Is edtech making a comeback?

India's battery-cell manufacturing push, Apple doubles down on India, and HAL-GE Tejas deal.

🗓 Morning, folks! It’s a new week.

💡 Spotlight: India shoots for a bigger slice of space 🚀

ISRO and the Department of Space are pushing hard on innovation and industry. They’re helping new private space start-ups grow and boost India’s global standing.

India’s space economy, currently worth $8.2 billion, is projected to soar to $44 billion by 2033. The bigger mission is to boost the nation’s share of the $630 billion global space pie from 2% today to 8% by 2035.

US President Donald Trump says the US won’t attend the G20 summit in South Africa. He claimed, though without evidence, that white people are being treated unfairly there.

Calling South Africa’s role as host a “total disgrace,” Trump criticised the nation ahead of the high-profile gathering of global leaders in Johannesburg later this month.

In response, South Africa’s foreign ministry called the White House’s decision “regrettable.”

Let’s hit it!

1 Big Thing: Nykaa Q2 profit soars 243% on beauty boom 💄

Nykaa’s parent FSN E-Commerce delivered a show-stopping quarter, with net profit shooting up 243% year-on-year on strong beauty and fashion sales.

By the numbers:

Net profit: ₹34.4 crore

Revenue: up 25% YoY at ₹2,345.9 crore

Gross profit: grew 28% at ₹1,054 crore

Gross profit is the amount a company earns after subtracting the cost of goods sold from its total revenue.

Breaking it down: this marks Nykaa’s highest gross margin in 12 quarters and its 12th straight quarter of mid-20% revenue growth.

Nykaa’s beauty business delivered strong performance which was driven by momentum across e-commerce, physical retail, and owned brands under the House of Nykaa.

The company said this quarter saw accelerated brand launches, particularly across Luxury and Korean Beauty, alongside the addition of 19 new stores, further strengthening their omnichannel presence.

2. JSW to form Japan-Korea JV for battery cell production in India 🔋

JSW Group is in advanced talks with Japanese and South Korean firms to set up a battery-cell manufacturing JV in India.

Context: China still dominates over 70% of the world’s battery-cell and component production, controlling key materials like lithium, graphite, and separators.

What’s the deal: the proposed joint venture will cater to EVs, commercial fleets, and grid-scale energy storage systems and is expected by March next year.

Japanese and Korean partners will likely bring advanced cell chemistry and raw-material expertise, while JSW focuses on local production and scaling.

How it helps India & JSW: for India, this means a step to localise battery production, reduce import costs and improve supply resilience.

Big theme: India’s battery-cell market is just taking shape but could hit $15–20 billion by 2030, driven by the EV boom and renewable storage needs.

3. Adani’s Kutch Copper mines a major Aussie win ⛏️

Kutch Copper (KCL) has signed a deal with Australia’s Caravel Minerals to speed up the development of a copper mining project.

Kutch Copper, a subsidiary of Adani Enterprises, produces refined copper to support India’s renewable energy, EV, and power infrastructure growth.

The deets: the project is expected to cost around $1.1 billion.

This deal will also allow KCL to purchase nearly all the copper produced by Caravel’s mine, which is approximately 62,000-71,000 tonnes per year at the outset.

This copper will be sent directly to Adani’s new $1.2 billion smelter in Gujarat, which is the world’s largest copper plant at one location.

FYI: the unit has also applied to become a listed copper-producing brand on the London Metal Exchange.

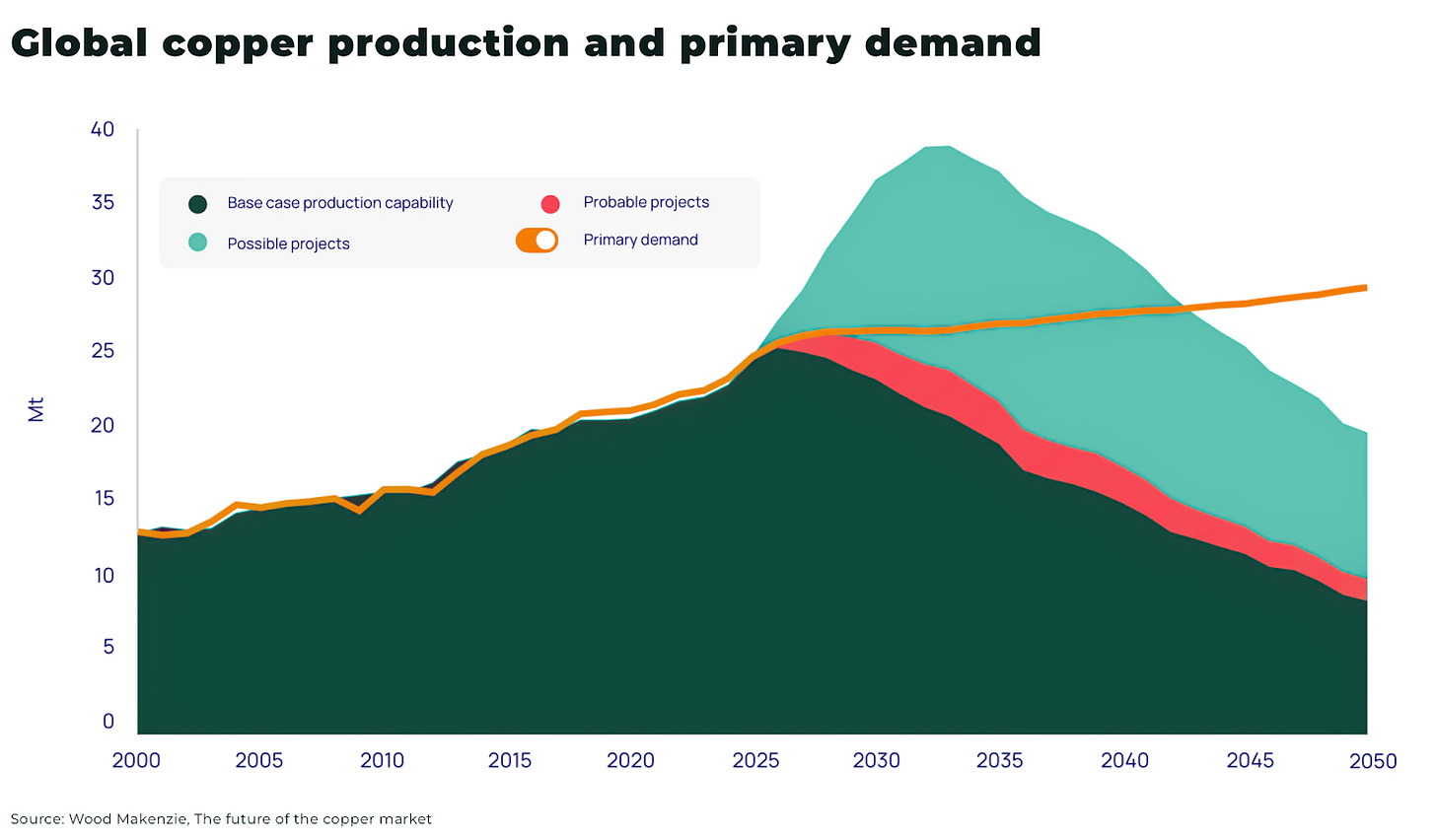

Big theme: global copper demand is set to jump nearly 50% by 2040, thanks to the rise of electric vehicles and renewable energy projects.

By FY30, sectors like construction, manufacturing, and power are expected to use about 3.24 million tonnes of copper.

While we are on deals,

UpGrad is in talks to acquire Unacademy in a deal that could value the test-prep platform at ₹2,800-3,500 crore.

Note: if it goes through, the merger would be one of the biggest in India’s edtech space, an industry that skyrocketed during the pandemic as online learning took off.

What’s the deal: Unacademy’s language-learning app, AirLearn, will become a separate company. UpGrad will buy only Unacademy’s test-prep business, including its offline centres, and won’t own any part of AirLearn.

Reports suggest that Unacademy is currently an attractive buy as it holds about ₹1,200 crore in cash reserves. The company has sharply reduced its cash burn in three months from a peak of over ₹1,000 crore annually to around ₹100 crore now.

4. TVS sells its Rapido stake worth ₹288 crore 🛵

TVS entered into an agreement with Accel and MIH Investments to completely divest from Roppen Transportation Services, the operator of Rapido for ₹288 crore.

Under this agreement, TVS will sell:

shares worth ₹143.9 crore to Accel India VIII (Mauritius)

shares worth ₹143.9 crore to MIH Investments One BV

TVS Motors had first signed a strategic partnership with Rapido in 2022 to explore collaboration opportunities.

Why it’s happening: with this divestment, TVS wants to monetise its investment from the ride-hailing company. Notably, the announcement also comes at a time when Swiggy is in the process of selling its 12% stake from Rapido to Prosus and WestBridge Capital.

5. Apple’s record $28B India dream takes flight 🍏

Apple is gearing up to produce a record $28 billion worth of devices in India in FY26. That’s a 22% jump from last year’s output.

The how: most of that growth will come from exports, which are expected to hit $22 billion, as Apple’s India-made iPhones fly off to global markets faster than ever.

What’s going on: in just the first half of FY26, Apple shipped $10 billion worth of iPhones, up 75% year-on-year and aims to double that by March.

The October-December quarter is usually Apple’s busiest export season, thanks to holiday demand and new launches like the iPhone 17 series, whose local sales are expected to climb 25% this year.

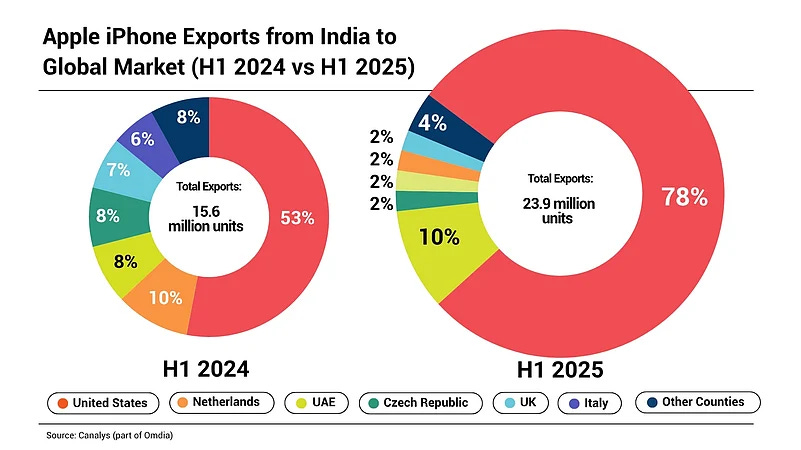

Zoom out: exports will make up nearly 78% of Apple’s total India production.

Shipments jumped from 15.6 million to 23.9 million units in just a year, with the US now taking nearly 80% of all India-made iPhones. It’s a clear sign of how quickly Apple’s India bet is scaling up.

6. Stocks that kept us interested 🚀

1. BHEL powers up with ₹6,650 crore NTPC thermal power deal ⚙️

Bharat Heavy Electricals (BHEL) gained more than 1% after bagging an order worth ₹6,650 crore from NTPC.

The deets: the order is to build a massive 800 MW supercritical thermal power unit in Odisha’s Sundargarh district.

A 800 MW supercritical thermal power unit is big enough to power over 8 lakh homes at once. It’s like lighting up an entire city with one giant plant.

The project is a full EPC package, covering design, equipment supply, civil works, and commissioning for Darlipali Stage II.

Darlipali Stage II is the second phase of NTPC’s large thermal power project in Odisha, which adds another 800 MW unit to boost electricity supply in eastern India.

Why it’s important: the state’s economy runs on energy-intensive sectors like steel, aluminum, and mining. This project ensures they get a stable power supply to sustain production and jobs.

2. HAL & US’ GE deal takes off with ₹62,000 cr boost for Tejas ✈️

Hindustan Aeronautics Ltd (HAL) has signed a major deal with GE Aerospace to procure 113 F404 jet engines for India’s homegrown Tejas Light Combat Aircraft (LCA) programme. The stock ended nearly 1% on Friday.

India’s defence move: the agreement follows the Defence Ministry’s ₹62,370 crore order to HAL for 97 Tejas Mk-1A aircraft for the Indian Air Force.

The newly secured GE F404-GE-IN20 engines will drive these fighters, ensuring stronger air capabilities and self-reliance in defence production.

The Tejas Mk-1A is a multi-role, single-engine fighter built for air defence, maritime reconnaissance, and strike missions, giving the IAF a modern, agile edge.

Why you should know about this: partnering with GE not only strengthens India’s Make in India push but also reduces dependence on imported defence technology.

What else are we snackin’ 🍿

⚙️ Trade thaw: China lifted its ban on exporting gallium, germanium, and antimony to the U.S., metals used in semiconductors and electronics.

🪙 Golden rush: India’s Gold ETFs saw $850 million inflows in October, the second-highest in Asia, pushing year-to-date inflows to a record $3.05 billion and AUM to $11.3 billion.

🚗 Trillion triumph: Elon Musk secured shareholder approval for his record $1 trillion Tesla pay package, affirming his vision to make Tesla an AI and robotics powerhouse.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

Make it a globe that respects individuals rather than seeing groups as cohesive.

This is a big order. it can only be done by people becoming more of who they are, rather than who they were told they are.

Her is the way i chose to do that.

“Nothing exists from whose nature some effect does not follow” “We feel and experience ourselves to be eternal.”

Here is the view from the version of Buddhism taught by SGI. Nam Myoho Renge Kyo is the primary teaching. Nam(u) 南 無 Is the transliteration of the Indian words Nam of namaste. It has many meanings. Two of them are respect,and declaration of equality. Myoho-妙 法 Myo is the word for real, and not material. It is the un-manifested, the potential, the unknown, the limitless. Ho is the word for manifested, specific, known, physical-therefore limited. Renge-蓮 華 Renge is lotus flower. Flower, and seed occur at the same time-i.e. cause and effect are created at the same time. The lotus blooms in muddy water, and is pure when it is openes. So a person’s wisdom can be opened at any time, and not be sullied by the past. Kyo- 經 This is the Chinese translation of the word sutra. Sutras were originally only spoken. The delivered meaning of sutra therefore includes speech, vibration. The Chinese word means the warp in cloth, and indicates that there is a continuation within change, a persistence, while events remain variable.