🗓 Good morning, the dip keeps dipping…

The market has been gripped by trade war fears. Trump’s 25% tariffs on Mexico & Canada kicked in Tuesday, sending markets tumbling.

The S&P 500 has now given up all gains since Trump assumed office. The Nasdaq saw one of the harshest declines in recent history, losing 10% in roughly 10 days.

Back home, after a sharp fall on Tuesday, Nifty recorded the longest losing streak on record, falling for 10 straight days.

By mid-day, China and Canada hit back with 10-15% tariffs on US food and agricultural products. Mexico’s President Claudia Sheinbaum said the country is ready to retaliate.

The western economy has been officially grasping for breath as well.

1 Big Thing: The Trump slump 🍊

Donald Trump appears hell bent to push the U.S. economy into a recession. From his POV, if that’s what it takes to pressure global nations into paying their "fair share" to access the American market, so be it.

Context: for all his flaws, Joe Biden handed Trump a strong economic engine: steady growth, a stock market at all-time highs, and a relatively stable labor market.

But… as they say, the stock market is not the economy. Critics argue that Biden’s boom was fueled by debt-led government spending, which also drove inflation higher, and left the U.S. in a weak fiscal position.

Meanwhile, interest rates remain at record highs, and young Americans continue to struggle with essentials like housing affordability.

Here’s Trump’s grand plan:

Bring manufacturing back to the U.S. — Use tariffs as leverage to force companies to shift production stateside, creating jobs for the masses.

Crash the economy (or Wall Street) — Pressure the Federal Reserve (under "Uncle Powell") to slash interest rates in response to a downturn, making loans cheaper, again helping the masses.

And it might be working. The stock market is entering a downturn, chipping away at the wealth of pensioners and savers. Meanwhile, GDP growth is projected to contract, with estimates suggesting a decline of over 2% in Q1 2025.

While the Trump economy may stink early in his term, it could eventually give him an easy win later—letting him take credit for a rebound. It’s a weird playbook. But classic Trump.

Big picture: as the orange man figures out his moods, the ripple effects it creates for global economies, including that of India, dependent on the dollar and the U.S. consumer engine, could be catastrophic.

2. Europe lifts India’s defence sector 🛡️

It was a good day for India’s defence sector yesterday, with defence stocks surging almost 7%. BEL, Cochin Shipyard, and Bharat Dynamics led the gains.

The boost came after European defence stocks soared after regional leaders pledged to increase military spending amid rising geopolitical tensions.

What triggered it: Ukrainian President Zelensky’s meeting with the US President fell flat, and with Trump suspending military aid to Ukraine, Kyiv is refusing a ceasefire without security guarantees.

This uncertainty pushed Europe to ramp up defence investments, triggering a broader rally across the sector.

Why it matters: when global defence spending rises, Indian military manufacturers gain traction.

More European investment means higher export opportunities for Indian firms, strengthening both domestic and global demand.

Investors are taking notice. With India already scaling up its defence production, this trend could keep the sector hot for the long run.

3. TSMC’s $100 billion chip bet 💾

Taiwanese chip giant TSMC is doubling down on U.S. manufacturing, pumping $100 billion into expanding its semiconductor production.

Why this matters: TSMC is the world’s largest and most advanced chipmaker, supplying semiconductors for smartphones, AI, EVs, and high-performance computing.

Context: TSMC had already pledged $65 billion to build three chip factories in Arizona under Biden’s administration.

This fresh investment will expand production capacity further, adding two more high-tech plants, focusing on 4nm chip manufacturing—some of the most advanced semiconductors in the market.

The why: this move is widely seen as a hedge against potential U.S. tariffs on semiconductor imports from Taiwan, proposed by the Trump administration. By pulling chip production closer, the U.S. is reducing reliance on Asia, and TSMC is making sure it stays ahead of the curve.

Big picture: the global semiconductor market is set to hit $702.41 billion in 2025, growing 8.71% annually through 2029.

4. Zydus’ one-shot solution 💉

Zydus Lifesciences is working on a first-of-its-kind combo vaccine for typhoid and shigellosis.

Both infections hit children the hardest and if successful, this could be a major breakthrough in public health. This aims to simplify immunization and expand coverage.

While separate vaccines for the two diseases already exist, a combo shot simplifies the process and makes immunization more effective.

Big picture: with India’s vaccine market expected to hit $1.31 billion in 2025, innovation in immunization is a growing opportunity.

5. Big daily movers 🚀

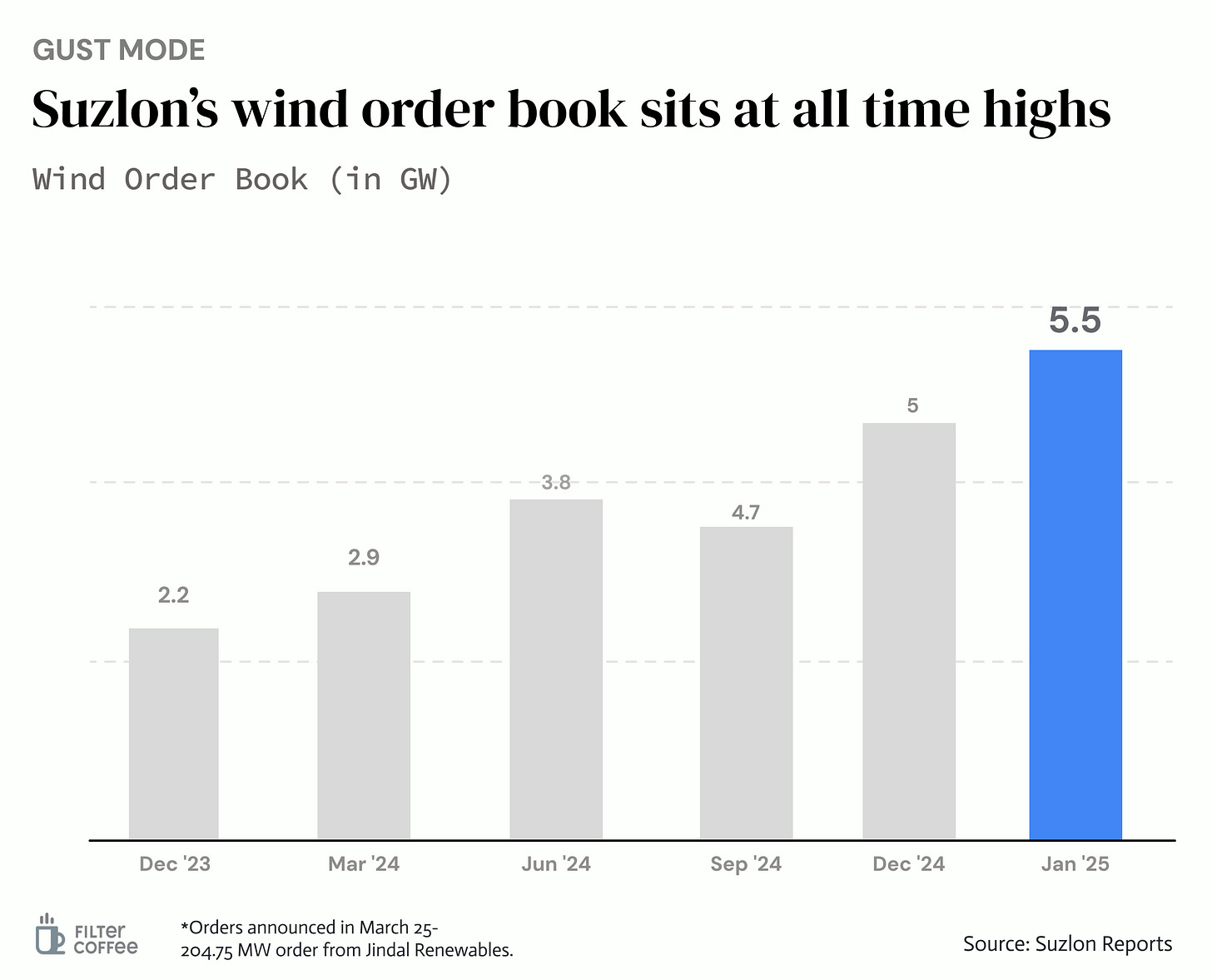

Suzlon shares surged over 3% after bagging a 204.7 MW order from Jindal Renewables.

The deets: under the new deal, Suzlon will install 65 wind turbines, each generating 3.1 MW of power, supplying energy to steel plants in Chhattisgarh and Odisha.

This order, combined with the 702.4 MW previously secured from Jindal Renewables, makes it the largest deal in the commercial and industrial (C&I) category.

6. Story in data — Energy goes clean ⚡

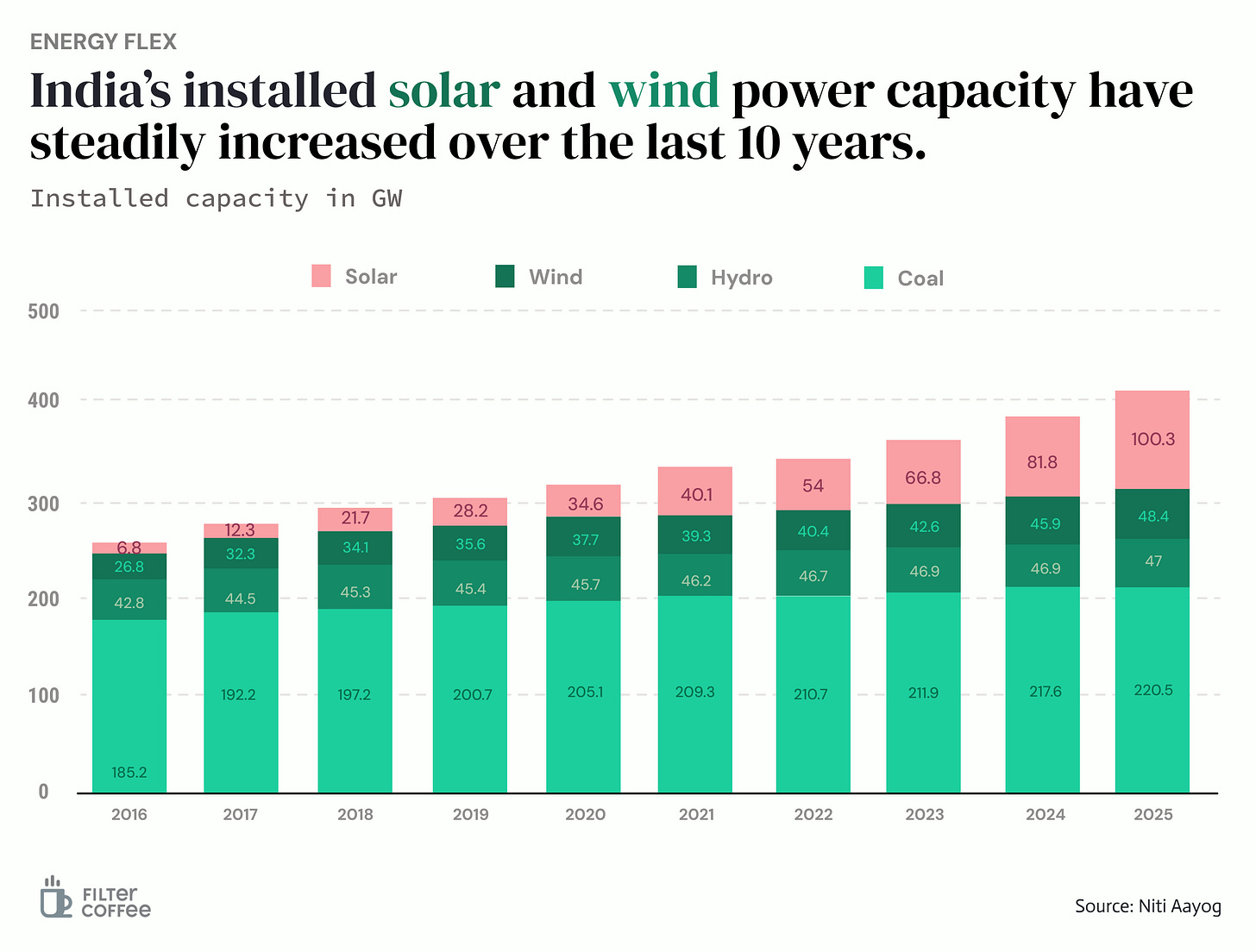

India’s renewable energy capacity has been steadily rising over the last decade.

Solar power has seen the fastest growth, now crossing 100 GW of installed capacity, while wind energy continues to expand.

With India targeting 500 GW of renewable energy by 2030, scaling both solar and wind will be key to reducing reliance on fossil fuels.

What else are we snackin’ 🍿

📈 Easy trade: Paytm launched UPI Trading Blocks, enabling auto-payments for stock trades directly from bank accounts.

🚆 Power boost: IRCTC & IRFC get Navratna status, giving them more independence & flexibility to operate like private companies.

🥤 Bottling switch: Coca-Cola is selling its North Gujarat bottling plant to Kandhari Global Beverages. The deal is valued at ₹2,000 crore.

💰Takeover mode: Jio Financial Services is acquiring 7.9 crore shares of Jio Payments Bank from SBI for ₹104.5 crore, gaining full ownership.

📊 Cash in: SEBI’s total income jumped 48% YoY to ₹2,075 crore in 2023-24. It received Rs 1,851.50 crore as income from fees.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.