Market summary: 📊

Indian investors are taking it easy after a crazy start to the week. US meanwhile resumed its flogging yesterday after a break for a couple days mid week.

US:

S&P 500 - down 2.12%

Nasdaq - down 2.96%

India:

Nifty 50 - down 0.10%

Sensex - down 0.18%

What’s brewing hot? ☕

📱 Some indigestion is overdue — Jio ended up churning some subscribers for the month of December, losing about 13 million users. That’ll be camp-Ambani’s 2nd ever month of negative sub growth since they launched in 2016. Price increases, inflation squeezing out the bottom, folks cutting out double-sims, data congestion in some parts as more users join the network, as well as competition fighting on a better footing may be responsible. Meanwhile, Airtel added 0.5 million subs, and VI lost 1.6 million subs for the month, as usual.

🌙 League of our own — as part of the ongoing mission to move India away from fossil fuel consumption, GOI brought in some incentives for clean hydrogen manufacturing. Hydrogen manufacturers will not be charged power transmission costs for over 25 years, and will be allowed to sell back unconsumed power to distribution companies — per new rules. India plans on generating about 5 million tonnes of clean hydrogen by 2030, which is nearly 50% of ALL the clean target set by Europeans, or just over 6% of the world’s annual hydrogen consumption.

Digital lender is playing dirty 💳

What’s poppin’ — a digital lending player called Dhani is getting roasted by users as well as regulators for lax monitoring and KYC practices that allowed scammers to create fake identities and get personal loans through the platform!

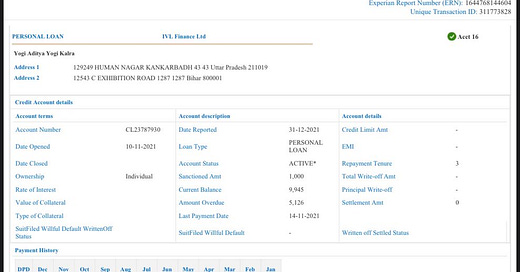

How shit rolled — the news broke when a bunch of popular Twitter accounts started posting about how they had found queries on their credit reports showing loans that had been taken out in their names, without their knowledge.

Basically, an individual or group of miscreants was using stolen PAN numbers, coupling them with fake names and addresses, to seek credit from Dhani — and their system, without a comprehensive check, would apparently initiate the loan and wire cash to the linked bank account. Money poof!

Things blew up on Twitter with several other users piling the feed with their own horror stories. Moneycontrol says even Sunny Leone found a loan initiated in her name!

Fyi, Dhani was previously Indiabulls Consumer Finance, before it changed dresses to appeal to the digitally-savvy junta. Their Android app has about 5 crore+ downloads on the Play Store, so without a comprehensive audit, its hard to say the extent of this mess.

What now — regulators are investigating. Dhani, meanwhile, claims it has beefed up support staff, slowed the process of initiating new loans, and is dealing with existing volumes on complaints.

Big picture — lowering guardrails in the name of friction-free experiences is giving a bad rep to an entire industry. Better monitoring from regulators seems long overdue.

SPONSORED

Savings have never mattered more 💰

Beginning of the year is a great time to set up your savings goals. Especially right now, when the markets are getting rough and the portfolios are being rocked!

Fi can help with this. Fi’s smart banking app makes it super simple to set up Jars and automate your savings and investments. You can set up a Jar for that Goa trip 🏖️ or the first car you’re planning, and automatically set money aside without having to worry twice!

Best part? Fi packs in an assistant, Ask.Fi, that makes it easy to get insights on your cash spending or just search your transactions by asking it questions like ‘How much did I spend on Swiggy?’.

Get a Fi account in under 5 minutes, and secure the bag for 2022 🙌

More Unicorns than you can keep up with! 🦄

Uniphore, a Chennai based enterprise software player, closed a $400 million Series E round from NEA, March Capital and others — doubling valuation to $2.5 billion, becoming India’s 9th unicorn of the year!

Uniphore has been around for over 15 years — selling conversational tools to automate customer engagement in call centers, basically helping agents be more effective as customers place their queries. Uniphore is now bringing its intelligence suite to power more use cases in HR, marketing, and other organizational needs.

The company employs over 600 people, servicing clients like Accenture and DHL. Fresh capital will go to improve tech, and fuel expansion.

And then back onto social commerce for a bit, 🛍️

DealShare, which became a unicorn just last month, raised another $45 million from Abu Dhabi’s Investment Authority, at a $1.7 billion valuation.

DealShare runs a group buying platform for daily essentials (soap, grains, clothing, food, that kinda deal) mostly focusing on price conscious Tier 3-4 customers. They do over 400K orders everyday, across 100+ cities.

Closing out — inflation ate Nestle’s Maggie 🍜

What’s poppin’ — Nestle’s business fell prey to inflation and rising prices of raw materials for the last 3 months of 2021 — resulting in a lukewarm show for the street yesterday when the company was due to report earnings.

Quick look at the stats:

Revenue of ₹3,739 crores, jumped 9% YoY — thanks to some price increases and holiday hot chocolate sales

Profits however tanked 20% YoY to ₹386 crores — there was a one-time cost item too

Numbers for the full year didn’t add up too well either — with profits up like 2% net-net.

Like other FMCG companies so far, management warned prices of packaging and other raw materials will remain high, but they’re doing their best to shave costs elsewhere.

What else are we Snackin’🍿

💪 Web3 solves everything – want to destigmatize cannabis? How about running ops on a DAO. CannaDAO is launching a blockchain-powered ecosystem of growers, sellers, consumers of weed to make global trade simpler.

💄 Mo brands – Mamaearth, which runs multiple D2C brands, is now launching another skincare label called Ayuga, based on Ayurvedic recipes.

📱 UPI on a roll – NCPI is planning to roll out UPI in Nepal, making it the first country outside India to adopt UPI as the payments platform. What a win!

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀