India’s deep tech dream gets a big boost 🚀

Suzlon’s 6x profit, Cipla eyes kids’ health, and OpenAI’s Amazon shift.

🗓 Morning, folks!

💡 Spotlight: India’s deep tech dream gets a big boost 🚀

The India Deep Tech Alliance (IDTA) got a funding upgrade with ₹7,500 crore in new commitments and heavyweight additions like Nvidia and Qualcomm Ventures joining the fold.

The coalition, launched in September at SEMICON India, is now backed by VCs such as InfoEdge Ventures, signalling global confidence in India’s deep tech potential.

The mission is to turbocharge homegrown innovation across AI, semiconductors, space, robotics, biotech, and advanced manufacturing.

Built on the government’s ₹1 lakh-crore Research, Development & Information (RDI) Scheme, this alliance aims to channel both capital and technical expertise into startups.

Let’s hit it!

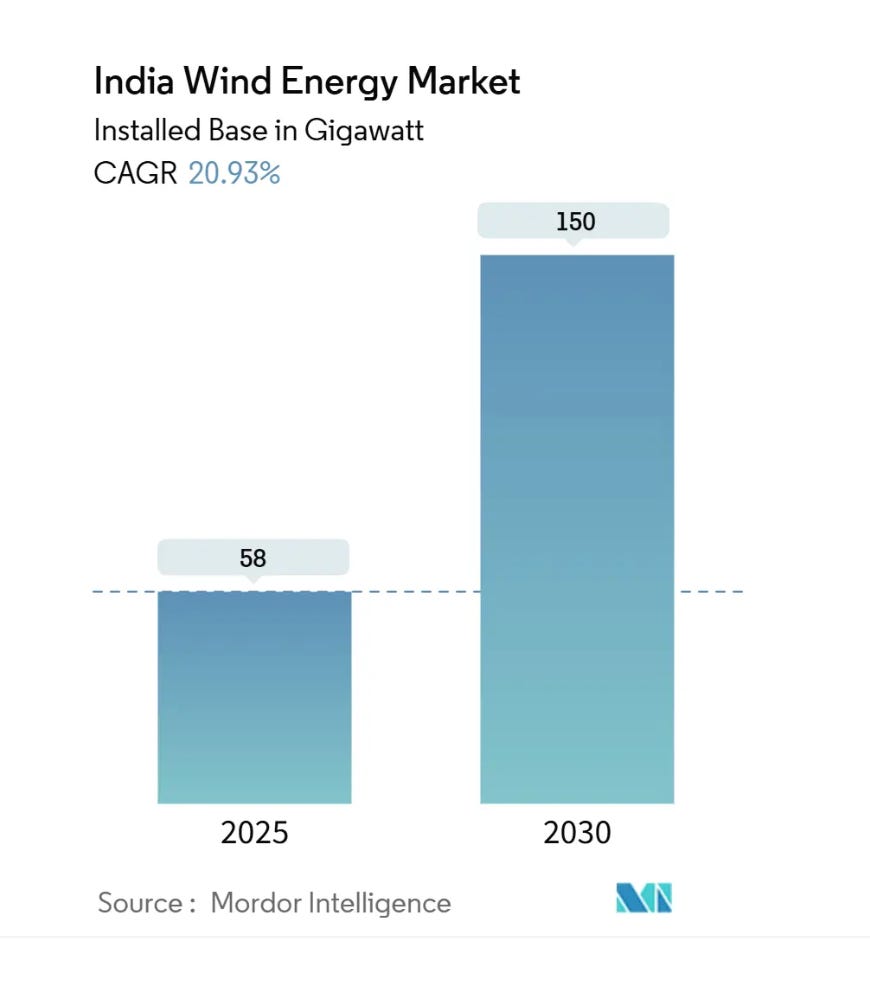

1 Big Thing: Suzlon Energy posts 6x profit surge in Q2 🌬️

Suzlon Energy reported a 6 times rise in its Q2 profits .

By the numbers: the company reported a consolidated profit of ₹1,278 crore, up 539% from ₹200 crore in the same period last year.

Revenue from operations also grew a sharp 85% from ₹3,866 crore as compared to ₹2,093 crore on a year-on-year (YoY) basis.

However, it is important to note that ₹718 crore of this came from a tax write-back, while the remaining gain was driven by its growing order book which also hit a record high this quarter.

A tax write-back occurs when a company sets aside money for taxes but later finds that it owes less than expected. The unused amount is then added back to its profits.

Of the total revenue,

₹3,241 crore came from Suzlon’s core Wind Turbine Generator business,

₹121 crore from its Foundry and Forge segment

₹575 crore from its Operations and Maintenance division.

The company’s energy deliveries were also the highest this year at 565 MW. With this Suzlon has crossed 6GW of order book at 6.2 GW, with the addition of another 2 GW in the first half of the current financial year.

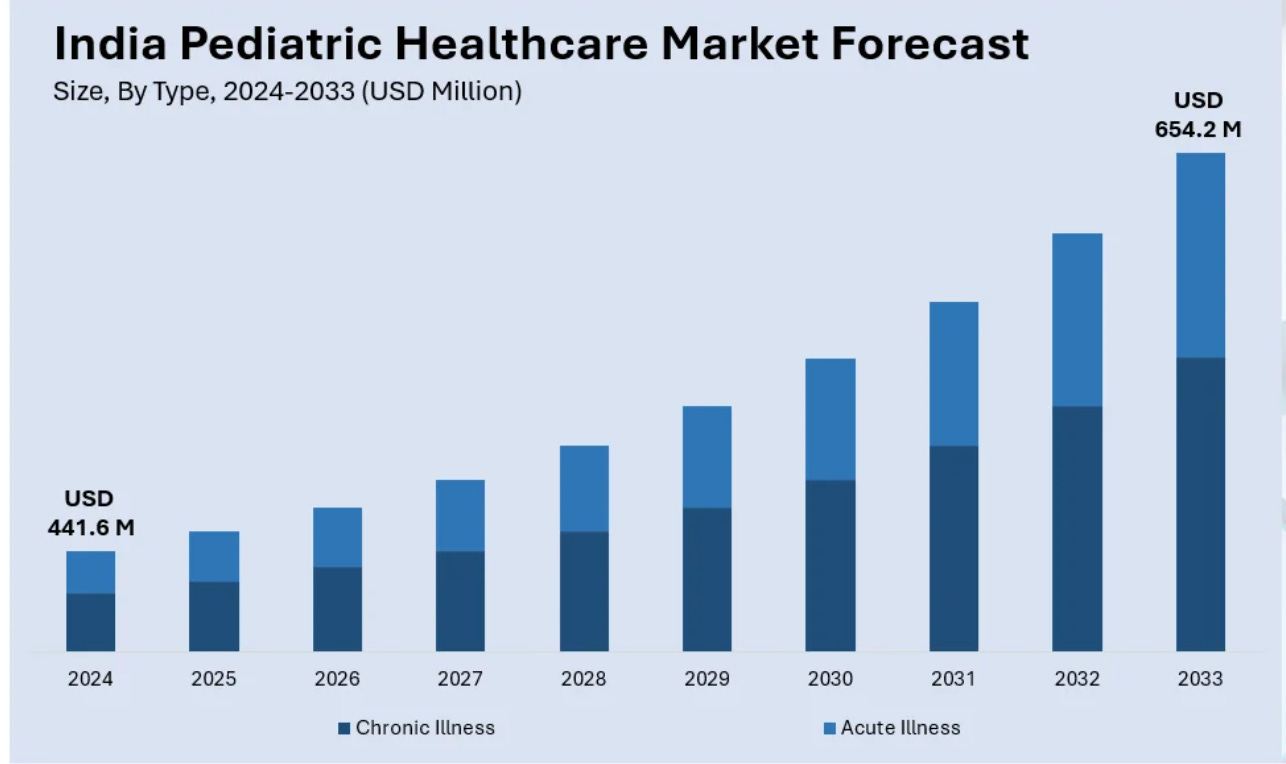

2. Cipla expands to pediatric health market with ₹110 cr acquisition 🧸

Cipla is set to acquire a 100% stake in Inzpera Healthsciences, a subsidiary of Tata Industries, for approximately ₹110 crore.

Incorporated in 2016, Inzpera focuses on developing, manufacturing, and marketing innovative pediatric pharmaceutical and wellness products.

What’s happening: the acquisition is a step to integrate Inzpera’s differentiated paediatric and wellness portfolio. This integration will leverage Cipla’s strong distribution network and operational expertise.

Big theme: India’s pediatric healthcare market size reached $441.6 million in 2024 and is expected to grow to $654.2 million by 2033, exhibiting an annual growth rate of 4.46% during 2025-2033.

Why it makes sense for Cipla: Inzpera’s differentiated pediatric and wellness portfolio complements the company’s strengths, while its extensive distribution network & operational scale can accelerate Inzpera’s growth.

While we are on acquisitions,

Indian Metals and Ferro Alloys (IMFA) wil acquire Tata Steel’s ferro alloys plant in Odisha, for ₹610 crore.

What’s the deal: the acquisition will help IMFA double its ferro chrome capacity from 2.84 lakh tonnes to 5.34 lakh tonnes, combining both organic expansion and the new facility.

Why it matters: the deal will help IMFA improve its margins. It also makes the company a stronger player in the domestic ferro alloys market, where supply shortages have been a persistent challenge.

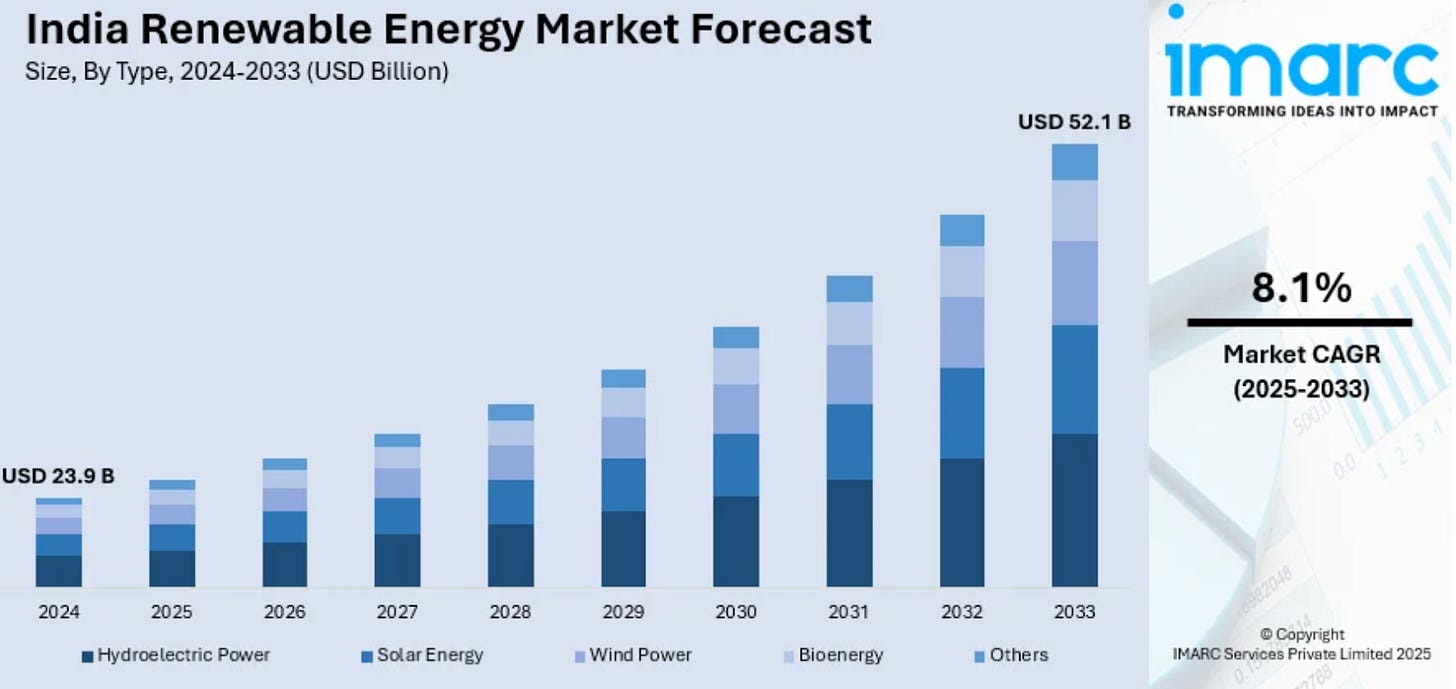

3. SAEL Industries is going for a ₹4,575 crore IPO ☀️

SAEL Industries announced that the company has filed its DRHP for a ₹4,575 crore IPO with SEBI.

The company operates in the renewable energy space and provides solutions like biomass-based power projects, solar parks, and agri-waste management.

The deets: the IPO size consists of a fresh issue worth ₹3,750 crore and offer-for-sale of ₹825 crore. The newly raised capital would be utilised to fund subsidiaries, repay borrowings, and expand capacity.

Zoom out: the company is yet to turn profitable, having reported a loss of ₹4.8 crore in FY24.

India’s renewable energy market is growing rapidly, expanding at an annual rate of 8.1%. It’s expected to reach a valuation of $52.1 billion by 2033, supported largely by government initiatives.

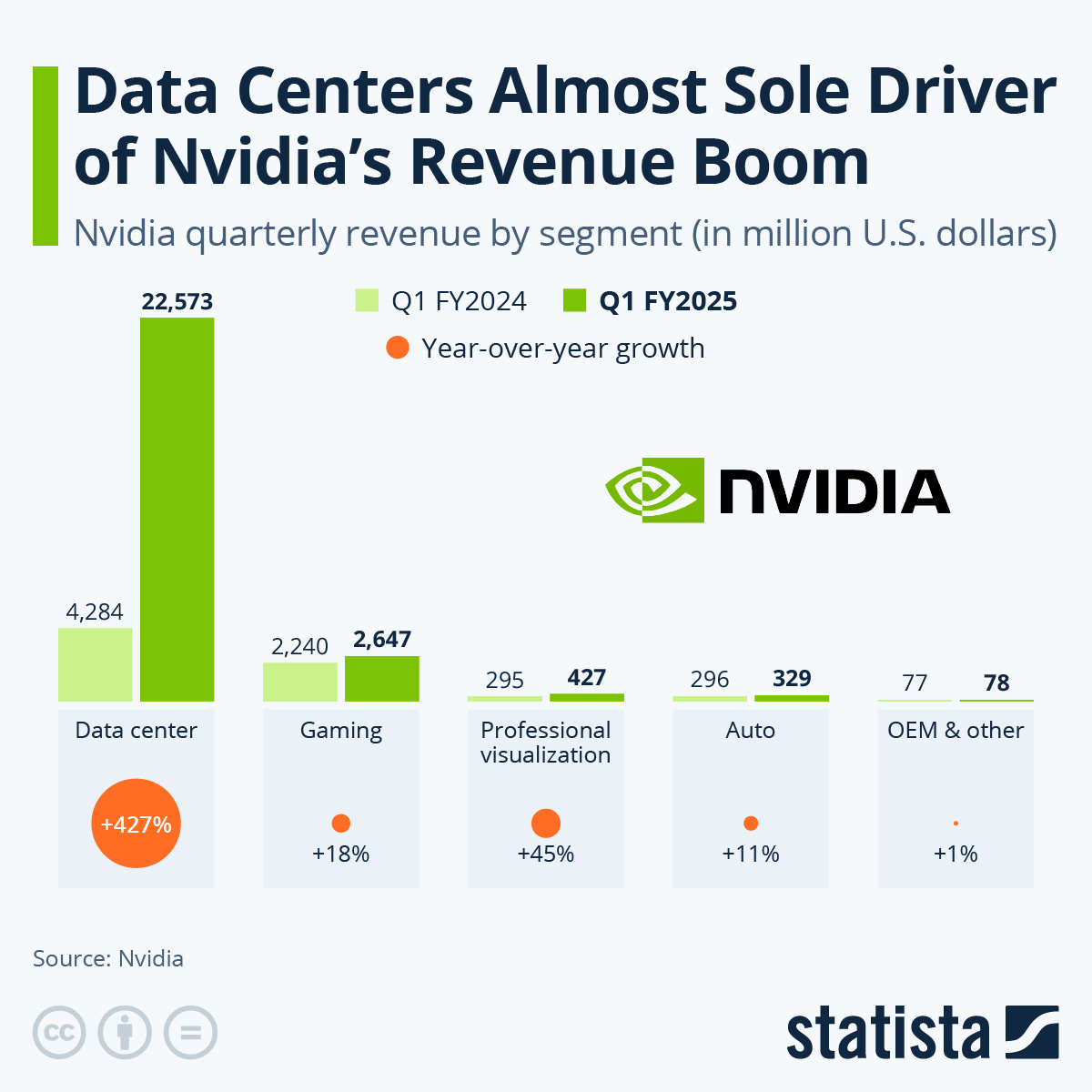

4. OpenAI’s Amazon deal shakes up Microsoft-Nvidia cloud race ☁️

OpenAI signed a massive $38 billion deal with Amazon Web Services (AWS) to access huge computing power using Nvidia chips. Amazon’s stock reacted with a 4% rise, hitting a record high.

This is OpenAI’s first-ever partnership with Amazon.

Breaking it down: under the deal, OpenAI will run its AI workloads on AWS data centers across the US, using hundreds of thousands of Nvidia GPUs. Over time, Amazon will build new infrastructure for OpenAI to handle growing AI demands.

This deal also adds to OpenAI’s growing list of partnerships worth nearly $1.4 trillion, including deals with Nvidia, Broadcom, Oracle, and Google.

“Scaling frontier AI requires a massive, reliable compute,” said Sam Altman, CEO of OpenAI. “Our partnership with AWS strengthens the broad compute ecosystem that will power this next era and bring advanced AI to everyone.”

OpenAI’s shift: for years, the company relied almost entirely on Microsoft’s cloud platform, Azure, after receiving over $13 billion in funding from the tech giant.

But that exclusivity ended earlier this year, freeing OpenAI to work with other big cloud providers like Oracle, Google, and now Amazon.

5. Stocks that kept us interested 🚀

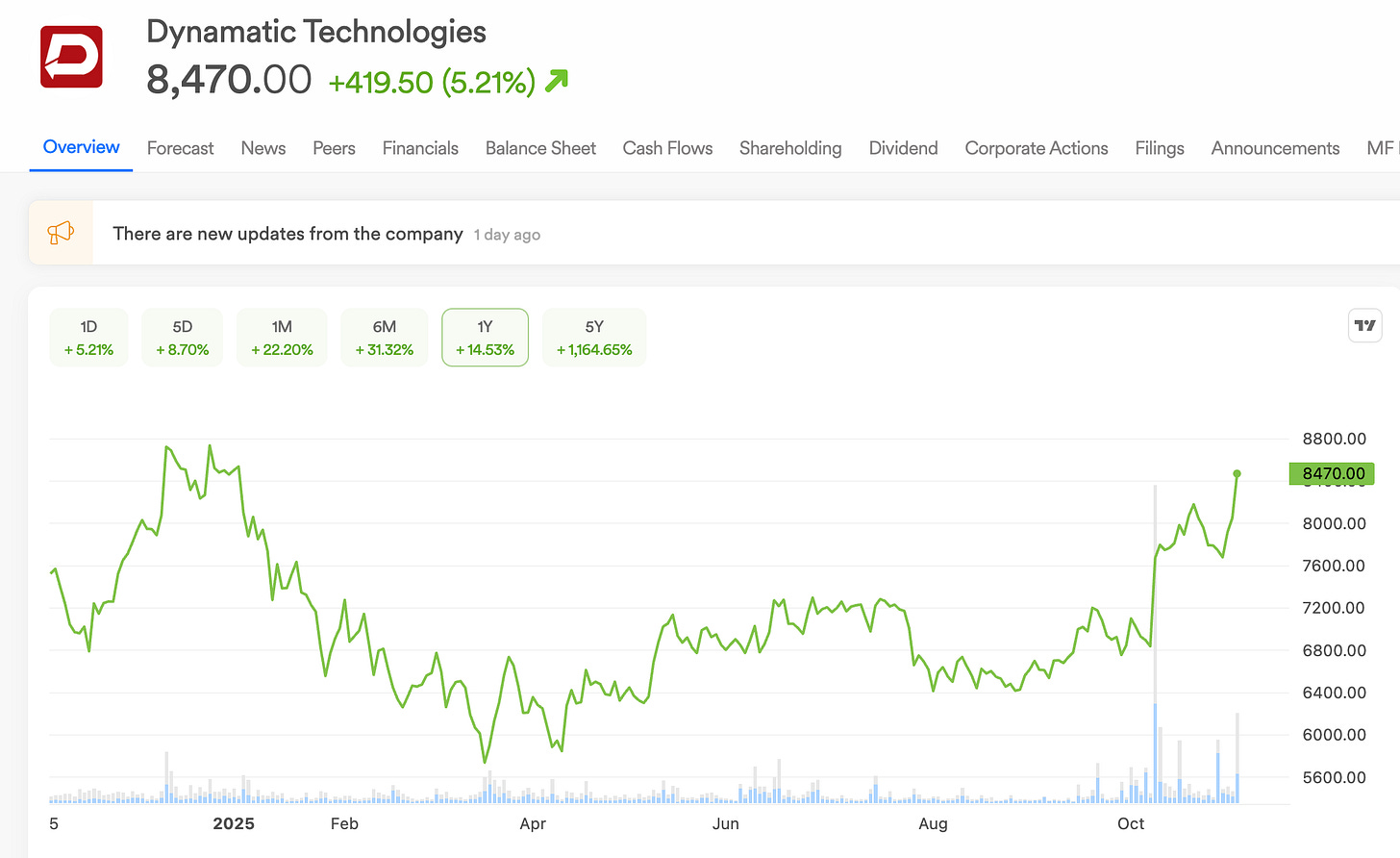

1. L&T- BEL pick Dynamatic Technologies for fifth gen fighter jet ✈️

Dynamatic Technologies soared over 5% in Tuesday’s trading session after being chosen as the exclusive partner by the L&T-BEL consortium for India’s fifth-generation fighter aircraft programme.

FYI: this fifth-generation fighter aircraft programme will make India one of only four nations, along with the U.S., China, and Russia to have fifth-generation fighter aircraft.

Dynamatic Technologies designs and manufactures high-precision engineered products for aerospace, automotive, hydraulic and defence industries globally.

Breaking it down: this partnership brings together the company’s experience in building aircraft parts, L&T’s strong engineering skills, and BEL’s experience in advanced electronics.

2. Marksans Pharma secures UK nod for breast cancer drug 💊

Marksans Pharma’s wholly-owned subsidiary, Relonchem, has received marketing authorisation from the UK’s Medicines and Healthcare products Regulatory Agency (MHRA) for Exemestane 25 mg film-coated tablets.

In simple terms, these tablets are used primarily for the treatment of breast cancer in women.

Why it matters: according to the WHO, in 2022, around 2.3 million women were diagnosed with breast cancer, and 670,000 lost their lives to the disease globally.

This trend aligns closely with Marksans Pharma’s strategy to expand its oncology and specialty medicines portfolio across key international markets. By securing this approval, the company can tap into the growing UK oncology segment.

What else are we snackin’ 🍿

🚘 Tesla reboots: Tesla appointed ex-Lamborghini India head Sharad Agarwal as its country chief to lead local operations.

💻 IBM layoffs: IBM will cut about 1% of its global workforce, while keeping U.S. headcount steady year over year.

🤖 AI alliance: Nvidia joined the $2 billion India Deep Tech Alliance as a founding member to mentor AI startups, strengthening its presence in India’s fast-growing AI ecosystem.

📦 IPO cleared: Shiprocket got SEBI approval to launch its IPO, marking a key step in the logistics platform’s growth journey.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

The deep tech push is interesting when you consider how TCS has been quietly shifting its consultng model. They've been investing heavily in AI research centers and partnering with startups through their venture arm. This alliance could give them more structured access to early stage innovations that they can scale globally.