🗓 Morning, it is Friday.

No luck with the markets so far. Sensex slipped another 0.29%, Nifty down 0.11% and investors continue to worry about the broader economy.

💡 Spotlight: The NIFTY FMCG index is deep in a 14-day losing streak, plunging 11.2% and wiping out ₹2.7 lakh crore in investor wealth.

Tobacco stocks took the biggest hit after the government hinted at raising the GST on tobacco. ITC fell over 1%, while Godfrey Phillips slid 8%, dragging the sector down further.

And since its Friday, here’s a quick picture of the team that wrote this newsletter to lighten up the day.

Let’s hit it 🚀

1 Big Thing: Mahindra bets on defense technology 🪖

In one of the most unusual matchups, the Mahindra Group is joining hands with defense-tech darling Anduril Industries to develop autonomous defense and surveillance systems.

The deal was announced as India and the U.S. continue to strengthen their collaboration on key national security initiatives.

For context, Anduril is one of the hottest tech ventures on the planet, founded by the eccentric 32-year-old Palmer Luckey (who also founded Oculus, the VR company) and backed by the Thiel boys. The company develops lethal autonomous weaponry for the U.S. defense forces.

This isn’t the first military-tech rodeo for Mahindra either. The company’s defense arm, MDS, has been steadily expanding its presence.

Partnered with Boeing and HAL to manufacture F/A-18 Super Hornet fighter jets in India.

Signed an MoU with Embraer for C-390 Millennium transport aircraft production.

Won a ₹1,350 crore contract in 2021 to develop Integrated Anti-Submarine Defense Systems (IADS) for the Indian Navy.

With Anduril, the partnership exclusively focuses on autonomous maritime defense systems and anti-drone technology specifically. Here’s what is in the pipeline:

Autonomous aerial systems to spot and take down unauthorized drones.

Next-gen command and control (C2) software for more effective defense operations.

Fully self-driving submarines built for surveillance and security.

Bigger picture: Defense remains one of the hottest global themes as the world order becomes increasingly multi-polar. Every serious nation is ramping up its military capabilities.

Look at India’s defense spending for a clue— with the latest budget, defense allocation is expected to reach ₹2.99 lakh crore for FY26.

2. India joins the lithium hunt 🔍

India inked an MoU with Argentina for lithium mining, another strategic move in securing critical minerals.

The why: Argentina is a lithium powerhouse. Part of the Lithium Triangle, the country holds 20% of the world’s 98 million tonnes of lithium reserves, ranking third in global reserves and fourth in production.

The Backstory: India has been steadily locking in lithium supply.

Last year, Khanij Bidesh India (KABIL) acquired five lithium mines in Argentina.

In 2022, India also struck a lithium exploration deal with Australia.

Bigger issue: India’s lithium dependency has skyrocketed, imports surged from 67% in FY15 to 97% in FY24. Today, almost 95% of this comes from China, and India is actively working to diversify.

At the same time, India is also exploring reserves in Jammu & Kashmir and Chhattisgarh to secure a domestic supply.

Zoom out: Lithium is the backbone of lithium-ion batteries, fueling everything from smartphones and laptops to EVs and renewable energy storage.

3. HP leaves the pin behind 👋

HP just acquired Humane AI’s assets for $116M, marking the end of the much-hyped wearable AI Pin.

The deets: founded by ex-Apple execs, Humane aimed to replace screens with a futuristic AI Pin that projected information onto a user's palm.

Investors, including Sam Altman and Marc Benioff, poured in $230M to back the vision.

What went wrong: despite the early buzz, the AI Pin flopped due to overheating issues, poor functionality, and underwhelming sales. Reviews were brutal, and the device failed to gain traction.

Worse, the launch video on X was a PR nightmare, with the founders seen pitching the product from a basement like R&D lab, hoping to mimic the Apple magic but falling short. Things never picked up from there.

What’s next: HP is absorbing the team into its AI innovation lab, HP IQ, to explore new AI-powered tech. The AI Pin business itself will be gone for good.

4. Vedanta’s big split 🔨

Vedanta has officially received shareholder approval for its long-awaited demerger.

What matters: the demerger will separate Vedanta into five independent, sector-focused companies.

Vedanta Aluminium – one of the world’s largest aluminium producers.

Vedanta Oil & Gas – India’s largest private-sector crude oil producer.

Vedanta Power – a major player in India’s power generation sector.

Vedanta Limited – will house the existing zinc business and new incubated technology verticals.

Vedanta Iron and Steel - a company with a highly scalable ferrous portfolio

Why care: the move could also help enhance overall valuation of the group. Generally, with such separation, investors are able to better understand the story and are more willing to pay a premium for growthier and hotter assets.

The deets: under the demerger plan, Vedanta shareholders will receive 1 share of each newly formed entity for every share they hold in the listed company as of the record date.

5. Big daily movers 🚀

✈️ RateGain, a global provider of AI-powered SaaS solutions for travel and hospitality, bagged a project from Thailand’s Nok Air for real-time competitive insights.

The deets: Nok Air is a budget carrier in Thailand.

RateGain will help Nok Air track market trends, pricing shifts, and customer sentiment in real-time, replacing outdated reports with live data.

The news helped RateGain surge nearly 7% despite the overall fall in markets.

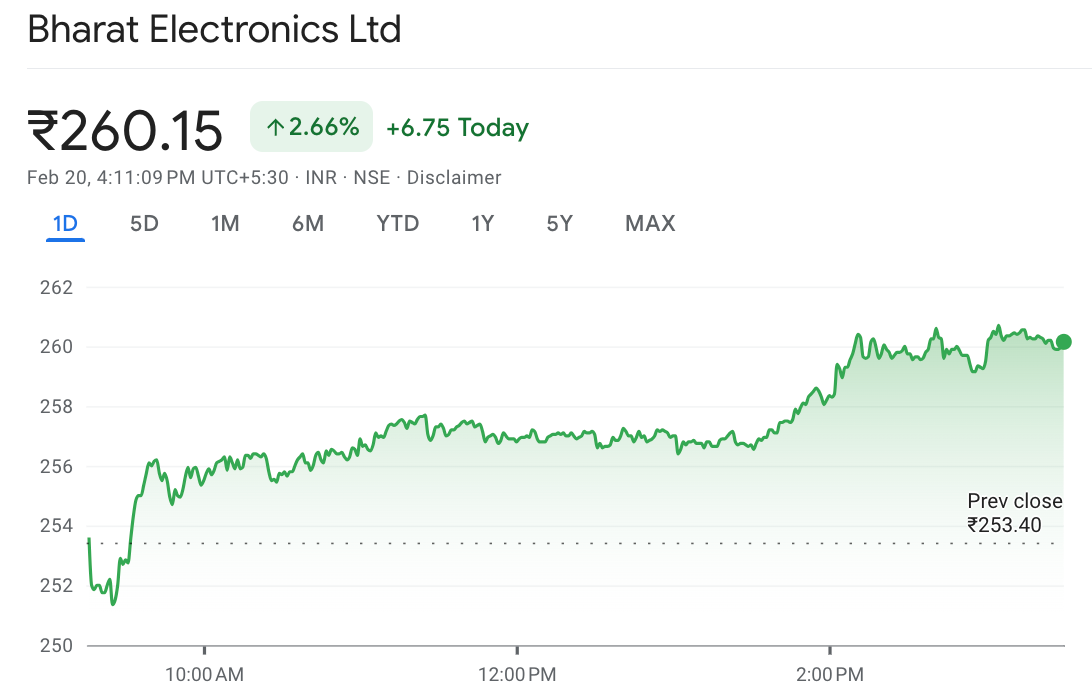

🛡️ Bharat Electronics Limited (BEL) gained nearly 3% after securing a ₹1,292 crore order from the Indian Defence Ministry.

The deal is for the supply of Software Defined Radios (SDR) and Data Communication Terminals (DCT) for the Indian Coast Guard, enhancing secure ship-to-shore communication.

The deets: developed in collaboration with DRDO, these radios will support multi-mission operations and strengthen India’s network-centric warfare capabilities.

What else are we snackin’ 🍿

🚨 App crackdown: India is set to ban 119 apps linked to developers in China & Hong Kong, mostly video and voice chat platforms.

🥡 Delivery trade: Zomato teamed up with StockGro to help gig workers sharpen their financial skills through educational workshops.

💰 Fintech IPO: PhonePe is gearing up to go public, eyeing a major listing.

🛡️ Taking control: after an 18-month battle, the Burman family has officially acquired control of Religare Enterprises.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.