👋 Morning, folks! It’s a new week.

💡 Spotlight: Silver futures on the Multi Commodity Exchange (MCX) surged to an all-time high of ₹1.04 lakh/kg last week, driven by safe-haven demand amid global tensions. Spot prices weren’t far behind at ₹1.01 lakh/kg.

That’s good news for Hindustan Zinc, the country’s largest producer of refined silver (99.9% purity), which stands to gain directly from the price rally.

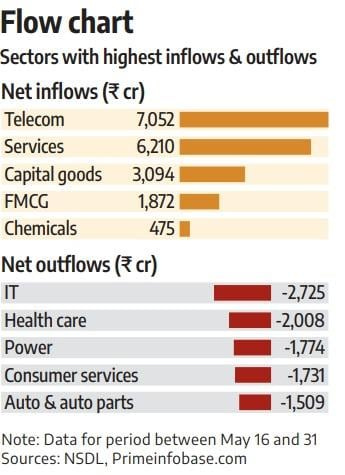

Meanwhile, foreign investors have been busy. FPIs poured nearly ₹7,000 crore into Indian equities in the last fortnight of May. Telecom led the charge with ₹7,052 crore in inflows, followed by services and capital goods. IT, on the other hand, saw outflows of ₹2,725 crore on weak global cues.

Let’s hit it!

1 Big thing: RBI cuts rates as inflation cools 💪

RBI surprised everyone with two big moves in its latest monetary policy. It cut the repo rate by 0.5% to 5.5%, its third straight cut, to help boost lending and spending as inflation cools down.

At the same time, it also reduced the cash reserve ratio (CRR) by 1%, making more money available for banks to lend.

In simple terms, the repo rate is the rate at which banks borrow money from RBI, lowering it makes loans cheaper for businesses and consumers.

The CRR is the portion of deposits that banks must keep with the RBI without earning interest, reducing it frees up more money for banks to lend.

By cutting both, the RBI is trying to put more money into the economy, making it cheaper to borrow and encouraging people and companies to spend and invest more.

Moreover, cutting the CRR will free up about ₹2.5 trillion for banks to lend, helping them pass on the lower repo rate to customers more quickly through cheaper loans.

Worth noting: banks already have plenty of extra funds in the system, with the RBI having added a solid ₹9.5 trillion in long-term liquidity since January.

Big theme: the key reason behind the 50 bps rate cut is this steady fall in inflation. With CPI now at 3.2%, the lowest since July 2019, the RBI is pushing to make borrowing cheaper.

EMIs could drop by ₹800–1,200 per lakh, giving relief to borrowers. But for savers, this also means lower returns on deposits, with savings rates already near record lows. This generally means people come for stocks or riskier assets to earn higher returns.

2. Tata takes charge of Apple fixes 🍏

Apple has tapped Tata Group to handle advanced after-sales repairs for iPhones and MacBooks in India.

The deets: Tata will take over from Taiwan’s Wistron ICT unit, managing complex repair work from its iPhone plant in Karnataka. Apple’s standard service centres will still handle routine fixes, but anything beyond the basics will now be routed to Tata’s facility.

This move fits Apple’s wider push to shift more operations to India as it reduces reliance on China.

The big trend: Apple’s supply chain is steadily tilting toward India, with Tata already assembling iPhones for both local and export markets.

As Apple’s India sales grow, so does the need for robust, reliable repair support, something that’s especially valued by Indian consumers. Bringing this repair capability in-house ensures tighter control on quality and speed.

Zoom out: India’s smartphone repair market is booming. With iPhone sales hitting 11 million units in 2023, Apple’s India market share jumped to 7% from just 1% in 2020.

3. Starlink gets India go-ahead 🚀

Starlink just bagged a key licence from India’s Ministry of Telecommunications, clearing the way for it to launch services in India.

This makes Starlink the third player after OneWeb and Reliance Jio to get this approval.

Starlink, already live in 100+ countries, aims to offer high-speed satellite internet to areas where traditional broadband struggles, think remote villages and hilly terrains where connectivity is patchy at best.

What’s next: while this is a big win, Starlink still needs a special GMPCS licence to fully deploy its satellite gear in India. It also awaits approvals on spectrum allocation and clearance from IN-SPACe to set up ground stations.

Zoom out: the satellite internet space is heating up fast. India is the world’s second-largest internet market, but nearly 400 million people still lack reliable access. Starlink’s entry, alongside OneWeb and Jio, could be a game-changer.

4. Nazara bags Smaaash in a rescue deal 🎮

Nazara Technologies has acquired Smaaash Entertainment for ₹126 crore, turning the once high-flying but bankrupt immersive entertainment chain into a wholly owned subsidiary.

Backstory: Smaaash was hit hard by COVID and defaulted on over ₹400 crore in dues.

The deets: the deal, approved by the NCLT under the Insolvency and Bankruptcy Code, includes a ₹10 crore equity infusion and a ₹116 crore inter-corporate loan to settle Smaaash’s creditor dues. Nazara now owns 100% of the company.

Why it matters: this marks Nazara’s entry into location-based entertainment, think VR, go-karting, cricket sims, bowling, and food all under one roof. It’s a strong offline complement to Nazara’s digital gaming play.

Flashback: Smaaash is backed by names like Sachin Tendulkar and Peak XV and once operated 11+ urban centres.

Zoom out: with this acquisition, Nazara is looking beyond screens, building a hybrid gaming ecosystem that spans both physical and digital worlds.

Worth noting: Nazara had earlier picked up a 60% stake in indoor playzone Funky Monkeys, signaling a broader push into offline entertainment.

5. Stocks that kept us interested 🚀

1. BEL scores big navy deal 🛳️

BEL bagged orders worth ₹2,323 crore from defence peers Mazagon Dock & Garden Reach Shipbuilders.

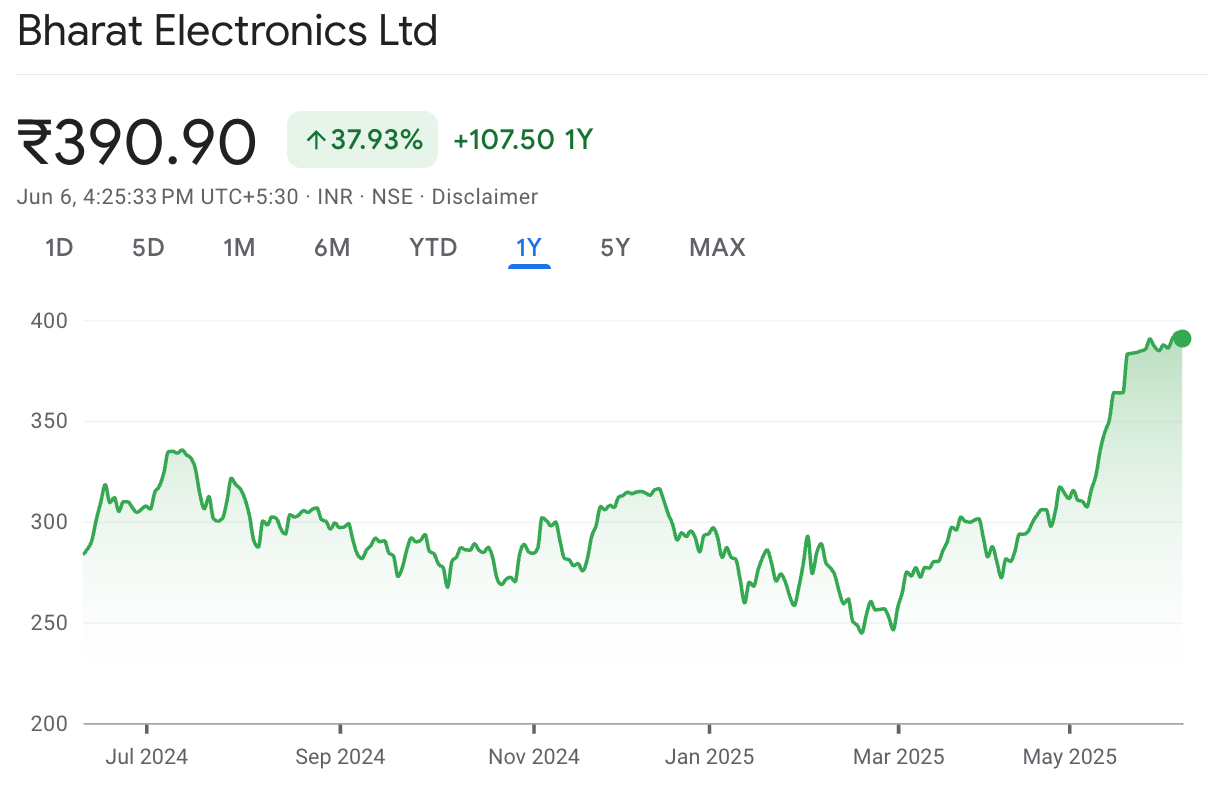

Bharat Electronics Ltd (BEL) builds high-tech electronics for the armed forces, including radars, missile systems, and avionics. It is a key player in India’s push for defence self-reliance.

The deets: this latest order is for the supply of spares to support missile systems onboard Indian Navy ships. These spares will ensure zero downtime for vital equipment so the Navy’s frontline ships stay fully mission-ready at all times.

This is BEL’s second big win in 2 days. Just on Wednesday, the company also signed an MoU with Germany’s Carsten Rehder to potentially build four multi-purpose cargo vessels.

Zoom out: BEL stock has been on a tear as it is up nearly 25% in the past month, 34% so far in 2025, and a stellar 51% in the past year.

2. Ashoka Buildcon bags big traffic tech deal 🚦

Ashoka Buildcon gained nearly 2% after bagging ₹1,387 crore worth of traffic management contracts across Maharashtra.

The deets: Ashoka Buildcon, through its tech subsidiary Ashoka Purestudy Technologies, is set to roll out a large-scale Intelligent Traffic Management System (ITMS) across key regions of Maharashtra.

The company is one of India’s leading engineering, procurement, and construction (EPC) players, with expertise in building roads, bridges, and now, smart mobility infrastructure.

The deal involves designing, installing, running, and maintaining traffic systems in Mumbai, Pune, Nagpur, Marathwada, and Konkan & Western Maharashtra.

Why it matters: with cities bursting at the seams and vehicles increasing, traffic management has become critical. Maharashtra, with its dense urban hubs and diverse geography from crowded metros like Mumbai and Pune to hilly terrains in Konkan, needs advanced solutions to manage traffic better and reduce congestion and accidents.

6. Story in data: Demat slowdown 📊

New demat account openings have steadily fallen in 2025, hitting a 12-month low in April.

From a peak of 45.5 lakh in July 2024, the number has slid to just 20.1 lakh. Market volatility, tighter F&O norms, and softer retail sentiment are cooling investor enthusiasm.

Average daily turnover has also declined, signaling lower trading intensity.

After two years of breakneck growth, retail participation seems to be taking a breather.

What else are we snackin’ 🍿

🚗 Wheels up: India’s vehicle retail sales rose 4.4% in May to 45.2 lakh units, driven by strong two-wheeler, three-wheeler, and tractor demand.

🖥️ Inflation remix: the stats ministry may tap OTT and travel platforms for CPI data, but Niti Aayog flagged if think-tanks should handle this instead.

🤝 OpenAI India talks: OpenAI is in talks with India under its new ‘OpenAI for Countries’ initiative to help boost national AI and data centre capacity.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

Hey folks,

The opening section mentions 7k Cr investments by FPIs and the second line mentions the split with Telecom leading with 7k Cr investments, followed by IT with 2.7k Cr. Is there some error in the numbers or am I reading it wrong?

"This is BEL’s second big win in 2 days. Just on Wednesday, the company also signed an MoU with Germany’s Carsten Rehder to potentially build four multi-purpose cargo vessels."

GRSE signed an MoU with Germany’s Carsten Rehder