Hi 👋, Tanvi here.

Filter Coffee hits your inbox every morning with notable tech and business news scoops to jump start your day.

Sign up below for free. 👇

Let’s go ahead and get started:

Market summary: 📊

Pretty upbeat start to the day in India, as investors take some hope from hints of declining new cases. US had a negative day, as markets actively rotate into stocks winning from reopenings.

US:

S&P 500 - down 0.25%

Nasdaq 100 - down 0.60%

India:

Nifty 50 - up 1.67%

Sensex - up 1.74%

What’s brewing hot? ☕

✅ Order be damned—WazirX is being slammed for listing Shiba Inu at a much higher price when the exchange opened the coin for trading last week. Basically, the third party that WazirX works with, couldn’t guarantee liquidity due to thin volumes at start, and early buyers ended up putting first money in at higher levels, only for prices to settle to average after volumes built up. Wazir is now promising loss makers compensation, but the episode shows just how reckless users as well as platforms are becoming in making markets work right now, with FOMO and greed for commissions taking control over everything else. Absolute mayhem.

✅ Lil Billie is a notty boi—Microsoft asked it’s founder Bill Gates to leave the company’s board, amidst probes that good ol’ Billie messed “romantically” with one of the staffers, 20 years ago. Folks would’ve let go, but this incident, combined with the man’s recent divorce, and then Bill’s connections with convicted felon and notorious sex offender Jeffery Epstein, is making the entire subject pretty hard to overlook.

Old media wears news clothes 🙄

What happened—media company WarnerMedia will be spun off into an independent business by its owner AT&T, merging it with Discovery group of companies, creating a streaming first media behemoth of about $150 billion in value.

WarnerMedia owns prominent brands like HBO, CNN, WarnerBros, DC, Pogo, while Discovery owns TLC, Discovery channel, and other lifestyle brands, all of which will now be offered to consumers via a single streaming service.

Other details:

Joint company will be led by Discovery CEO David Zaslav

$20 billion to be spent each year on making shows/movies

Target is to crush the streamers Netflix, Disney, and Prime Video

Why is this happening—old media companies are reeling under the assault of tech-first streaming media platforms, as nobody watches TV anymore, and globally cable connections are being cut down at an alarming pace.

When was the last time you put on Discovery anyway...

But then, the profit pools of old media, secured via bundled pricing, fine print, jacked up cable prices, and practices of casually nickel-and-diming consumers, meant the old guys were just too comfortable lying in their cozy bed of cash profits to act, even if they saw disruption coming close on the horizon.

Anyway, once Wall Street started sniffing the shift to online streamers, old-media stocks were hammered for poor growth, which finally served the wake up call to the industry. Half-assed streaming transformations were promised, and the entire media game now realizes that big changes are due for survival in the post COVID world.

Going forward—largest media conglomerate in the world, Disney, was the first to wholeheartedly accept its fate, and made a 100% pivot to streaming with Disney+.

Irrespective of the intermittent hiccups, in 2 years, they managed to scale to 100 million users and that’s looking good. The No. 2 and the rest of the guys are hoping for a similar journey now. Whoever doesn’t, meanwhile risks going obsolete.

But then, kicking off a streaming operation is one thing, growing it to 200 million paid subs like Netflix?

Missed em Unicorns much? 🌈

Back on venture ave, we have a new unicorn—B2B commerce platform Moglix raised $120 million at a $1 billion valuation from Falcon Edge, Tiger, Sequoia and a bunch of others.

Moglix, kinda like the Alibaba of India, offers a platform that makes sourcing and purchase of industrial goods simple for manufacturing businesses. Nearly 500,000 SME manufacturers leverage the platform, with 16,000 suppliers on the other hand offering a broad portfolio of products.

Meanwhile, the company also offers customers a comprehensive SaaS platform that helps with backend logistics operations like procuring, packaging, as well as supply chain financing—adding clarity, visibility, and common standards.

What matters—global B2B commerce is a $10 trillion+ market, often overshadowed by consumer commerce, but given antiquated systems and poor tech penetration, offers a greenfield for leading players. Still Day 0 for the market in India.

Quickly turning heads onto Fintech lane, 💳

Payment processor Pine Labs raised another $285 million topping valuation over $3 billion, with big name buyers Marshall Wace, Baron Cap, and Temasek pitching in.

Pine labs, which essentially provides terminals to process payments, serves over 150K merchants across India, processing nearly $30 billion digital payments volumes. If we were to guess, less than 10% of all the merchants in India have probably adopted the full force of digital payments, which makes the addressable so damn long.

Fresh funds will be utilized by it to improve merchant tools portfolio, and beef up tech stack.

Musk takes a dump on Bitcoin 💩

Bitcoin continues to be stripped of its “decentralized” skin, crumbling under the assault of the world’s richest man, Elon Musk.

Last night was a stretch though—in a silly tweet war against anon-Twitter accounts, Musk slammed the currency for hurting the climate, because of the gazillions in power it consumes 24x7 to keep Bitcoin mining operations running.

Then he even hinted that Tesla might sell its Bitcoin holdings, worth $1 billion+, which triggered panic sell, dragging $BTC below $44K.

Quickly bringing in the Honorable Dr. Patel to summarize the entire timeline here:

Bottomline: until we have systems talking to systems, eliminating human emotions from the equation, the faultless benefits of decentralization are going to be hard to realize. For now, the entire ecosystem stands undermined by these shenanigans.

Meanwhile, public market investors are kinda relieved to have Musk offer his undivided attention to crypto fist-fights, letting stonkers breathe easy for a few days.

Ah, and while we’re on public markets, ☝️

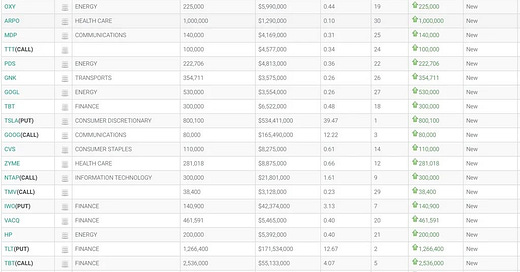

Michael Burry, the analyst from “The Big Short”, just opened a $500 million+ short position on Tesla, essentially betting that the company’s stock is overvalued.

Otherwise a not so happening day yesterday… see yalls tomorrow!

What else are we snackin’ 🍿

📱 Time for Android - Clubhouse is finally launching its Android app this week in India, Japan, Brazil, and Russia. Those tanking download numbers should see some life.

💰 You joke? - Credit Suisse donated $1 million to two Indian non-profits for procuring COVID medical supplies. Grateful, but a million from one of the largest financial corps in the world?

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀