☕ Starbucks Bets Big on India

$SBUX hopes a thousand stores in India could solve its growth problems.

Not too long ago, a ₹300 coffee was considered too fancy for most Indians.

Today, it's a casual indulgence for the average urban consumer.

The shift perfectly captures India’s explosive consumerism of the past decade. And Starbucks is betting that we have long ways to go.

What's the deal?

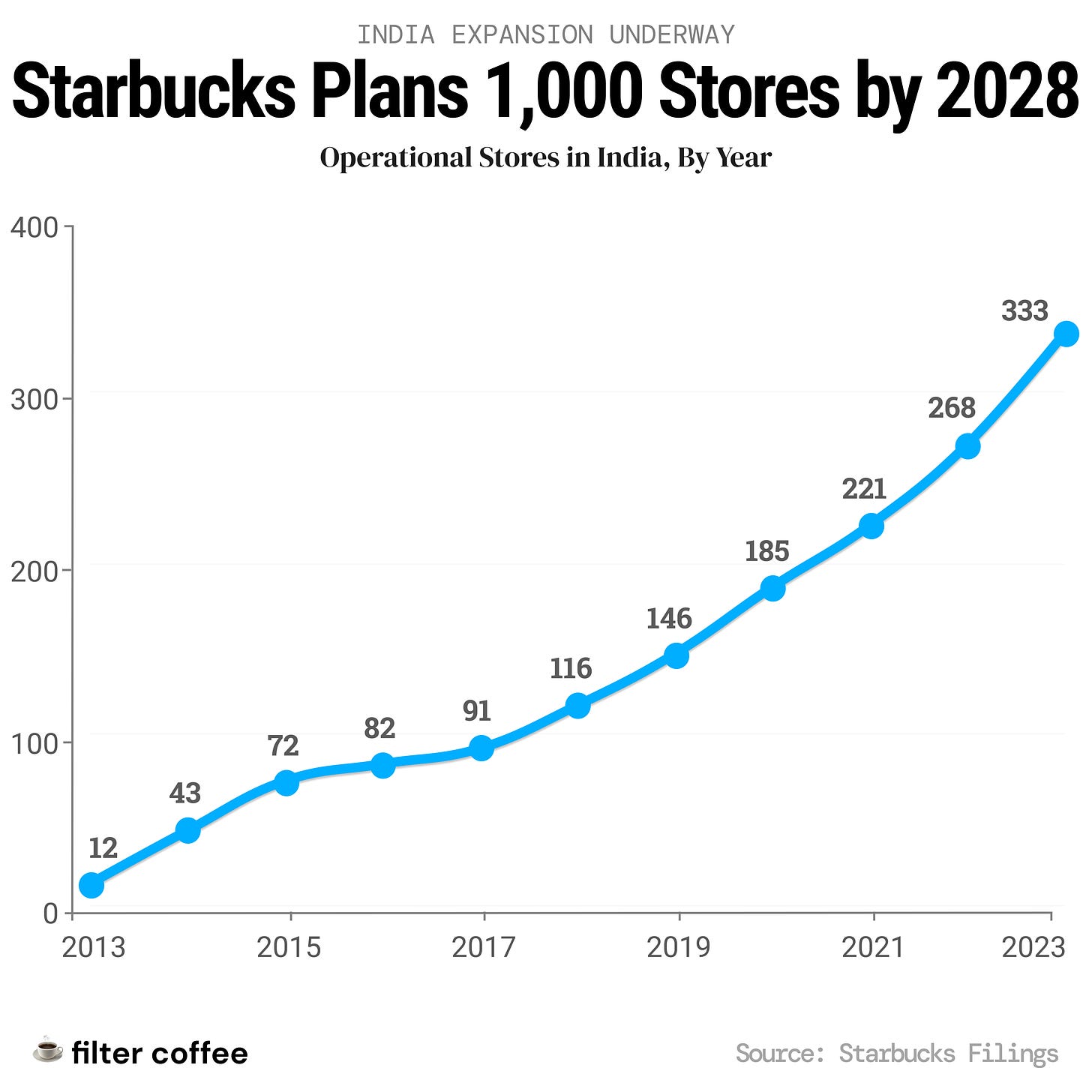

Few months back, Starbucks CEO Laxman Narasimhan announced plans to more than double their coffee shops in India — from around 400 currently to 1,000 over the next 4 years.

Their expansion target? Tier 2 and 3 cities and towns countrywide.

And they've got a solid partner in Tata to make this happen. The Tata-Starbucks joint venture kicked off way back in 2012, marking Starbucks' entry into the Indian market.

The big picture

We will spend a whopping $900 million on coffee in 2024. That number is expected to cross $2 billion by 2032.

Currently, over 50% of our coffee consumption is instant coffee in home, but that is slowly changing.

The average Indian consumes only 30 cups of coffee per year, compared to the global average of 200 cups. Room for improvement is big.

Starbucks wants to make that shift happen. But they're not alone. Local rivals like Third Wave, Blue Tokai have opened 150 stores in the last 3 years alone.

Bigger problems

Despite raking in record revenues of $29.5 billion last year, SBUX 0.00%↑ has been on a downward spiral. Investors are angsty.

Two main reasons:

Their same-store sales are dropping, stalling revenue growth and worrying investors that the company is losing focus on core consumer.

Competition is heating up, especially in major markets like the US where customers have plenty of options.

Narasimhan believes global expansion and experimentation could be the way forward. Investors suggest focusing on core coffee offerings and fixing store-experience should be the smarter play.

Zooming out

Starbucks' bet on India is reminiscent of their bold move into China a few decades ago when the country had similar favorable conditions — a growing middle class, love for American brands, and rising spending power.

China brings in over $3 billion in annual sales for Starbucks, which is over 10% of the company’s total revenues.

For the coffee giant, India needs to rapidly become the next China. Otherwise, Narasimhan's job might just be on the line.