Hi 👋, Tanvi here.

Filter Coffee hits your inbox every morning with notable tech and business news scoops to jump start your day.

Sign up below for free. 👇

Let’s go ahead and get started:

Market summary: 📊

Back to back down days in India as investors try to balance IPO exuberance with earnings reality. China taking on its tech companies sent chills on Wall Street and tech stocks were given a beating.

US:

S&P 500 - down 0.47%

Nasdaq - down 1.12%

India:

Nifty 50 - down 0.49%

Sensex - down 0.52%

What’s brewing hot? ☕

✅ I’d like to do more — space fascination is bringing generosity out of Jeff Bezos. Blue Origin tells NASA it will knock off up to $2 billion from the cost of developing a lunar lander, if it wins NASA’s contract for a comprehensive program that’s supposed to put humans on the moon for the first time since the Apollo program. Both SpaceX and Blue Origin are competing for the program.

✅ Choppy markets, but IPOs lookin’ good — the bid for Glenmark Life Sciences was oversubscribed by 2x on Day 1, with the retail portion filling up within an hour of doors open. GLS essentially makes active pharmaceutical ingredients (APIs), which are basically the lab-version of a medicinal drug, which is then scaled out to setup manufacturing processes, and get it to people. Biz made ₹1,500 crores in revenues, and ₹300 crores in profits last year. Here’s Bloomberg on the bid.

EV dreams getting funded ⚡

What happened — Lucid Motors, a Tesla rival, went public today on the Nasdaq via a SPAC merger, raising $4.5 billion from the markets. Stock popped 11%!

Lucid hasn’t sold a damn car yet, but that doesn’t matter when it comes to EV stocks! The company’s IP is believed to be top notch — especially its battery technology, which Lucid claims beats Tesla with a 800kms range with a single charge.

What’s next — Lucid’s first car is called “Lucid Air”, an expensive luxury sedan costing $80K+, which has gotten about ~10K bookings so far. First delivery is expected at the end of 2021.

Lucid is basically trying to be the Cadillac of EVs, targeting the high-end “luxury” segment — a category Tesla pioneered, but slowly abandons as it goes mass market.

$LCID worth it? — well with Ford, Volkswagen, Hyundai and the rest of the pack crowding the bottom of the pit, there’s definitely much less fist-fighting at the top. But, that’s IF Lucid can deliver a car on time, and proportionately scales deliveries.

Big IF, that took Tesla 13 years to get right, profitably.

SPONSORED

Get in on the hot stuff 🙌

Getting in early on credible top trends is a great way to accelerate wealth building.

Tesla is hot. Nike is the undisputed shoe king. Spotify is disrupting audio entertainment. Netflix is now entering gaming. Amazon is the new king of retailing. 📈

But the options to capture these themes and diversify via local markets can be limiting.

Stockal helps 1.25 lakh folks in India, as well as Indians in the Middle East and SouthEast Asia, break boundaries and deploy capital in the global markets.

With no account-minimums, free sign-up and fractional investing, you can get started for as low as $1. Check em' out!

What’s poppin’ on Venture Street 💰

Sharechat is killing it — the vernacular social network raised another whopping $145 million, revising valuation to over $3 billion, in a round led by Temasek and Moore Strategic Ventures.

That’s a 40% valuation bump in 3 months — and fresh funds will mostly be put to sustain the lead on the short video app Moj, which is apparently topping the charts with 75 million monthly active users, edging out MX TakaTak by 10 million.

Then turning heads to a HOT AF direct-to-consumer segment, 👌

Beauty brand MyGlamm, which is backed by Amazon — raised $71 million from big name investors including Accel and Bessemer.

Cosmetics as a category has been on FIRE since COVID, with the markets betting on a permanent shift away from offline retail (and the prying eyes of the neighborhood vendors), offering women consumers more choice and freedom.

Besides, the the wildfire lit by highly funded DTC roll-up companies is also heating up the game here.

Quick look at Adani’s mega raise, 👀

What happened — the Adani Ports empire was able to pull in $750 million in additional capital via a bond offering from the international markets.

Coupon rates for the 10 year and 20 year bonds stand at 3.5% and 5% each, and the bid was oversubscribed by nearly 3 times. While it’s unclear where the $$ is going, there’s a healthy roster of projects on hand, as well as an acquisition mandate to pursue.

Why care — kinda amusing that despite the overhanging regulatory scrutiny, and risk of volatility to the stock, international optimism on India and then Adani’s role in shaping it remains unhinged.

Closing out — Kings met at the top of the hill 👑

Big Tech giants have been around forever, but those cash machines are churning some serious growth rates that’d put the sharpest of unicorns to shame!

Quick rundown of the second quarter performances:

Google freaking killed it. Total revenue up 66% YoY. But most importantly, YouTube grew sales by 85%+ — Displaying incredible momentum. Investors rewarded the stock by 5%.

Microsoft delivered too — with cloud computing boom looking great, but the party turned a bit sour as Xbox revenues and Surface growth declined a bit.

And then Apple, which somehow convinces users they need a $1,000 device even in the middle of the biggest economic crisis of our lifetime — saw revenues jump 36% to $81 billion!! iPhone sales jumped more than 50%!!

Unless your a perma-skeptic, its hard to find one obvious catalyst on the horizon that could suggest growth slowing down for these giants.

Tomorrow comes Amazon and Facebook, but the stakes have been raised now!

Tweet of the day 🐦

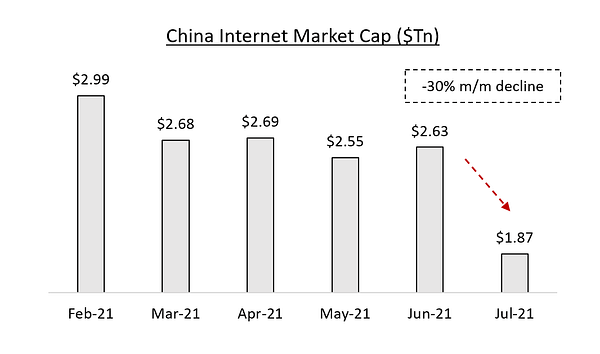

Global markets continue to dump Chinese stocks as governments beef up scrutiny. Or is it a great buying opportunity?

What else are we snackin’ 🍿

🤙 Call mission control - Jaguar is setting up a dedicated mission control center to tackle semiconductor shortages.

😎 Big one - GOI is planning on bringing the LIC IPO during the fourth quarter of the ongoing financial year.

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀