🗓 Morning, folks!

Absolutely no luck with this market. Sensex and Nifty took another beating yesterday, down about 1% for the day. IT stocks were among the worst hit.

💡 Consider this: Nifty 50 has joined the ranks of the worst-performing equity markets this year, alongside Thailand (10%) and the Philippines (6.7%). India’s weakness comes particularly from the pullback of foreign investors, who have now pulled out nearly $5.4 billion since hitting its peak.

But, things cant go down forever. At what point does the streak reverse and stocks start looking like a bargain?

News wise, pretty weak day. Let’s run through a few things quickly.

1 Big Thing: India remains a HOT market for Private Equity 💰

KKR is making a bold move in India's healthcare sector by acquiring a 54% stake in cancer care hospital chain Healthcare Global Enterprises (HCG) for ₹3,466 crore.

The deets: HCG is one of India's largest cancer care providers, with a network of specialty hospitals across the country. The company posted ₹558 crore in revenue for the December 2024 quarter, with a modest profit of ₹7 crore.

KKR has a history of big healthcare bets in India, previously investing in Max Healthcare, Baby Memorial Hospital, Healthium, and Gland Pharma.

The broader picture: Amidst poor health habits, pollution, and general neglect, one in nine Indians is expected to face a cancer diagnosis in their lifetime. An unfortunate but brutal reality.

As a result, India is rapidly scaling its cancer infrastructure. 200 new cancer centers are coming up nationwide. 4,500 daycare beds will be added to district hospitals in the next three years.

In Budget 2025, the government proposed full exemption from basic customs duty on 36 life-saving drugs and concessional 5% duty on six more.

While we are on acquisitions,

Adani Power secured a letter of intent to acquire Vidarbha Industries Power (VIPL), a financially distressed thermal power company under insolvency proceedings.

The deal gives Adani access to VIPL’s 600 MW thermal power plant in Nagpur. This comes amid reports that Adani Power is also eyeing Reliance Power’s 600 MW Butibori thermal plant, a deal estimated between ₹2,400 and ₹3,000 crore.

Macro theme: nearly 70% of India’s power still comes from coal, making it a critical category.

2. Pfizer bets on India’s aging population 💪

Pfizer is doubling down on neurology, teaming up with Mylan Pharma to market anxiety and Parkinson’s drugs in India.

The deets: Mylan, known for its over-the-counter medicines, has landed a five-year deal to ramp up distribution and marketing for Pfizer’s Ativan and Pacitane.

Ativan is widely used to treat anxiety disorders, while Pacitane helps manage Parkinson’s and other severe neurological diseases.

Pfizer is playing smart here, nearly 70% of its drug sales in India already come from local production, with its Goa plant alone accounting for half. By outsourcing distribution to Mylan, it expands reach without increasing operational costs.

The neurotherapy market in India is seeing a surge, fueled by rising mental health awareness and an aging population.

3. India’s AI boom gets a boost 🤖

Bharat Forge’s subsidiary, Kalyani Powertrain, is teaming up with US-based semiconductor giant AMD to develop made-in-India servers.

The deets: AMD is a global leader in high-performance computing, producing processors and accelerators that power everything from cloud computing to AI workloads. By joining forces with AMD, Bharat Forge aims to build locally manufactured solutions for India's booming auto, telecom, cloud, and AI sectors.

AMD will provide design support and technical expertise, ensuring these servers meet global standards.

Why it matters: India’s data center industry is on track to hit $10 billion by 2027, creating a massive opportunity for homegrown server manufacturing.

Currently, most high-performance computing (HPC) and server infrastructure is imported. This partnership could help shift production onshore, reducing dependence on foreign tech firms.

4. Quick walk down venture lane 🤝

GenieMode just rubbed the lamp for a fresh $50 million in funding, with Multiples Alternate Asset Management leading the Series C round.

The B2B sourcing platform connects global retailers with Indian manufacturers, helping streamline procurement across home goods, fashion, and furniture.

The deets: the funding will fuel GenieMode’s expansion across the US, Europe, and the Middle East while boosting its tech and supply chain capabilities.

This isn’t its first big raise—back in April 2022, the Tiger Global-backed startup secured $28 million in a Series B at a $162 million valuation, followed by a $7 million Series A later that year.

Zoom out: India’s B2B e-commerce market was worth $5.6 billion in 2021. By 2025, it’s expected to hit $60 billion, growing 10x in just four years.

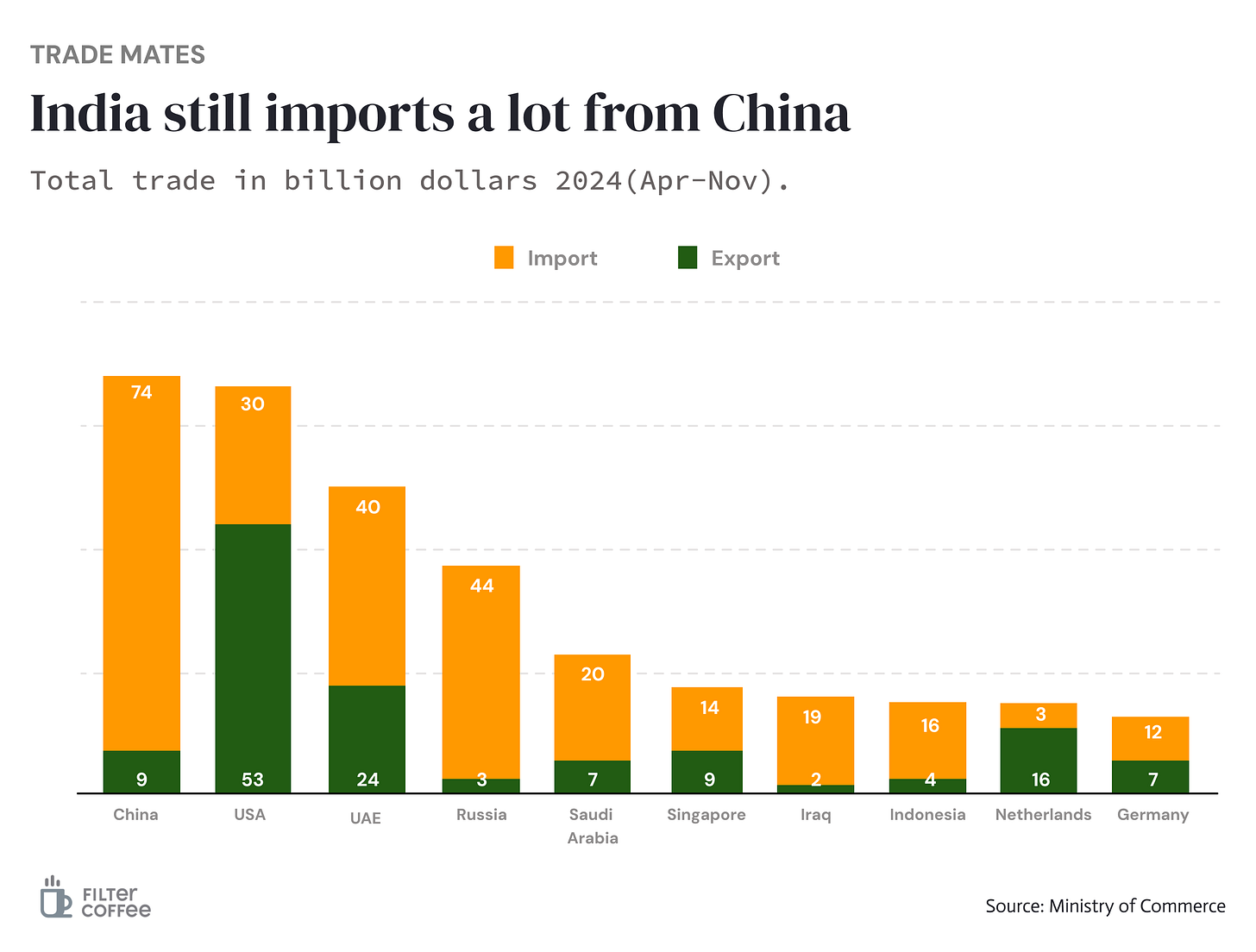

5. Story in data — India imports a lot from China 🇨🇳

India’s trade imbalance with China is massive, with imports towering over exports.

Between April to November of 2024, India imported $74B worth of goods from China while exporting just $9B—one of the widest gaps in global trade.

Reducing dependence on Chinese imports remains a key economic priority for India.

What else are we snackin’ 🍿

📱 Airtel x Apple – Bharti Airtel is teaming up with Apple to offer Apple TV+ and Music to its telecom customers.

💸 PF on UPI – Provident Fund Organisation is rolling out UPI-based withdrawals to make PF claims quicker and hassle-free.

🏏 Cricket fever – A record 602 million people tuned in to watch the India-Pakistan Champions Trophy clash on JioCinema, setting new streaming records.

🎋 Green Packaging – India’s first biopolymer plant to open in UP’s Lakhimpur Kheri, turning sugarcane into eco-friendly packaging.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

crisp but so valuable