India’s fastest unicorn

WPI in positive territory, auto acquisitions, and, Sterling ties up with China.

🗓 Morning, folks!

Markets ended mixed on Monday, breaking an 8-day winning streak. Both Sensex and Nifty slipped 0.2% each, dragged down by profit-booking in autos and weakness in pharma and IT.

Auto stocks were among the top losers in the auto pack, while pharma stocks including Dr Reddy’s and Cipla shed 1–2% after tariff-related commentary hit sentiment. IT stocks also stayed under pressure, limiting any upside despite Reliance Industries lending support to the benchmarks.

Broader markets, however, held firm. Public sector stocks extended their run, with HUDCO, IREDA and NHPC climbing 3–4%. Rail stocks like RVNL and Siemens rose 2–3% on hopes of higher government orders, while real estate players including Prestige Estates, DLF and Oberoi Realty also added around 2% each.

💡 Spotlight: India’s Wholesale Price Index (WPI) moved back into positive territory in August, hitting a four-month high of 0.52%. The trend mirrored retail inflation, which rose to 2.07% after touching an eight-year low in July.

Both wholesale and consumer prices bounced back in August after being unusually low in July. In simple terms, prices started rising again at both the factory level and the shop level.

Food prices stayed in deflation for a third straight month, though the fall was less sharp. Meanwhile, manufactured goods, which covers nearly two-thirds of the WPI basket climbed to 2.55%, also a four-month high.

Let’s hit it!

1 Big thing: Tata Tech buys German auto engineering firm ES-Tec 💰

Tata Technologies has acquired Germany’s ES-Tec Group for €75 million.

ES-Tec is Germany’s premium automotive engineering services provider with expertise in Advanced Driver Assistance Systems (ADAS) connected driving, and digital engineering. Whereas Tata Technologies is a global engineering and product development firm that provides digital services and R&D solutions to automotive, aerospace, and industrial clients.

Why it matters: the acquisition strengthens Tata Tech’s engineering and R&D capabilities in next-gen mobility, especially in ADAS and digital engineering, two of the fastest-growing areas in the auto sector.

It also deepens its presence in Germany, giving access to top talent and strategic OEM accounts.

Zoom out: as cars get smarter and more connected, engineering services around ADAS, autonomous systems, and digital mobility are seeing huge demand.

ADAS are slowly entering India through premium models, e.g., Hyundai Tucson, Mahindra XUV700, MG Gloster. But penetration is still below 5% of vehicles, compared with 50–60% in developed markets.

While we are on acquisitions,

Apollo Hospitals Enterprise is buying back IFC’s 30.6% stake in Apollo Health and Lifestyle (AHLL) for ₹1,254 crore, raising its ownership to 99.4%.

Background: Apollo had earlier diluted its stake in AHLL by selling a chunk to IFC. With this buyback, it regains near-total control of its retail healthcare arm.

2. L&T to build second bullet train project worth ₹2,500-5,000 crore 🚄

Larsen and Toubro’s transport infrastructure business vertical won an order worth ₹2,500-5,000 crore from the National High Speed Rail Corporation Ltd.

The deets: the deal covers 156 km of high-speed ballastless track between BKC in Mumbai and Zaroli village in Gujarat. It includes 21 km of underground sections and 135 km of elevated viaducts.

The company will handle design, supply, construction, testing, and commissioning using Japan’s Shinkansen J Slab Track technology, which allows trains to hit speeds of 320 kmph.

Why it matters: once complete, the Mumbai–Ahmedabad bullet train will cut travel time between the two cities from over 6 hours by rail to about 2 hours.

This is L&T’s second major bullet train track order. Back in 2022, it bagged the 116 km package between Vadodara and Sabarmati. With the new win, L&T now controls more than half of all track work on the project.

Big theme: India’s high-speed rail dream is massive, with over 6,000 km of bullet train corridors planned across the country. The flagship Mumbai–Ahmedabad project alone is worth ₹1.1 lakh crore, funded largely by a soft loan from Japan, and is expected to be operational by 2030.

3. Sterling Tools ties up with China for EV parts ⚡

Sterling Tools, through its EV arm Sterling Gtake E-Mobility (SGEM), is partnering with China’s Landworld Technology to make on-board chargers and DC/DC converters in India. The stock closed nearly 5% higher on the update.

For context, Sterling Tools is an Indian auto component maker best known for manufacturing high-tensile fasteners and EV sub-systems like motor controllers and chargers. An on-board charger lets an electric car charge its battery from a plug.

The deets: SGEM has signed a tech license and supply agreement with Landworld to locally manufacture on-board chargers, DC/DC converters, and multi-function units that also include power distribution systems.

The why: until now, most Indian EV makers have depended on imported chargers and converters, which are costly and vulnerable to supply disruptions. By manufacturing these parts locally, Sterling not only reduces import reliance but also captures a high-growth niche in the EV value chain.

For Sterling, this adds a new revenue stream beyond motor controllers and powertrains, making it a more complete EV sub-systems supplier.

4. Glance becomes India’s fastest unicorn 📱

Glance has raced to a $1.8 billion valuation within a year, making it India’s fastest unicorn, per the ASK Private Wealth Hurun Unicorn Report 2025.

The deets: the company delivers personalised, AI-driven content directly to smartphone lock screens. It hit unicorn status in record time, backed by Google, Mithril Capital, and Jio Platforms. It now boasts over 235 million active users across Asia.

This is a rare feat that signals the pace at which Indian consumer tech is scaling.

India minted 11 unicorns this year alone, with Zepto, Udaan, Physics Wallah, and Yubi leading the charge. As AI becomes central to digital commerce, Glance is betting big with “Glance AI” targeting the US, Japan, and India as its next growth markets.

5. Adani Power to build ₹25,000 crore Bihar plant 🔥

Adani Power bagged a Letter of Intent from Bihar State Power Generation Company to set up a 2,400 MW thermal power plant in Pirpainti, Bhagalpur.

A 2,400 MW thermal power plant is basically a giant electricity factory that burns coal to make power. It can generate enough electricity at full capacity to light up and run around 10–12 million homes at the same time.

The deets: this is a $3 billion project which will be built on a build–finance–own–operate model, with three units of 800 MW each. Coal requirements are tied up under the government’s SHAKTI policy, ensuring steady fuel supply.

Why it matters: Thermal power is still the backbone of India’s electricity system. About 55–60% of India’s total power generation comes from coal-fired thermal plants. These plants work by burning coal to create steam, which spins turbines to produce electricity.

Big theme: India has big renewable energy goals which includes 500 GW of non-fossil capacity by 2030. However, coal remains the most reliable and cheapest option for now. Renewables like solar and wind are growing fast but are weather-dependent, so thermal power provides the base load that keeps the grid stable 24/7.

6. Stocks that kept us interested 🚀

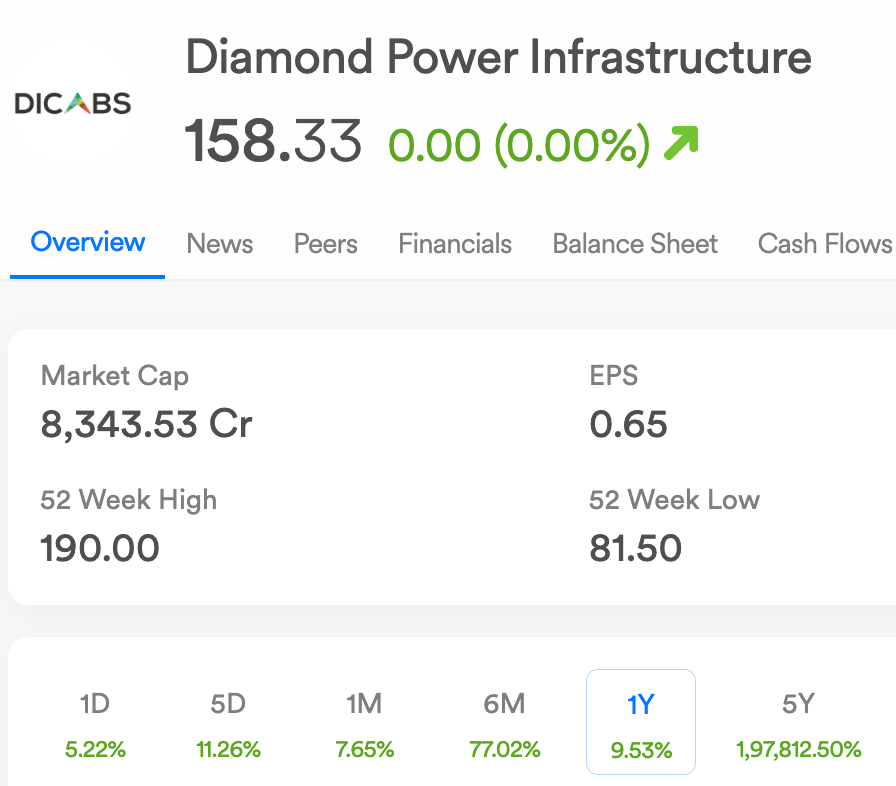

1. Diamond Power bags ₹236 crore Adani order, stock up 2% 💸

Diamond Power Infrastructure’s shares gained nearly 2% after it won a ₹236 crore order from Adani Energy Solutions.

What they do: Diamond Power Infrastructure manufactures and supplies electrical conductors used in large-scale power transmission projects.

The deets: The new order covers 5,403 km of AL-59 Zebra conductors for Adani’s Jamnagar project, with execution due by June 30, 2026. Just last week, the company secured a ₹184 crore order for 4,215 km of conductors for Adani’s Khavda IV-D project.

Why it matters: Consecutive project wins from a major client like Adani strengthen Diamond Power’s order book and revenue outlook. It signals steady demand from India’s power transmission expansion.

2. Engineers India wins ₹618 crore Africa deal 🌍

Engineers India’s stock was in focus on Monday after it bagged a ₹618 crore international contract for a fertiliser plant in Africa.

Engineers India is a state-owned firm that provides consultancy, engineering, and project management services mainly in petroleum, petrochemicals, and infrastructure.

The deets: under this deal, the company will deliver project management consultancy (PMC) and engineering procurement & construction management (EPCM) services. Simply put, it will oversee the design, planning, and execution of the new fertiliser plant from start to finish.

Zoom out: India is one of the world’s biggest fertiliser consumers but depends heavily on imports to meet its needs, especially for phosphates and potash. Africa, on the other hand, has rich reserves of raw materials like phosphate rock but lacks large-scale processing capacity and modern plants. This creates a natural partnership.

What else are we snackin’ 🍿

🔥 IPO fever: Groww is prepping a public listing at a valuation of about ₹80,000 crore ($9 billion).

🦄 Startup streak: India minted 11 new unicorns and added 54 future unicorns in 2025, showing resilience despite funding and regulatory headwinds.

📦 Export lift: India’s exports grew 6.7% YoY to $35.1B in August, though shipments dipped from July’s $37.2B. Imports also fell to $61.6B.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.