India's battery storage future gets Adani's push

Relief to Indian exporters, new green IPO on the block, and a defence collab.

🗓 Morning, folks!

Markets bounced back strong on Tuesday as Sensex and Nifty recovered most of last week’s losses, tracking upbeat global cues.

Aviation, auto, and metal stocks led the charge. IndiGo soared over 3% after robust air traffic data, while Mahindra & Mahindra climbed nearly 3% on healthy auto sales.

💡 Spotlight: Shrimp and textile stocks ride trade wave 🍤

Shrimp and textile stocks jumped after President Trump said the US is “getting close” to sealing a new trade deal with India. The deal could slash tariffs on Indian exports and give a big boost to two of India’s most export-heavy sectors.

Apex Frozen Foods jumped 12%, Avanti Feeds rose 5%, while textile majors like Gokaldas Exports & KPR Mill gained up to 7%. The US buys over half of India’s shrimp exports and a big chunk of its textiles, so any tariff relief would be a major win.

Let’s hit it!

1 Big Thing: SoftBank offloads full Nvidia stake for $5.83 billion 💰

SoftBank has sold its entire $5.83 billion stake in Nvidia as it shifts focus to investing in ChatGPT maker OpenAI.

What’s brewing: SoftBank also sold about 40 million T-Mobile shares between June and September 2025, earning around $9.17 billion. This sale is part of SoftBank’s larger plan to cash in on some of its investments and free up capital.

T-Mobile is one of the largest U.S. telecom companies, offering mobile services, wireless internet, and data plans. SoftBank became its second-largest shareholder after Sprint’s 2020 merger with T-Mobile, while Deutsche Telekom remains the majority owner.

Note: this isn’t SoftBank’s first time selling Nvidia shares. Its Vision Fund first invested about $4 billion in the chipmaker back in 2017, then sold everything by 2019.

Even after selling, SoftBank still works with Nvidia through its AI projects, including the massive $500 billion Stargate data center planned in the U.S.

2. Adani Group to build India’s largest battery storage project in Gujarat ⚡

Adani Group is building India’s largest Battery Energy Storage System (BESS) and one of the world’s biggest single-location installations at Khavda, Gujarat.

The project will have a power capacity of 1,126 MW and energy capacity of 3,530 MWh, enough to power over 7 lakh homes for three straight hours.

Why you should know about this: the BESS will store extra solar and wind energy and release it when demand peaks. This will help ensure 24/7 renewable power while also cutting carbon emissions.

How Adani will do it: the project will use advanced lithium-ion batteries and smart energy management systems housed in over 700 battery containers.

These will allow real-time control of power flow, reduce transmission losses, and make renewable energy more dependable.

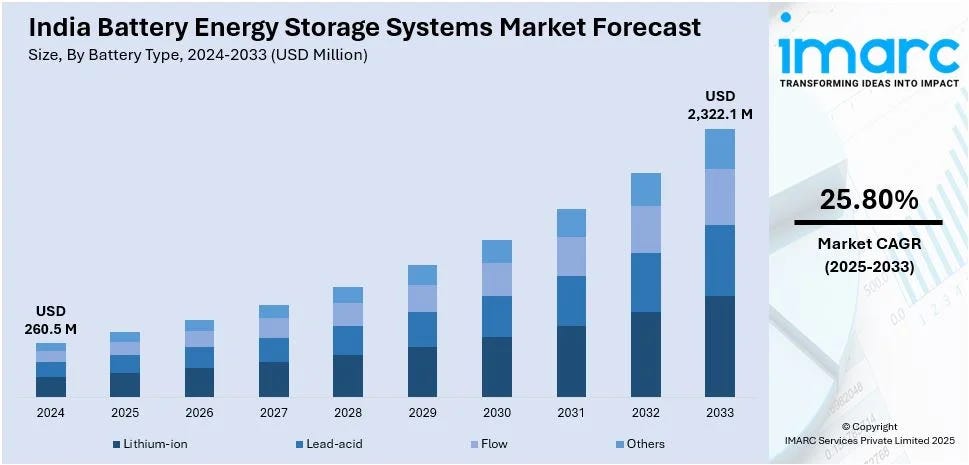

Zoom out: battery storage is becoming the new backbone of the global energy transition. As India’s renewable capacity surges past 80 GW, storage is the missing link that can turn intermittent solar and wind into round-the-clock clean power.

3. Syrma SGS strengthens defence game with Elcome stake ⚙️

Syrma SGS Technology rose nearly 3% after announcing plans to acquire a 60% stake in Elcome Integrated Systems.

The company is also looking to buy Navicom International to strengthen its footprint in the defence and maritime sectors.

Navicom International provides marine navigation, communication, and automation systems for ships and offshore platforms.

Elcome is a leading Indian defence and maritime electronics firm known for its integrated command solutions and mission-critical technologies.

Why it’s important: the acquisition leverages Syrma’s manufacturing scale, engineering capabilities, and supply-chain network with Elcome’s expertise in radar, navigation, and command systems.

4. WestBridge raises its stake in Star Health by investing $12 million ❤️🩹

WestBridge Capital increased its stake in Star Health Insurance with a $12 million investment during the first half of this financial year.

Context: the move aligns with WestBridge’s bigger aim to foray into the insurance game. The company is coming up with its own general insurance venture called Kiwi.

WestBridge is a private equity firm that provides purpose-driven capital to entrepreneurs and manages over $8 billion worth of assets in India.

Background: the company had first backed Star Health over a decade ago and partially exited during its IPO in 2021. With this investment, WestBridge wants to rebuild its stake in the company.

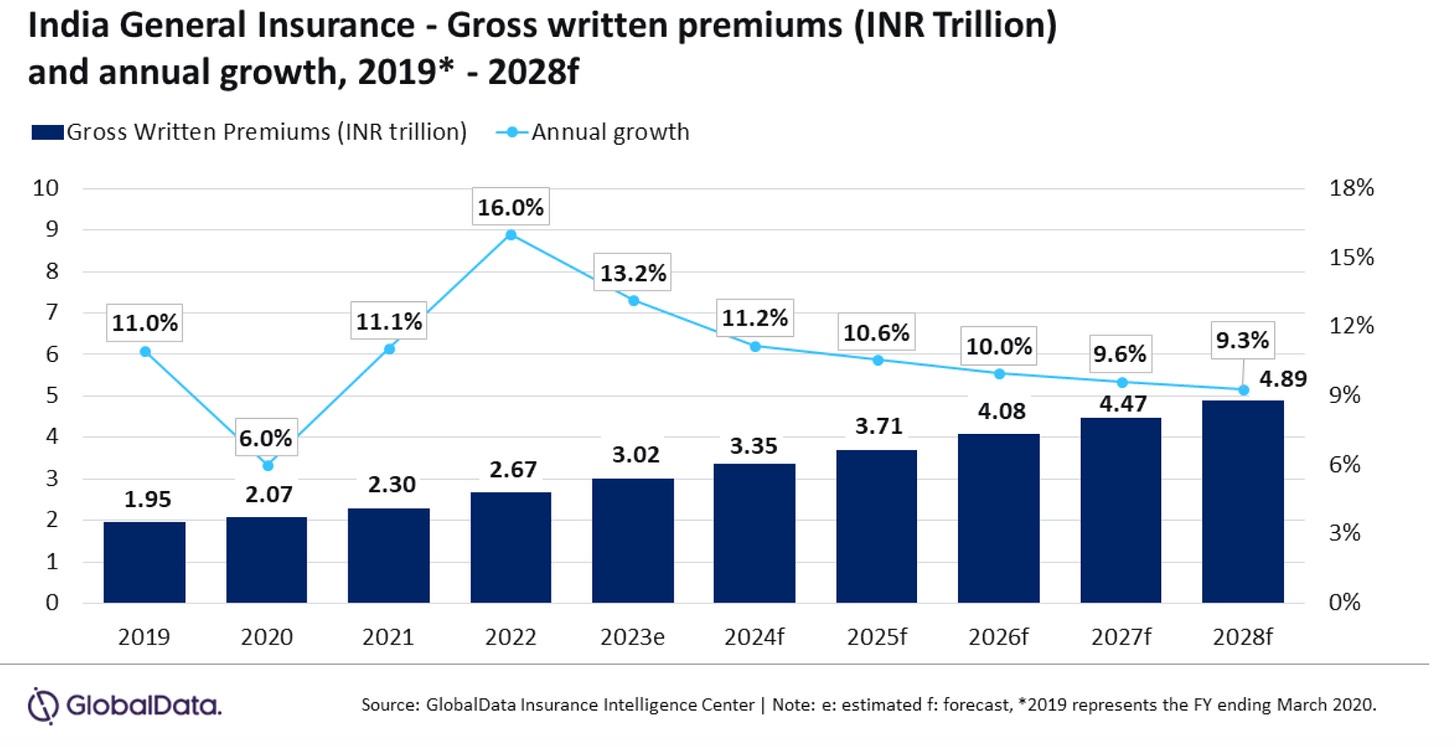

Big picture: India’s insurance market is slated to grow at the rate of 9.3%, mainly driven by personal accident and health (PA&H), motor, and property insurance lines.

By partnering with an established health insurer like Star Health, the company can tap into its existing market and strengthen its foothold.

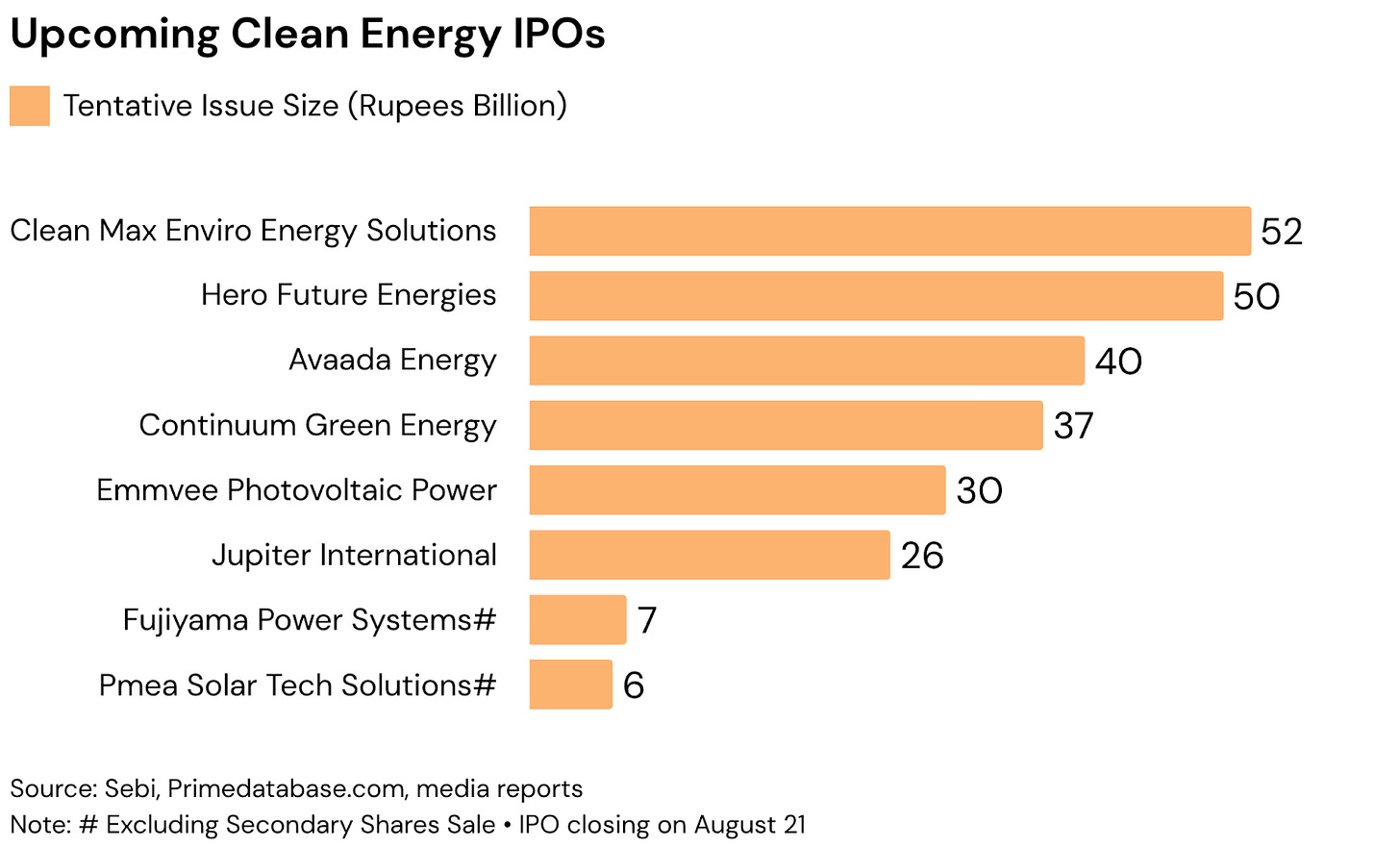

5. CleanMax joins India’s green IPO wave with ₹5,200 crore 🚀

CleanMax Enviro Energy Solutions has received approval from SEBI to raise ₹5,200 crore through an IPO.

The company supplies solar, wind, and hybrid power, energy services, and carbon credit solutions to various industries.

Breaking it down: the IPO comprises a fresh issue of shares worth up to ₹1,500 crore and an offer for sale of up to ₹3,700 crore by promoters and existing shareholders.

The company filed its DRHP in August 2025 and has now begun investor roadshows.

Big theme: India is witnessing a fresh wave of clean-energy IPOs as companies tap into the government’s strong push for renewables. Over a dozen green-energy firms are preparing to go public, aiming to raise more than $4 billion collectively.

This surge in green listings follows a renewed momentum in India’s broader IPO market after a sluggish start to the year.

While we are on IPOs,

Finnable is raising ₹250 crore in a funding round led by Z47 and TVS Capital.

Finnable is a digital lending platform that provides quick personal loans to salaried professionals through partnerships with banks and NBFCs.

How it’s positioned: in India’s competitive digital lending space, which includes players like Stashfin, Kissht, Fibe, mPokket, and CASHe, the competition is heating up.

Finnable stands out for its focus on salaried borrowers and low default rates, supported by AI-driven risk models and strong banking partnerships.

6. Stocks that kept us interested 🚀

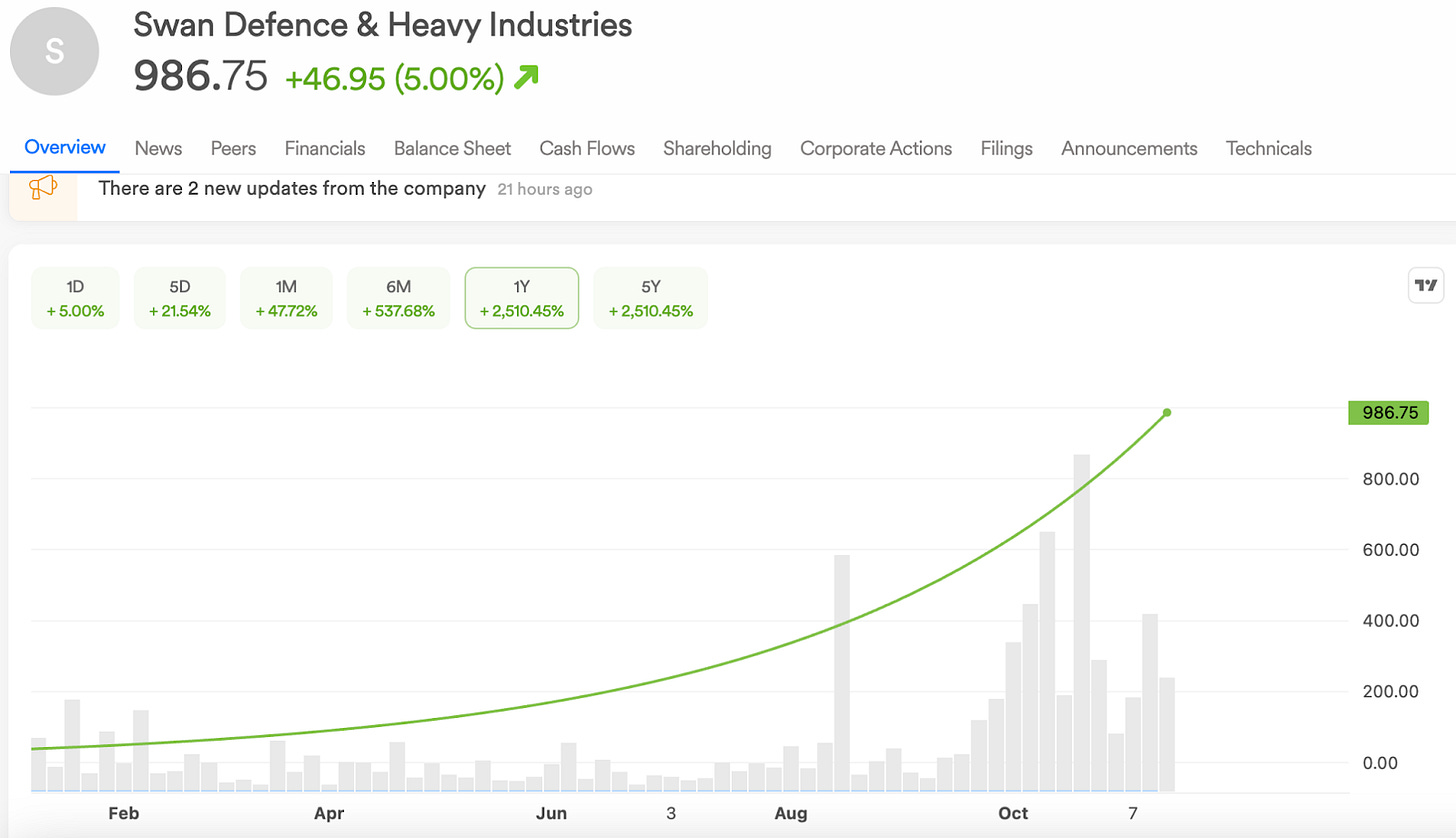

1. Swan Defence bags $220 million shipbuilding deal in Norway 🚢

Swan Defence and Heavy Industries (SDHI) hit 5% upper circuit after it bagged a major shipbuilding order worth $220 million.

The company signed a Letter of Intent (LoI) with Norway’s Rederiet Stenersen AS to build six large ships that carry liquid chemicals safely across oceans.

About the order: the tankers, each 18,000 DWT, will be built at Pipavav in Gujarat and designed by Marinform AS and StoGda (Norway). They will be certified by DNV, a global authority that ensures ships meet top safety and environmental standards.

Why it matters: Pipavav was once one of India’s most promising private shipyards but had fallen into financial distress before Swan Defence took over.

Landing this global order is a credibility boost for the company. For India, it signals a revival of private shipbuilding strength and attracting international clients.

2. ACME Solar wins major 450 MW green power project ⚡

ACME Solar Energy landed a 450 MW-1800 MWh assured peak power project from SJVN. The project will deliver reliable peak power and marks ACME’s first use of Indian-made solar cells under ALMM List-II.

ALMM List-II refers to the Approved List of Models and Manufacturers issued by India’s Ministry of New and Renewable Energy (MNRE).

The deets: awarded under the SJVN FDRE-IV tender, the 25-year contract was secured at a tariff of ₹6.75 per unit.

The SJVN FDRE-IV tender is part of SJVN’s push to build round-the-clock green power projects using a mix of solar, wind, and battery storage.

The project combines 300 MW of solar capacity with 1800 MWh of Battery Energy Storage System (BESS) to ensure consistent power even when the sun’s down.

What else are we snackin’ 🍿

🇺🇸 Tariff twist: Donald Trump said the US would bring down tariffs on India, signalling a friendlier turn in trade talks.

🛡️ Strategic ties: India and Vietnam signed an agreement to deepen defence cooperation, focusing on technology transfer, joint research, and stronger defence industry partnerships.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.