India’s job market hits a speed bump

Hindustan Zinc's bet, Cruise IPO, and Razorpay acquires POP

🗓 Morning, folks!

Markets closed lower on Tuesday as Trump’s tariff threats and Middle East tensions rattled sentiment. The Nifty & the Sensex ended in the red, with IT and defence the only sectors in the green.

💡 Spotlight: May wasn’t exactly a good month for job seekers in India.

The country’s unemployment rate ticked up to 5.6%, from 5.1% in April, per the latest labour force data. And it’s not just a blip, the pain was felt across the board.

Youth joblessness? Up.

Rural India: 13.7% (vs 12.3%)

Urban India: 17.9% (vs 17.2%)

Women unemployment rate rose to 5.8%, slightly above men at 5.6%.

But here’s the real kicker: fewer people are even trying to find jobs. The Labour Force Participation Rate fell to 54.8%, meaning a chunk of the population is sitting this one out.

1 Big thing: Hindustan Zinc doubles down on metals 🪙

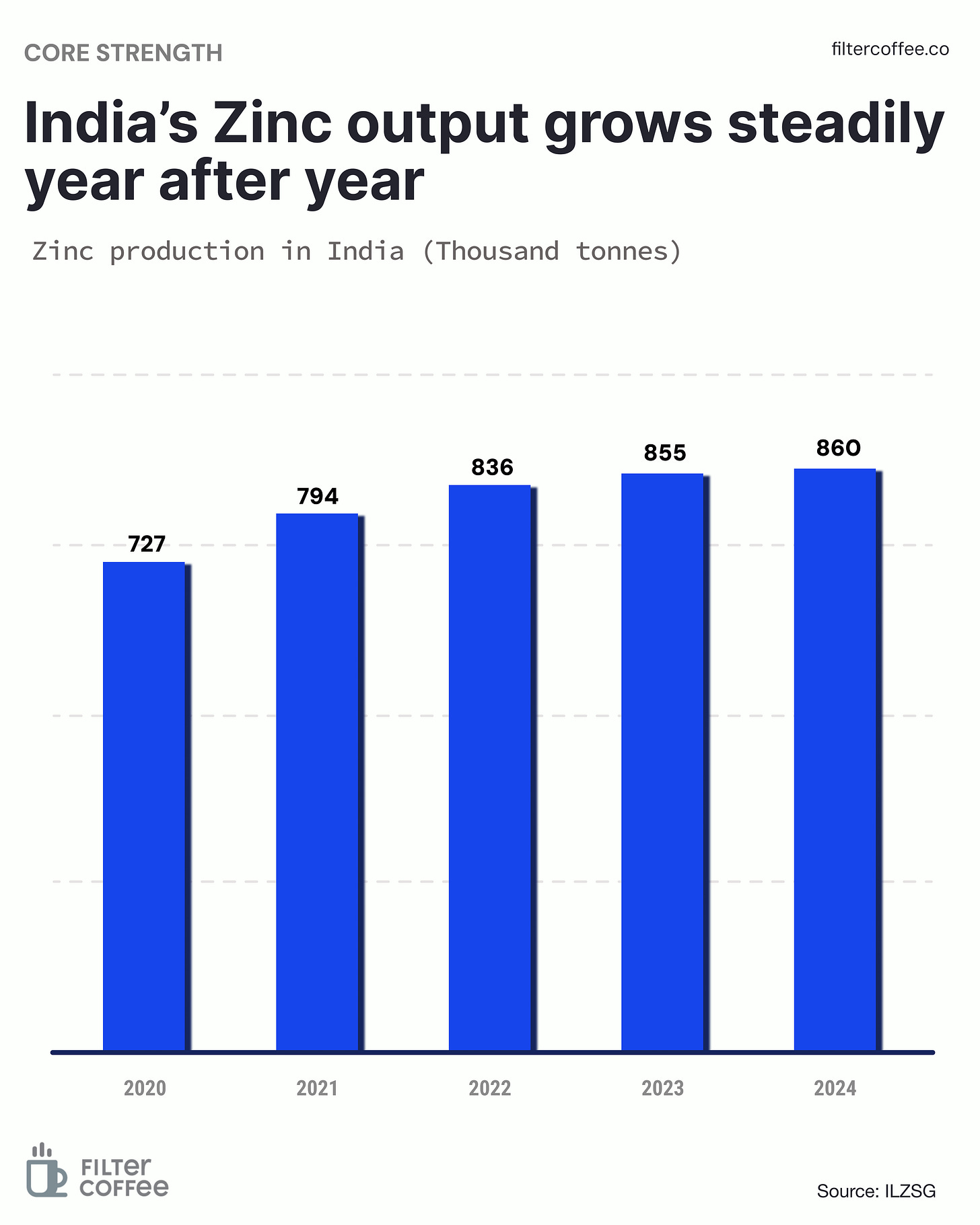

Hindustan Zinc is going big. Its board just approved a ₹12,000 crore expansion plan to double production capacity of zinc, lead, and silver over the next 36 months.

What matters: the project includes a new 250 ktpa smelter at Debari, along with expanded mines and mills. The company wants to ride the wave of soaring demand, both at home and globally, while helping India become self-reliant in zinc.

Zoom out: Zinc and silver may not grab headlines like lithium or copper, but they’re quietly powering the future.

Zinc is critical for steel galvanization, battery tech, and renewables, while silver demand is skyrocketing with the growth of solar energy and electronics.

India’s industrial output is expected to grow over 7% annually for the next five years, and metals like zinc are foundational to this capex cycle.

Add to that growing defence, infra, and power sector spend, and Hindustan Zinc’s expansion could cement its position as a core supplier to India's growth engine.

Worth noting: on the same day as the expansion news, HZL also announced a ₹10/share interim dividend. That translates to a ₹2,679 crore payday for parent company Vedanta, which owns 63.5% of the stock.

Shares of Hindustan Zinc closed up 5.1% on Tuesday, and are up nearly 9% over the past month.

2. US Defense Department bets on OpenAI 🤝

OpenAI has been awarded a $200 Million contract to provide the U.S. Defense Department with AI tools.

The details: the one-year contract marks OpenAI’s latest move to expand its footprint in the U.S. government. It follows the company’s announcement in December of a partnership with defense startup Anduril to deploy advanced AI systems for national security missions.

The why: OpenAI will collaborate with the Defense Department to explore how AI can streamline tasks such as improving access to health care for military members & bolster cybersecurity efforts.

Worth noting: this is the first project under its new initiative, OpenAI for Government, which will provide U.S. agencies access to tailored AI models, national security support, & product roadmap insights.

Zoom out: OpenAI is also working to build additional computing power in the U.S. In January, Altman appeared alongside President Donald Trump at the White House to announce the $500 billion Stargate project to build AI infrastructure in the U.S.

3. Cordelia Cruises sets sail toward IPO shores 🛳️

Waterways Leisure Tourism, the operator of Cordelia Cruises, has filed its DRHP with SEBI to raise ₹727 crore through an initial public offering.

Founded in Mumbai, the company operates India’s only domestic ocean cruise service, with one vessel, MV Empress, sailing to destinations like Mumbai, Goa, Lakshadweep, and even international ports like Sri Lanka and Malaysia.

The deets: the entire issue is a fresh offering. Around ₹552 crore will go toward lease payments to its step-down unit Baycruise IFSC, with the rest for general corporate purposes.

Worth noting: since launch, Cordelia has hosted over 5.5 lakh guests and sailed 2.25 lakh+ nautical miles, making it a first-of-its-kind IPO play in Indian cruise tourism.

Zoom out: India’s cruise tourism is still early-stage, but with rising middle-class incomes and demand for domestic travel experiences, the space is ripe for growth.

Cordelia’s listing could pave the way for a broader wave of leisure travel companies entering the public markets.

4. Razorpay steps into UPI with POP 💸

Fintech giant Razorpay acquired a majority stake in the fast-growing digital payments & rewards platform POP, while also investing $30 million into the company.

The deets: launched in 2023, POP offers UPI payments & is best known for its main feature POPcoins, a multi-brand rewards currency that consumers earn when making payments or shopping on the platform.

The why: the $30 million funding will be used to strengthen its product offerings, boost merchant base, & enhance consumer rewards via its POPcoins program.

With this investment, Razorpay marks its entry into the consumer UPI space following in the footsteps of BharatPe, which rebranded its PostPe app last year to do the same.

Zoom out: POP crossed 6 lakh daily transactions & 1 million unique monthly users in its first year. As of May 2025, it ranks as the 21st largest UPI player in the country, processing 13.6 million transactions. The young fintech is now positioning itself to compete with heavyweights like CRED & Paytm in India’s crowded UPI ecosystem.

5. Stock that kept us interested 🚀

1. Axiscades signs a defence deal 🪖

Axiscades hit the upper circuit after signing a deal with European defence giant Indra.

The stock rose 5% on Tuesday, marking its second straight day of being locked at the upper circuit, and is now up 92% year to date.

The company provides design-to-delivery solutions for aerospace and defence clients, with a strong focus on indigenous manufacturing.

The deets: Axiscades signed a Memorandum of Understanding (MoU) with Spain-based Indra, under which Indra will source key defence equipment from Axiscades’ India facility, this includes antennas, TACAN systems, and countermeasure units designed to protect aircraft from guided missile attacks.

The two firms are also exploring joint product development for India and global markets, and deeper partnerships in airborne defence systems.

Why it matters: the deal puts Axiscades at the center of India’s growing defence manufacturing ambitions, while giving it access to proven European tech and long-term contracts, a potent combo for future growth.

What else are we snackin’ 🍿

💨 Turbine turnaround: Tata Group is in talks with McKinsey & Co to lead a major transformation at Air India after last week’s fatal crash.

📱 Aladdin lands: Jio BlackRock Mutual Fund has introduced Aladdin, BlackRock’s powerful investment analytics and risk management platform in India.

📉 Exports slip: India’s exports dipped 2.17% in May to $38.7B, dragged down by falling crude prices and softer demand. Imports also shrank 1.6%, narrowing the trade deficit to $21.9B

⚡ Global throttle: Ultraviolette is taking its high-speed electric bikes to Europe, aiming to make exports 35% of its revenue by 2028.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.