🗓 Good morning, blink and it is mid week.

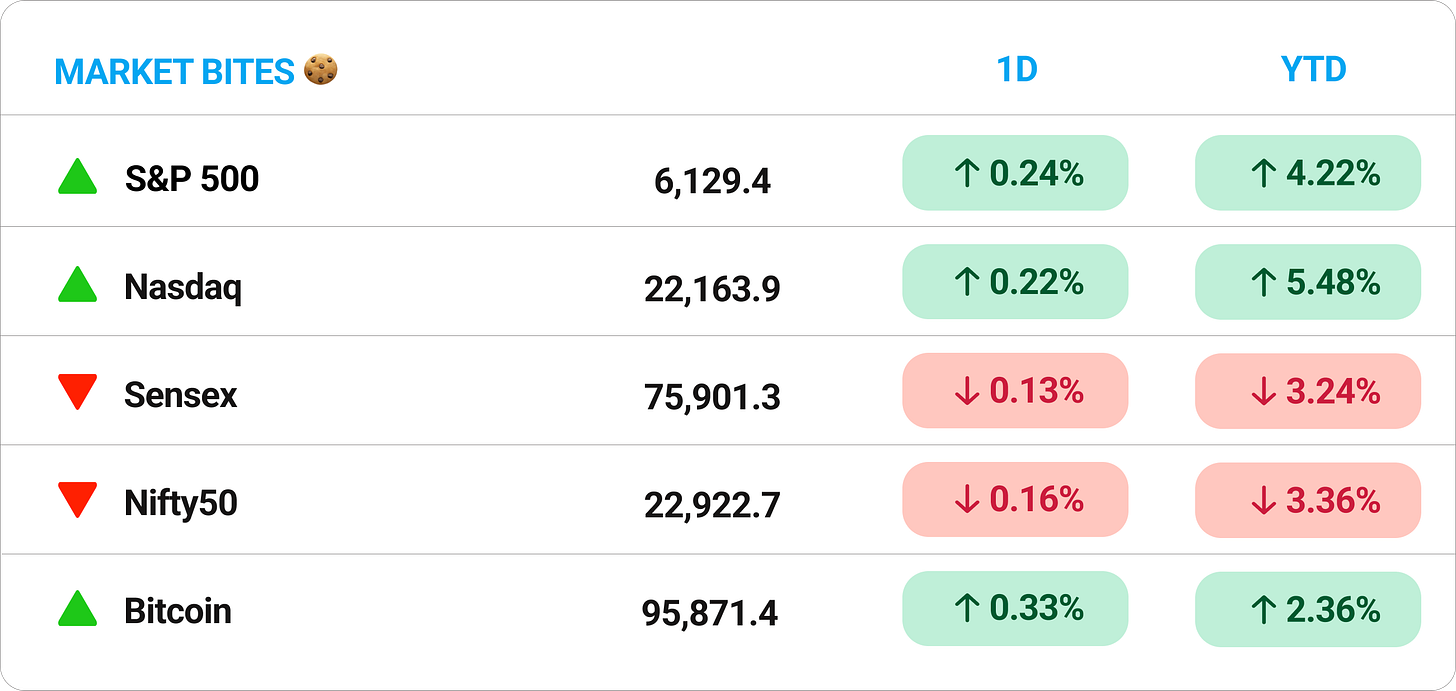

Markets appeared shaky on Tuesday, with both Sensex & Nifty ending the day flat.

Back in the west, earnings optimism is helping shake off Trump’s tariff scare, with the S&P 500 closing at another all time high.

💡 Spotlight: as earnings season nears its end, Indian companies just posted their slowest revenue growth in five quarters, net sales for 382 firms in the BSE 500 index rose just 4.1%, the weakest since September 2023, per Moneycontrol.

Another data point that suggests a potential slowdown in the works, limiting markets year to date.

Easy news day today, let’s hit it. 🚀

1 Big Thing: Tesla takes the India turn 🚗

Days after Elon Musk’s meeting with PM Modi, the EV giant posted 13 job openings on LinkedIn, signaling that its long-awaited market entry might actually be happening soon.

The deets: the listed jobs span service advisors, managers, and sales advisors. Majority of the roles are open in Delhi and Mumbai, signaling potential new showrooms in those metros.

Why now: India recently slashed import duties on high-end EVs priced above $40,000 from 110% to 70%, which makes conditions more favorable for Tesla.

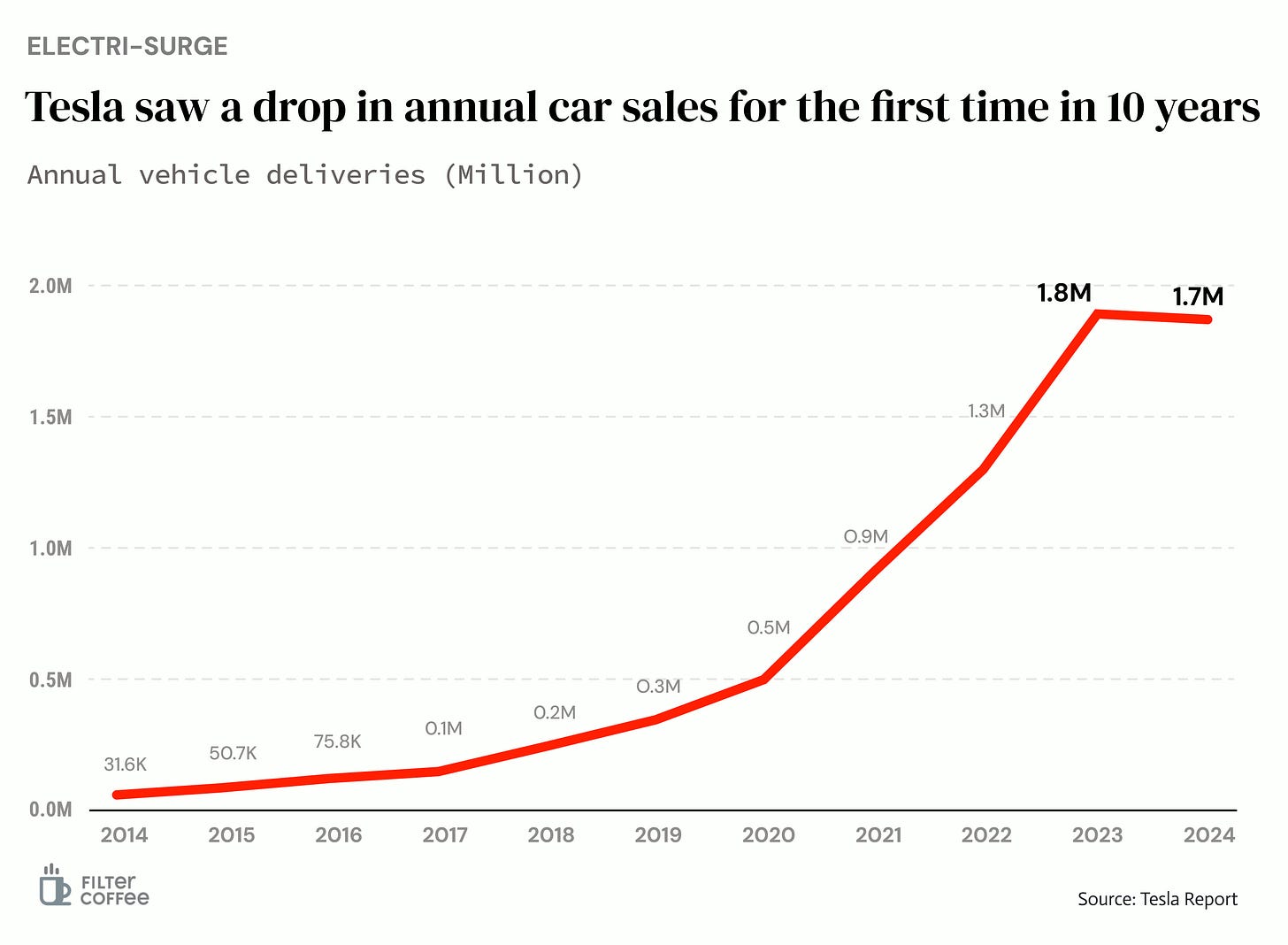

But here’s the mega trend: for the first time in history, Tesla saw a decline in EV sales on an annual basis, signaling maturity in its core markets (read Europe, US, and China). India has all the potential to help them buck this trend.

Zoom out: India is still a small EV market, with just under 100,000 electric cars sold last year, compared to China’s 11 million. But with a growing base of affluent buyers in India, Tesla may in fact be competing with other luxury brands on factors beyond just electrification.

Meanwhile, back home, auto giants like M&M, Bajaj Auto, and Hero Moto were among the top Nifty losers after Tesla officially posted its hiring update.

2. Uno reverse in the D2C world 🚨

Sirona, a startup that provides feminine hygiene products, has officially reclaimed its brand from Good Glamm Group, marking a rare case of a startup buying itself back post-acquisition.

Context: Good Glamm initially bought a majority stake in Sirona for ₹100 crore in 2021 and fully acquired it in October 2024 for ₹450 crore in an all-cash deal.

However, the acquisition was marred by disputes over delayed payments, forcing Sirona’s founders to issue legal notices, pursuing a messy corporate fist fight.

What went wrong: Sirona's co-founders had filed a default notice against The Good Glamm Group for failing to make the final payments related to the acquisition six months before the final transactions.

Zoom out: Good Glamm, once a content-to-commerce darling, has been facing financial strain, high cash burn, and a series of executive departures.

Worth noting: not that long ago, The Good Glamm Group was valued at over $1 billion.

3. NTPC goes big on Nuclear ☢️

NTPC, which is one of India's leading power generation companies, is planning to build 30 GW of nuclear power capacity, tripling its original 10 GW target, in a $62 billion expansion push.

The move follows the government’s decision to open the sector to private and foreign investment.

The deets: two power plants, totaling 2.6 GW, are already under construction in Rajasthan and Madhya Pradesh.

For the proposed expansion, the company is scouting land across major central and Western Indian states.

Why it matters: India has committed to 100 GW of nuclear power by 2047 as part of its broader 500 GW non-fossil fuel push.

But nuclear expansion has been slow, limited by the Atomic Energy Act of 1962, which bars private investment, and strict liability laws that deter foreign suppliers.

But the recent budget tried to change that, including amending laws, and a ₹20,000 crore investment targeting small modular reactor (SMR) research, with at least five reactors expected to be operational by 2033.

Nuclear has generally been a hot theme. We wrote about that a while back.

4. Meat me on Dalal street 🍖

Licious, the Temasek backed meat and seafood delivery startup, is eyeing a $2 billion IPO.

Nearly 75% of India's population still buy their meat and fish from mom and pop shops. Licious is betting on the new consumer class willing to pay more for speed and convenience.

By the numbers: the company has been tightening its financials ahead of the listing, but is still likely going to fall short.

Revenue hit a mere ₹850 crore last year, with a monthly run rate now at ₹72 crore. Losses have been cut by 44% to ₹294 crore over two years, and burn rate is down to ₹12 crore from ₹26 crore.

Licious processes 1.2 million orders monthly, with over 90% repeat customers.

Big picture: India’s fish & seafood market reels in $58.9 billion annually, while the meat market is worth $26 billion. With growing urban demand, Licious is betting big on convenience.

5. Who got the bag? 💸

Spyne, an AI-powered product display tool, raised $16 million in a Series A funding round led by Vertex Ventures.

The deets: Spyne helps businesses create high-quality product images without expensive cameras, studios, or photography skills—think AI-powered product photoshoots at scale.

Spyne currently serves over 1,200 dealers globally, with 70% of its business coming from the US and another 25% from Europe.

While we’re on fundraises…

Devices-as-a-Service (DaaS) platform Swish Club secured $4.5 million from Powerhouse Ventures in a pre-Series A round.

The AI-driven platform is known for being India's first digital platform offering laptop rentals for enterprises and smartphone leasing for corporate employees.

What else are we snackin’ 🍿

💰 Micro moves: SBI Mutual Fund launched a micro SIP of ₹250 for first-time investors under the Jan Nivesh Scheme.

🤖 Musk’s bot: Elon Musk’s xAI rolled out Grok 3, its latest chatbot model, designed to generate more human-like responses. It beats OpenAI’s flagship models on several key benchmarks.

📈 LG’s listing: LG Electronics has started roadshows for its Indian unit’s $1.5 billion IPO, which could value the company at a whopping $15 billion.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.