☀️ Morning, and Happy Friday!

No real movement on the Street. Nifty and Sensex closed flat, dragged down by real estate and auto stocks. Nifty Bank held up, with SBI Card and Bajaj Finserv up 2%.

💡 Spotlight: the RBI scrapped its "increased risk weight" rule, which would’ve forced NBFC’s to set aside more cash for loans. Generally speaking, the move is aimed to make lending easy — in hopes that it helps spur economic activity.

1 Big Thing: Nvidia roars, markets snore 🤷

Nvidia just dropped another monster Q4 earnings, the kind that usually sends Wall Street into a frenzy. But the stock barely moved.

By the numbers: the AI chip giant reported $39.3 billion in revenue, up 78% YoY, with $22.1 billion in net income, an 80% surge from last year.

The data center business alone brought in $35.6 billion, nearly double from a year ago, while Nvidia’s new Blackwell AI chips added $11 billion to the mix.

Wall Street stayed unfazed though. After months of Nvidia crushing estimates, investors are harder to impress than a desi parent at a school awards function.

What’s ahead: Nvidia expects Q1 revenue at $43 billion, well above what markets were forecasting, which sets the stock and the AI trade up for another robust quarter. But margins are slipping. The aggressive Blackwell rollout is a factor, and U.S. tariffs aren’t helping either.

There’s also the competition problem. Chinese AI startup DeepSeek says it can train models on less advanced chips, raising concerns for companies like OpenAI that rely on Nvidia’s hardware.

Big picture: Nvidia has missed earnings estimates just once in the past five years, but after months of dominance, investors are starting to wonder — how much further can AI infrastructure spending go, before the typically cyclical semiconductor sector takes a pause.

Back Home 🇮🇳: A Surprise Comeback

While Nvidia was fighting investor fatigue, SpiceJet pulled off an underdog moment.

The airline posted a ₹26 crore profit for Q3—a massive turnaround from last year’s ₹301.5 crore loss. Revenue jumped 35% YoY to ₹1,651 crore, helped by a 47% drop in fuel expenses.

For an airline that’s been through more turbulence than a budget flight in the monsoon, this quarter finally gave investors something to cheer about.

2. Fintech is having a moment 💰

India’s oldest payment dawg is preparing for an IPO.

PhonePe brought in JP Morgan, Citi India, Morgan Stanley, and Kotak Mahindra Capital to manage the listing and early reports suggest the Walmart-backed company is gunning for a $15 billion valuation.

The financials back it up: the company reported a 73% revenue jump in FY24, hitting ₹5,064 crore, while also posting its first-ever annual profit.

The deets: digital transactions have exploded, and PhonePe owns a big chunk of the UPI game, processing over 50% of all UPI transactions in India. That’s dominance you don’t see every day.

The road ahead: despite profitability competition remains a challenge.

Paytm, Google Pay, and new players like Jio Financial are quickly catching up. With regulatory shifts and evolving payment models, the fintech space won’t be an easy ride.

Still, Walmart is backing this bet hard, and if the IPO lands at that $15 billion valuation, this could be one of the biggest fintech debuts India has ever seen.

Meanwhile, another IPO is brewing ☕

Chai Point is prepping to hit D-Street by mid-2026.

The tea café chain currently runs 170 stores across major Indian cities but has an ambitious plan—adding 300 more outlets by 2026.

The Indian tea market was valued at approximately $15 billion in 2023 and is expected to grow at a moderate rate driven by urbanization, income growth.

But the real story here is India’s growing cafe culture and the demand for premiumized experiences. Competition is equally heavy though.

3. Nazara goes offline 🎳

Nazara Technologies just made an unexpected move and bought out a 60% stake in Funky Monkeys for ₹43.7 crore.

The deets: Funky Monkeys is a premium indoor play zone for kids offering safe and interactive play areas. Think ball pits, slides, and birthday party bashes. This is a completely different business from Nazara’s usual digital plays.

Context: Nazara has been on an acquisition spree. So far, till December 2024, Nazara Technologies has acquired 16 companies.

In 2024 itself, Nazara spent $40 million on 2 acquisitions. Funky Monkey and Fusebox are the latest additions to Nazara’s collection.

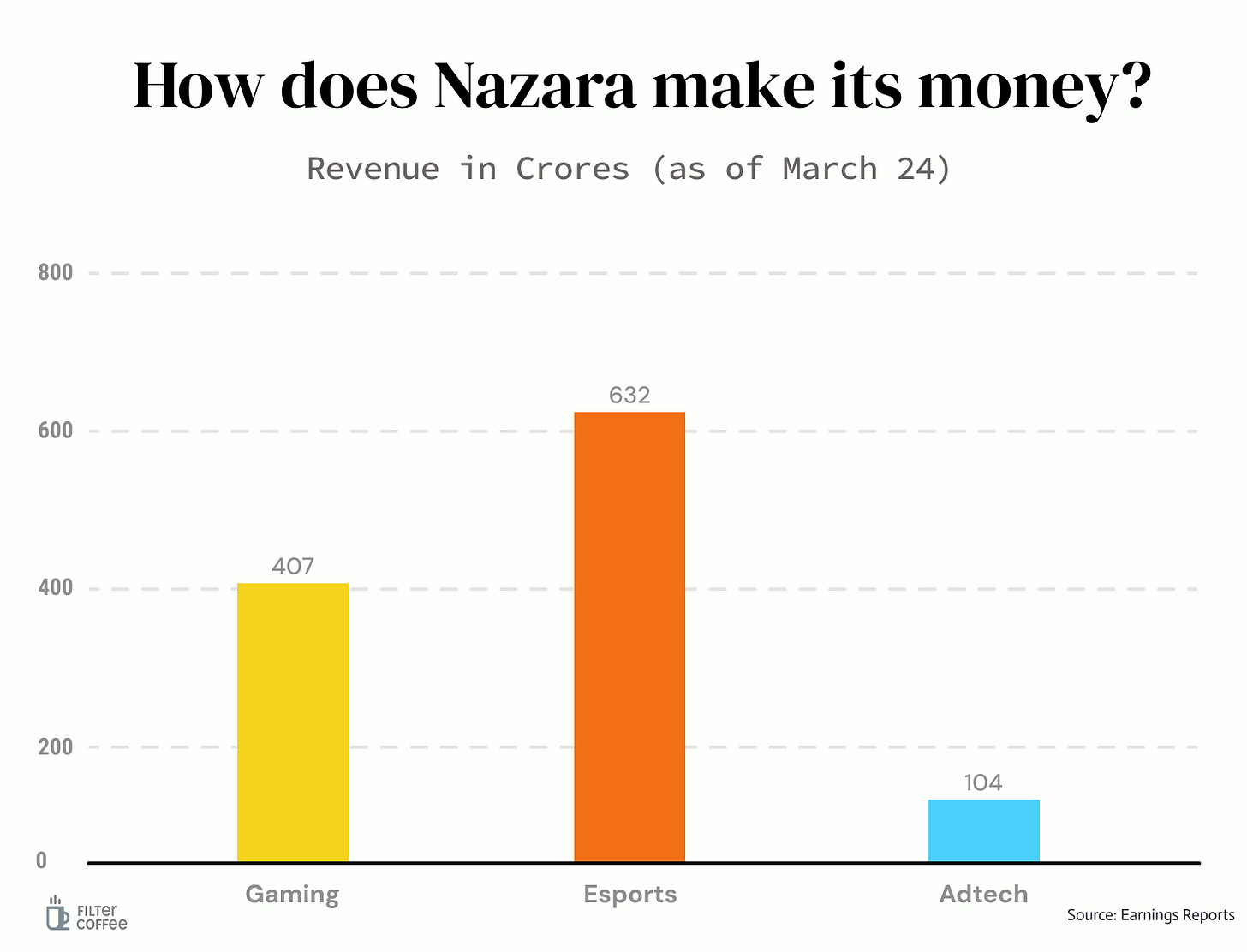

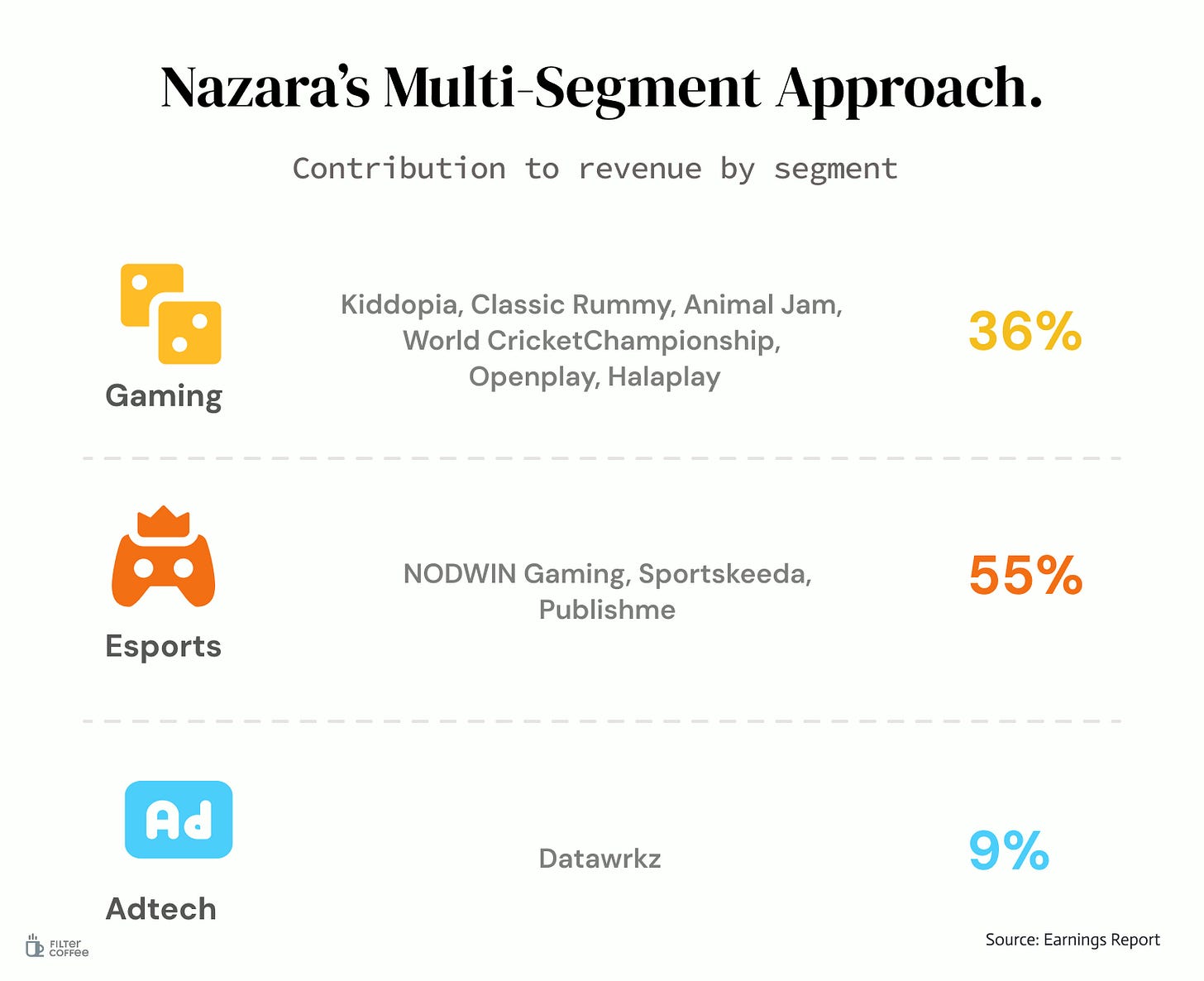

Nazara’s money machine is diversified, but not evenly spread. Some bets are paying off big, while others are just getting started. With its push into offline entertainment, the company is testing how far its brand can stretch beyond screens into the real world.

4. UltraTech dives into wires & cables 🔗

UltraTech Cement is stepping into the wires and cables business with a ₹1,800 crore investment. The company will set up a manufacturing unit in Gujarat.

The deets: as part of the expansion, UltraTech is acquiring Kesoram Industries.

The acquisition will be executed through a 1:52 share swap ratio. This means, for every 52 shares of Kesoram, shareholders will get 1 share of UltraTech Cement.

The wires and cables industry has witnessed significant growth. In 2024, the market size of the cables & wires business was valued at approximately $12.8 billion, which is expected to reach $42 billion by 2034 — as India’s infrastructure spending continues to witness a generational boom.

Zoom out: UltraTech’s surprise entry sent shockwaves through the sector. Polycab and Havells stocks tanked up to 20%, as investors braced for fresh competition from a deep-pocketed new player.

5. Quick trip down venture lane 💰

Mumbai-based MOC Cancer Care has raised $18 million led by Elevation Capital, with participation from angel investors and existing backers.

With 30+ centers across India, MOC is working to bridge the gap in specialized cancer care beyond metros. The funding will fuel expansion of its daycare oncology services and expand treatment options for cancer patients.

Why it matters: India reports 1.4 million new cancer cases annually, but access to treatment remains limited outside Tier-1 cities. MOC aims to fill this gap by providing high-quality, affordable cancer care in underserved regions.

While we’re on fundraises…

FanTV, an AI-powered content platform, raised $3 million in fresh funding. The round was led by Mysten Labs, Cypher Capital and others.

Founded by ex-Gaana CEO Prashan Agarwal, FanTV blends AI and blockchain for creators. With 8M+ users, 80K+ creators, and 30M+ transactions, FanTV processes 1.2M hours of AI-generated content monthly.

What else are we snackin’ 🍿

🔍 Get smart – Paytm partnered with Perplexity AI to add smart search to its app, letting users chat in Indian languages for financial decisions.

🚗 Maruti vrooms– Maruti Suzuki will start production in the new factory in Haryana. Eyeing for 6 million passenger cars by 2030.

💰 Crypto heist – Hackers stole $1.4B in Ethereum from Bybit last week. Now, Bybit is offering $140M to anyone who can help track it down.

😎 Reshuffle: Tuhin Kanta Pandey will replace Madhabi Puri Buch as the next Securities and Exchange Board of India (Sebi) chairman.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.