Market summary: 📊

Turning out to be another dud of a week for India with Thursday ending in the red too. US had a mixed session, but tech continued to pull back ahead of holidays.

US:

S&P 500 - up 0.055%

Nasdaq - up 0.29%

India:

Nifty 50 - down 0.80%

Sensex - down 0.72%

What’s brewing hot? ☕

1️⃣ Equity is the new CAC — BharatPe is launching a $100 million Merchant Shareholding Program (MSP) — basically a program to reward merchants who stick with the platform with some stock in the company. All current 7.5 million merchants will be eligible, as well as new ones who stay for more than 3 years. That’s one way to remain competitive.

2️⃣ It’s all inflated — US inflation is at a record high — a 30-year high in fact, with a 6.2% increase in prices over the last 12 months. When you print unlimited money, and put $$ in everyone’s pockets in the name of stimulus, that’s what you get. Good thing however is that asset prices keep going up, Bitcoin is already flying, and if you’re invested, you’re not taking the worst of it. Those FDs are screwed though.

Next up is PharmEasy 🥕

What happened — India’s largest e-pharma platform, PharmEasy, dropped docs for its IPO a couple days ago — looking to raise ₹6,250 crores ($843 million) from the public markets.

PharmEasy started as an online medicine-delivery service, expanding later into digital consultations, and since then has been integrating left and right with adjacent services. First, it acquired rival Medlife. In June, it purchased Thyrocare’s diagnostics lab network. Then Aknamed, the hospital sourcing and payments platform.

COVID has obviously been a blessing — helping scale up to 25 million+ registered users now, pulling in ₹2,360 crore in revenues this year. Still losing about ₹641 crores though, but are we still hung up on that?

Quick link to the DRHP.

Big Picture — still day 1 for digitization of healthcare in India, and also more $$ per person than your average tandoori-naan delivery company lol.

Who raised the big monies 💰

Sleep-products seller Wakefit closed a $28 million Series C round from SIG, Sequoia and others — at a $380 million valuation.

Wakefit started as an online-vendor of foam mattresses, and since has expanded into work-from-home furniture like study tables, bookshelves, and other living room stuff. You hear that Casper?

Anyway, Wakefit also runs 22 offline-stores (omnichannel FTW), and revenues are expected to top ₹700 crores this year.

Big game — the online home furniture market in India is expected to reach $20 billion in the next 3 years. How else would nesting-millennials shop huh?

Meanwhile, Indian NFT scene keeps pulling $$ 🔥

Lysto, that’s building APIs and infrastructure tools to build, deploy, and sell NFTs from any platform, raised $3 million in a seed round from BEENEXT, Better Capital and a bunch of big name angel investors.

Lysto bet is that more brands and creators would want to mint and deploy their creative digital assets seamlessly — and they’re building a Stripe-like (one line of code) interface to help do that. Can’t say we understand half of it, but good luck!

Emerging platforms are swinging big 👊

Post-COVID consolidation is slowly picking up. 2 major bids 👇

🍔 Food delivery: Doordash will acquire Wolt, for $8 billion — a food delivery company based in Finland, mostly dominating Northern Europe.

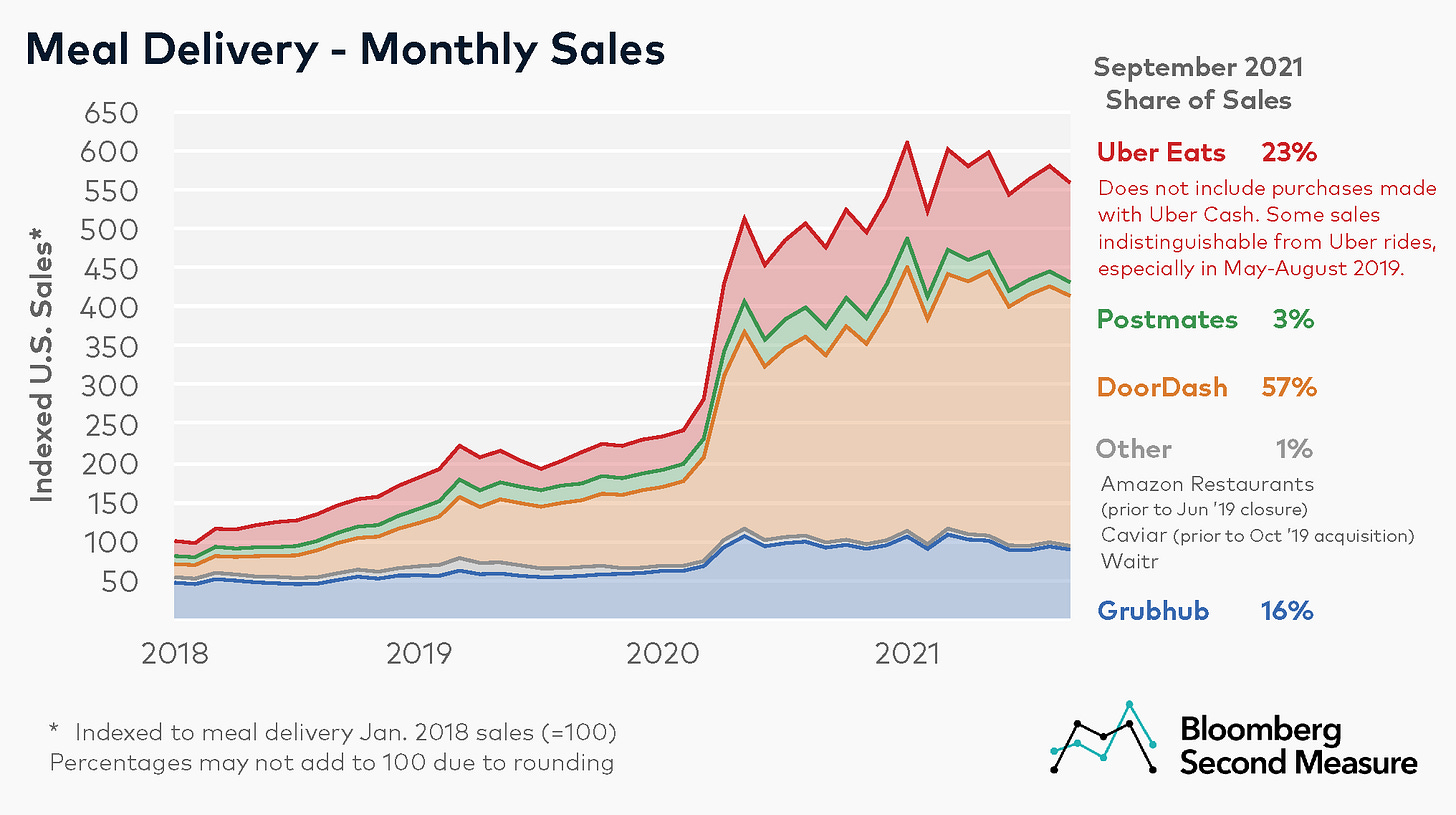

Doordash has been a story of top-notch management from Day 1 — a late entrant to the delivery market, the company built on everyone else’s mistakes to now own more than 50% food-delivery market share in the US, leaving the No.2 Uber in the dust. Just look at this chart 👇

Anyway, $DASH-model is working, and now they’re copy-pasting it worldwide, ironically just as Uber aggressively quits global markets. Check back in 5 years. 🤙

✨ Immersive Gaming: Unity, a $35 billion game developer, which basically makes a “platform” (think the AWS of gaming) so that independent game-developers don’t have to build everything from scratch , is buying a VFX company called Weta Digital.

You’ve watched Weta — these are the guys behind visual effects in movies like Avatar, Lord of the Rings, and other hits.

Anyway, with immersive gaming expected to be extremely popular in the AR/VR future, Unity wants to strengthen its design chops. Deal value was $1.625B.

Event of the day — 10x FC Subscribers 🤙

Join us today, along with Stoa School, for a chill session on how to grow Filter Coffee. We’re taking ideas from our readers (you) and pretty much anyone lol on how we can 10x from here. No idea crazy! Also, great chance to network with folks in the game!

Here’s a link to RSVP. BYOB 🍻

What else are we snackin’ 🍿

📵 No 24x7 scrolling - Instagram is testing a feature called Take a Break, which’ll remind you to take mini-breaks from scrolling every now and then. What a joke!

📉 Paytm lands flat - just 1.89x bids poured in for PayTM’s $20 billion IPO, with most demand coming from retail investors. Good thing, it's fully subscribed, but not exactly the fist-fight other IPOs are seeing. Tchk.

👎 Shame, shame - a McKinsey partner, Indian-American Puneet Dikshit, was nabbed by the SEC for insider trading. Puneet apparently traded based on insider-information of one of Goldman Sachs’ acquisitions, through his own and his wife’s account. Genius.

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀