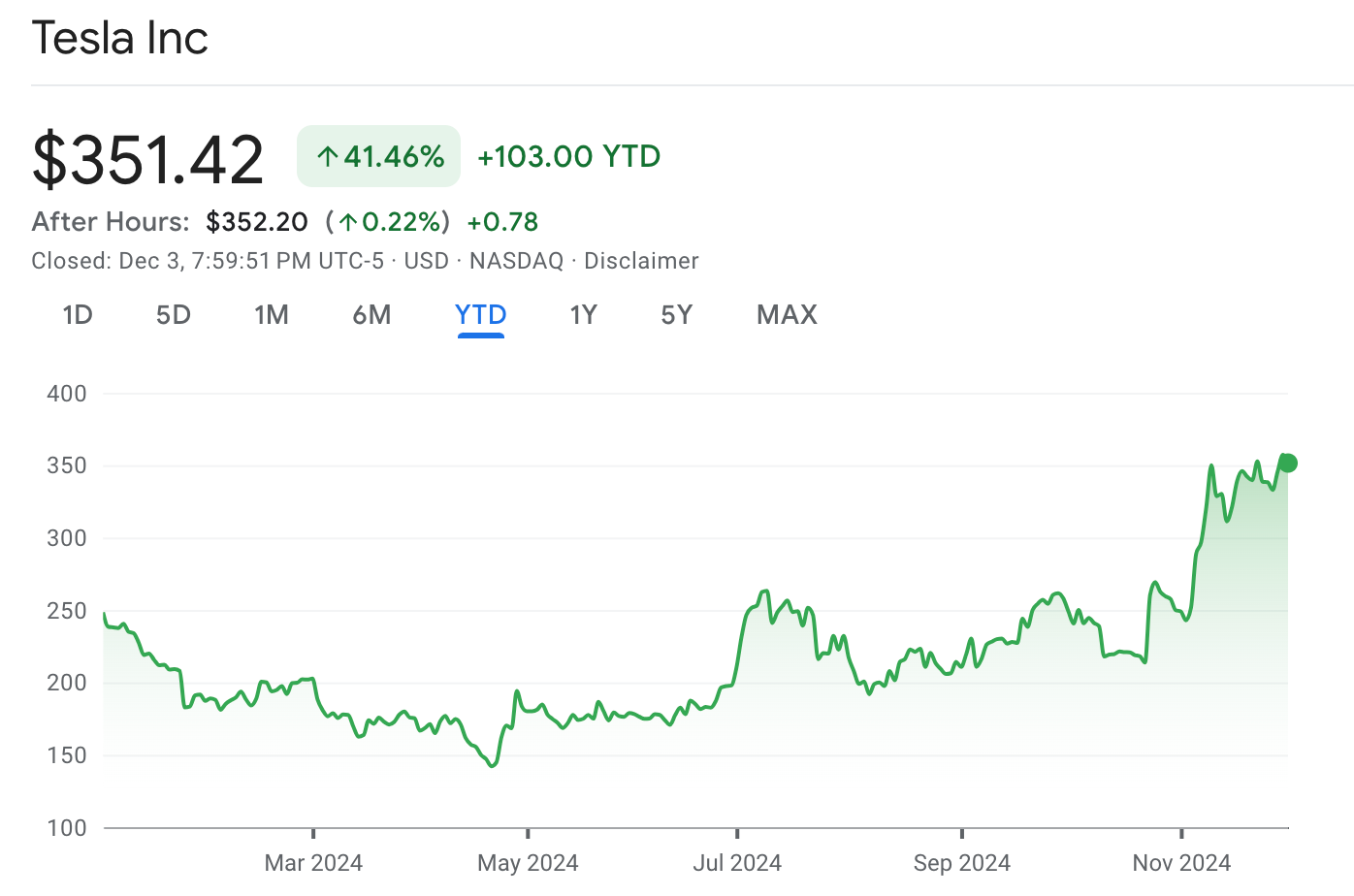

Zoom out: the unrivaled access Elon enjoys in Trump’s new term have bouyed his companies to new heights. xAI just raised at over $50 billion. Tesla is having the run of its life. Christmas came early!

What else are we snackin’ 🍿

👋 CEO stepdown: Intel’s Pat Gelsinger was fired as CEO after just 3 years, the company continues to struggle.

🌞 Energy revolution: Tata Power has commissioned a 431 MW DC solar farm in Neemuch, Madhya Pradesh, spanning over 1,635 acres.

🥊 Brand battles: IndiGo has filed a lawsuit against Mahindra Electric over the use of "6E" in its new electric vehicle, the BE 6E.

🚤 Navi in the clear: The RBI has lifted the ban on Sachin Bansal’s Navi and ended restrictions imposed on the NBFC back in October 2024.

That’s a wrap! Don’t let the Weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

Some interesting moves happening across industries!