Jane Street faces SEBI's wrath

India’s $1 trillion chemical push, Reliance buys FACEGYM, and Lenskart bets on AI.

🗓 Morning, folks! It’s a new week.

Last week saw a little bit of everything, a flood of DRHP filings, fresh M&A deals, and an eyebrow-raising scam.

What’s on deck now? Hopefully fewer headlines from the Enforcement Directorate.

But markets will be watching:

The start of earnings season

The upcoming India–US trade talks

And the GST Council meeting later this week

Plenty of signals to track as Q2 kicks into gear. 👀

💡 Spotlight: India wants to be a $1T chemical giant

NITI Aayog has laid out a bold roadmap to turn India into a $1 trillion chemical manufacturing hub by 2040, a 5x jump from where the sector stands today.

The plan includes fiscal incentives, faster environmental clearances, FTAs, and world-class chemical hubs, all designed to push India’s global share from just 3.5% to 12% over the next 15 years.

The current challenge? India imports a large chunk of its specialty chemicals and feedstock, leading to a $31 billion trade deficit. But with global supply chains shifting and green chemistry gaining traction, policymakers see a window to transform a fragmented sector into a high-value, innovation-driven ecosystem.

Let’s hit it!

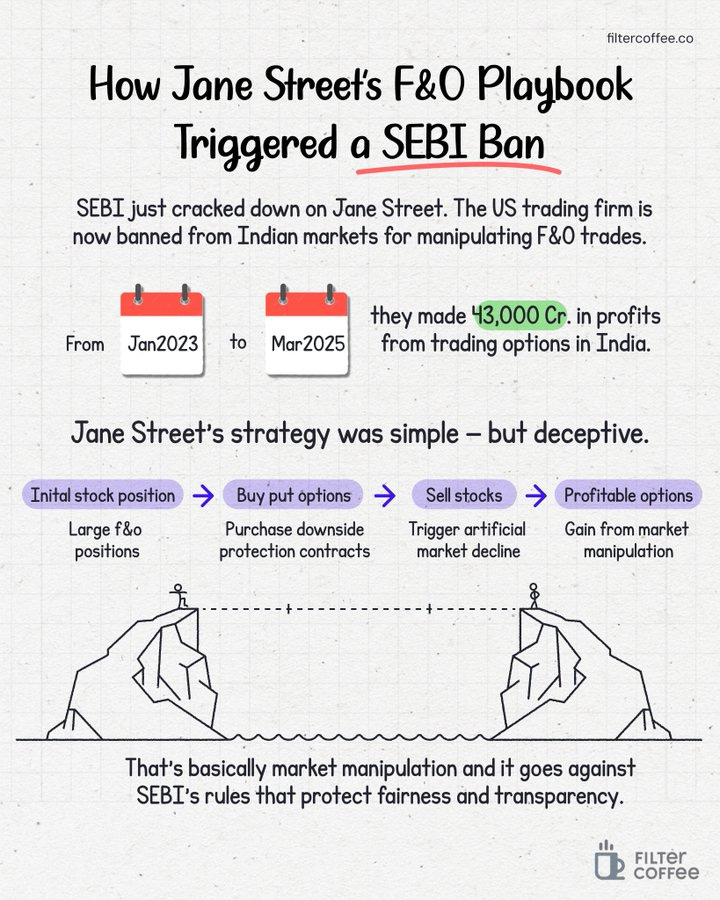

1 Big thing: SEBI bans Jane Street for fraud 🚨

SEBI on July 3, 2025 barred four entities of the US-based Jane Street Group from accessing Indian securities markets, alleging fraud and manipulation in the derivatives segment.

The derivatives segment is where people bet on the future price of stocks or other things instead of buying them directly.

Jane Street is a classic prop trading shop, buying and selling securities anywhere and everywhere they can find, to try and snatch a quick profit.

What exactly happened: the company bought a bunch of Bank Nifty contracts to make prices look strong, but at the same time sold bets that prices wouldn’t go up too high, so they could make money both ways. Later in the day, their other companies would suddenly sell huge amounts of those contracts to push prices down.

SEBI then found this pattern getting repeated and alleged that these were not normal trades but were manipulation and against the SEBI Prohibition of Fraudulent and Unfair Trade Practice (PFUTP) Regulation.

As per the SEBI, this firm was bending the rules to make extra profits while making it tough for genuine market participants.

Big numbers: SEBI says Jane Street made over ₹43,000 crores in profits in the Indian Markets, mostly at the expense of small retail traders.

2. Reliance tones up its beauty game 💅

Reliance Retail Ventures has announced a minority investment in UK-based FACEGYM for an undisclosed amount.

FACEGYM specialises in non-invasive facial workouts paired with advanced skincare formulations.

The deets: with this acquisition, Reliance will establish FACEGYM’s standalone studios across India and introduce the brand in select Tira stores.

Reliance Retail’s Tira will also lead FACEGYM’s entry into the Indian market, overseeing its local operations and market development.

Why it matters: the partnership aligns with Reliance Retail’s strategy to expand its footprint in the beauty and personal care space, led by Tira & a growing portfolio of owned brands such as Akind, Dream, and Nails Our Way.

While, we are on acquisitions,

Lloyds Enterprises’ bet on gold 🔥

Lloyds Enterprises shares were in focus after the company announced it will acquire a 31.5% stake in Geomysore Services India.

Geomysore Services India is a gold exploration and development company operating across India since 1994.

Why it matters: this investment will deliver attractive long-term returns and multiply the overall value proposition of the company.

This move also aligns with the company's strategy to explore investment opportunities in the mining sector.

3. Del Monte Foods files for bankruptcy 🥫

Less than a year after its last debt shake-up, Del Monte Foods is back in the headlines, this time filing for Chapter 11 bankruptcy.

Based in California, Del Monte Foods is one of the oldest canned food brands in the U.S., known for its packaged fruits, vegetables, and ready meals.

The deets: the company entered a lender-backed restructuring support agreement and plans to sell most or all of its assets through the bankruptcy court. A judge has approved $165 million in fresh financing to fund operations during the sale.

What led to the bankruptcy: a pandemic-driven inventory glut, rising rates, and last year’s drop-down transaction, where assets were shifted away from some lenders and it piled pressure on the business. In June, the parent company skipped a debt payment as part of a lawsuit settlement.

Zoom out: in recent years, several food companies have gone bankrupt as the pandemic crushed in-person dining and disrupted supply chains.

Chains like Red Lobster, Friendly’s, and Cici’s Pizza filed for protection, while packaged food giants like Dean Foods and Del Monte weren’t spared either.

4. Lenskart bets big on smart glasses 👓

Lenskart is doubling down on the future of eyewear, investing in Mumbai-based Ajna Lens to build AI-powered XR smart glasses.

Ajna Lens is a deep-tech startup blending AI vision, spatial computing, and XR tech to create immersive experiences. Their products are already used in defense, education, and enterprise.

Why this move: Lenskart wants to combine its frame design and engineering chops with Ajna’s cutting-edge tech to make smart glasses that feel as natural as regular specs.

Zoom out: this isn’t Lenskart’s first rodeo; its smart glasses journey started with Phonic audio glasses back in December 2024. With an omnichannel footprint across 14 countries, the company plans to tap rich customer insights to fuel innovation.

5. Stocks that kept us interested 🚀

1. ONGC & MOL’s sustainable ethane deal 🤝

Oil and Natural Gas Corporation - ONGC has signed an agreement with Japan’s Mitsui O.S.K. Lines to build, own, and operate two very large ethane carriers - VLECs.

These VLECs will be used to transport imported ethane, an essential feedstock for petrochemical production from international markets to ONGC Petro Additions, ONGC’s dedicated downstream subsidiary based in Dahej, Gujarat.

Ethane is used in the production of ethylene, which is a key input of plastics, synthetic fibres, and chemicals.

This deal also marks ONGC’s deeper push into securing supply chains for critical feedstocks amid rising petrochemical demand.

The big picture: the carriers are expected to incorporate next-gen fuel-efficient technologies, aligning with global decarbonisation goals for maritime shipping making this a win for both business and sustainability.

6. Story in data: Green Surge 📊

India’s energy shift is gaining serious momentum.

For the first time, green power additions outpaced coal in FY25, with 28 GW of new renewable capacity added, nearly double the year before.

While coal growth has plateaued at 219 GW, renewables surged to 172 GW, narrowing the gap like never before.

This marks a pivotal milestone as India pushes to decarbonise without compromising on growth.

The trend also signals growing investor appetite and policy support for clean energy as a long-term bet.

What else are we snackin’ 🍿

💻 Most valuable: Nvidia became the world’s most valuable company, hitting a record $3.92 trillion market cap, overtaking Apple and Microsoft.

📦 Copper Concentrates: Hindustan Copper is setting up a ₹400 crore concentrator plant in, Madhya Pradesh, aiming to triple ore production over the next few years.

🚀 Satcom Launchpad: Hyderabad-based Ananth Technologies is set to become the first Indian private company to offer broadband-from-space using a homegrown satellite.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.