India’s drone game levels up

Rupee crosses ₹90 mark, Venture Street hot, and IndiGo's pilot woes.

🗓 Morning, folks! ☀️

The market opened weak on Wednesday, slipped deeper through the day, then clawed back sharply from the lows, with private banks and IT leading the rescue.

Even after the rebound, both the Sensex and Nifty closed lower, extending the losing streak to four straight sessions.

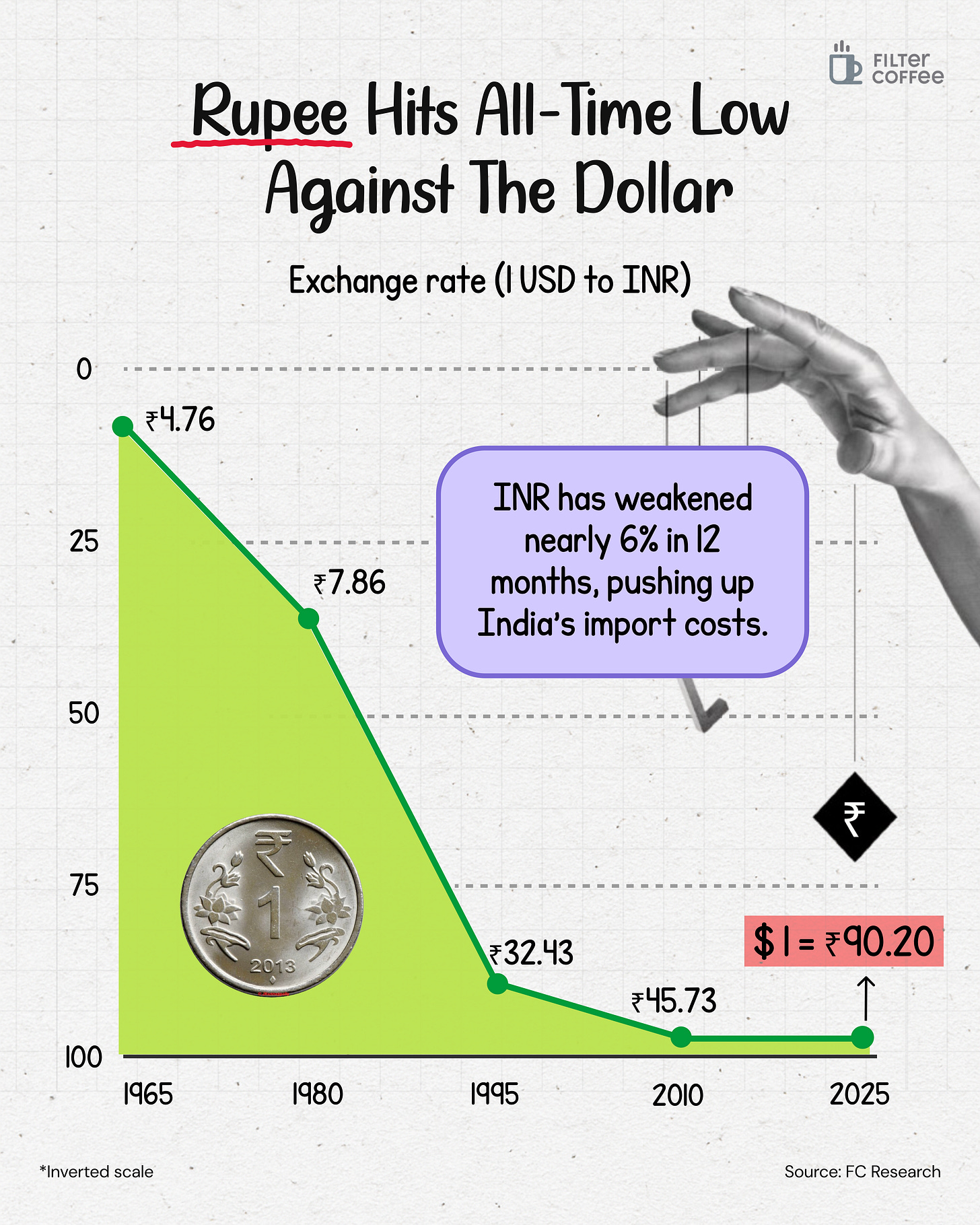

The rupee’s fresh record low against the dollar kept nerves high, raising worries over import costs and reinforcing the risk-off mood as FIIs continued to pull money out.

With the MPC meeting coming up and global cues still not offering much direction, traders mostly stayed cautious, and the screens stayed red by the close.

Onto the currency market,

The Indian rupee slid sharply on Wednesday, breaching the key ₹90-per-dollar mark for the first time ever.

The fall was driven by soft trade and portfolio inflows, alongside rising uncertainty around the India US trade deal.

💡 Spotlight: India’s Services sector picks up ⬆️

India’s services engine found its groove again in November.

A private survey released on Wednesday showed a rebound as new business orders picked up, supported by firmer demand, while price pressures stayed relatively muted.

The HSBC India Services Purchasing Managers’ Index (PMI), compiled by S&P Global, climbed to 59.8 in November from 58.9 in October.

This signals faster expansion after growth cooled to its slowest pace since May in the previous month.

Let’s hit it!

1 Big Thing: India steel demand fuels major tie-up 🤝

Japan’s JFE Steel and India’s JSW Steel are teaming up to run the steel business of Bhushan Power & Steel (BPSL) together.

JFE Steel is a Japanese steelmaker producing flat and long steel, specialty products, and providing engineering and recycling services globally.

Breaking it down: this is a big partnership where a global steel giant is putting serious money behind a major Indian plant.

JFE will invest ₹15,750 crore to buy a 50% stake in JSW Kalinga Steel, making it one of the largest foreign investments in India’s steel sector.

A quick rewind: JSW bought Bhushan Power for ₹19,700 crore in 2019 through the insolvency process.

Why this asset matters: BPSL already runs a fully integrated steel plant and an iron ore mine in Odisha, with a current capacity of about 4.5 million tonnes of crude steel a year.

The plan now is ambitious, to scale up to 10 million tonnes by 2030, with room to stretch to 15 million tonnes later, which would put it among India’s biggest steel assets.

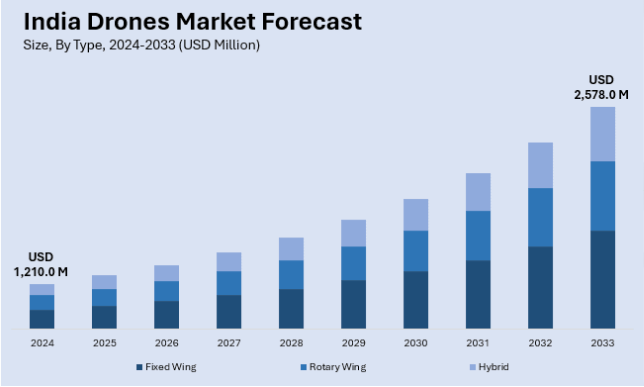

2. JSW Defence plans drone plant in Hyderabad 🚀

JSW Defence plans to build a new military drone factory in Hyderabad as part of a $90 million project, in partnership with US company Shield AI.

Shield AI makes drones that can think a bit for themselves. Its software acts like a built-in pilot, helping the drone fly and handle missions with less constant control from a human.

What’s taking shape: at this Hyderabad plant, JSW plans to manufacture Shield AI’s V-BAT, a mid-sized military drone.

The partnership is structured as a long-term licensing deal, which means JSW is not just assembling parts. It will get the right to use Shield AI’s technology, learn how it works through a formal transfer of know-how, and train Indian teams to build and maintain it properly.

Worth noting: JSW says it will invest ₹1,200 crore across its defence plans, and ₹320 crore of that is specifically meant for the technology transfer from Shield AI.

Why it matters: Instead of importing these drones, India could make them at scale at home for the armed forces.

And if the facility grows as planned, it could also become a hub that supplies drones to other countries. Manufacturing is expected to begin by the last quarter of 2026.

3. Hindustan Copper-NTPC join hands for key mining projects 🤝

Hindustan Copper and NTPC Mining have signed a Memorandum of Understanding (MoU) to pursue copper and critical minerals development.

Breaking it down: the two companies will work together to explore investment opportunities in mining, developing, and processing minerals from HCL’s existing reserves.

They will also team up to bid for critical mineral blocks in upcoming auctions.

What will both the parties gain: with this partnership, the two state-owned enterprises can pool resources, expertise, and capital to scale up mineral mining. They also stand to benefit from a stronger, more secure supply chain for these critical minerals.

What’s the significance: India uses over 750,000 tonnes of copper each year but produces only about 550,000 tonnes. Since copper is essential for electricity networks and the clean-energy transition, the country has to import the rest.

India also imports around 80% of its critical minerals, materials needed to make electric vehicles, solar panels, wind turbines, and batteries. These minerals are key to achieving India’s renewable-energy goals and its 2070 net-zero target.

While we are on partnerships,

Websol Energy System signed a deal with Linton Manufacturing for ingot and wafer production in India.

Websol Energy System is involved in the production of solar cells and solar modules.

While US-based Linton Crystal Technologies produces monoscrystalline ingots. This is a high-quality raw material used in advanced solar cells and semiconductor devices.

What will the companies get: under the agreement, Websol will acquire key production equipment from Linton to expand its manufacturing capabilities beyond just finished goods.

Big picture: India currently imports about 80% of its solar-grade polysilicon, wafers, and ingots from China, Vietnam, and Malaysia, creating supply chain risks and cost volatility.

4. Adani buys Trade Castle Tech Park 🤑

Adani Enterprises has bought 100% of Trade Castle Tech Park (TCTPPL) for ₹231.3 crore.

In plain words, TCTPPL mainly brings two things to the table: a sizable piece of land and the clearances needed to begin construction.

What’s brewing: the deal is being executed through AdaniConneX (ACX), Adani’s joint venture with EdgeConneX, a specialist in data centres.

The company has not shared the exact project blueprint yet, but the intent is clear: build new infrastructure, including data centres.

Quick context: AdaniConneX is a 50:50 partnership between Adani Group and EdgeConneX, with an ambition to develop a 1 GW national data centre platform over the next decade.

5. What’s heating up in the startup world? 💰

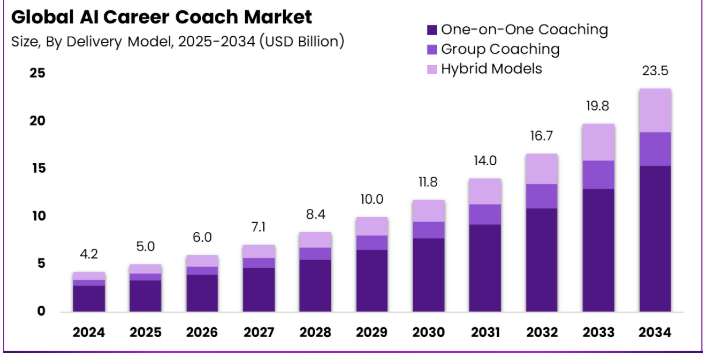

Yoodli just closed a $40 million Series B round, led by WestBridge Capital, with Neotribe and Madrona also joining in.

Yoodli it is like a private rehearsal room for high-stakes conversations.

You can practice interviews, sales calls, leadership chats, and tough feedback moments with an AI roleplay partner, then get instant, specific pointers on what to improve.

The raise positions Yoodli to scale its coaching platform at a time when companies are increasingly turning to AI tools to standardize training and improve communication performance.

More on fundraises 💸,

Furlenco has raised ₹125 crore in a new funding round from Sheela Foam, with Whiteoak and Madhu Kela also investing.

FYI: Sheela Foam first bought a 35% stake in Furlenco in July 2023, spending ₹300 crore in cash, and this is its first fresh investment since then.

Furlenco says it is now in its strongest growth phase. It will use the money to build better products, make its supply chain smoother so deliveries and operations run faster, and expand its offline presence.

The larger goal is clear: strengthen the business over the next few years and get it ready for a possible IPO when the timing is right.

6. Stocks that kept us interested 🚀

1. NBCC lands ₹665 crore boost with five fresh infrastructure orders💰

NBCC India bagged five orders worth ₹665 crore for construction and repair work for public-sector entities across multiple cities and projects.

NBCC India is a government-owned company that provides engineering, construction, and project management services for public and private infrastructure projects.

The deets: the scope of these projects covers construction, project management, renovation, plumbing, sanitary work, and interiors across Ghaziabad, Delhi, Hyderabad, Kolkata, Kanpur, and Lucknow.

Big picture: these contracts add to NBCC’s already expanding order book. Just last month, the company won a ₹2,966 crore consultancy project.

Consistent wins like these help NBCC sustain its margins and stay competitive. This is especially important as it faces larger public-sector rivals like IRCON International and Engineers India in a crowded construction market.

2. BEML secures ₹414 crore order from Bangalore Metro 🚇

BEML won an additional ₹414 crore order from Bangalore Metro Rail Corporation (BMRCL) to supply new trainsets for Bengaluru Metro’s Phase II.

In plain terms, BEML will build more metro coaches for the city, adding to its long track record in India’s metro network.

FYI: the company has already supplied around 1,250 metro cars for the Delhi Metro, 325 for the Bengaluru Metro, and about 84 for the Kolkata Metro.

This fresh order strengthens BEML’s growing rail and metro business, one of its core pillars alongside defence and aerospace, and mining and construction.

What else are we snackin’ 🍿

✈️ Flight chaos: IndiGo cancelled over 100 flights across India due to a crew shortage, offering passengers alternative flights or refunds and urging them to check schedules before travelling.

📊 Bank Nifty boost: Yes Bank and Union Bank will join the Bank Nifty by end-December 2025, a move expected to attract about $249 million in passive inflows.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.