India's ₹40,000 cr defence boost

Beauty IPO, smartphone export rush, and largest ever solar project.

🗓 Morning, folks!

Markets had a serious case of the Mondays yesterday, with major indices pulling back on concerns around US debt downgrades.

For context, Moody’s, the famous credit rating agency, slapped a lower rating on US government’s debt citing slowing GDP growth and ballooning debt burden. While India and rest of the world opened lower, US investors infact shrugged off the news as immaterial.

💡 Spotlight: smartphones just dialled in a win.

India’s smartphone exports have overtaken petroleum and diamonds to become the country’s top export category, a major milestone for the electronics sector.

In FY25, exports jumped 55% YoY, more than doubling in two years. Shipments to the US rose 5x, and Japan 4x, showing how Indian-made phones are going global, fast. That’s a lot of iPhones.

Let’s hit it!

1 Big Thing: India to remilitarize, rapidly 💣

India’s Defence Acquisition Council (DAC) just approved ₹40,000 crore in emergency arms buys. This marks the fifth fast-track procurement round since 2019, to speed up weapon and ammunition purchases.

The procurement is a special provision that lets the armed forces skip red tape and directly buy high-priority defence gear with contracts requiring delivery within months, not years.

What’s in the haul:

Surveillance drones & kamikaze drones

Loitering munitions and long-range artillery ammo

Missiles, rockets, and air defence systems

Drone detection radars from Bharat Electronics Limited

This gear will be used by the Army, Air Force, and Navy, all of whom are coordinating closely with defence finance teams to ensure speed and accountability.

The why: speed is strategy. With Operation Sindoor unfolding on the western border, the armed forces are moving to plug capability gaps fast.

Drones and missiles used in the operation, like the Heron Mk 2 and Rampage, were bought through earlier emergency powers.

This success has turned emergency procurement into a trusted play, with repeat orders now placed for domestic production.

Meanwhile, defence stocks are on a tear. The nifty defence index is up more than 50% over the past month.

2. Delhivery delivers profit in Q4 🚚

In Q4FY25, Delhivery turned profitable, posting a net gain of ₹73 crore which is a sharp reversal from the ₹69 crore loss it reported in the same period last year.

By the numbers:

Sequential growth: Net profit nearly tripled from ₹25 crore in Q3FY25

Revenue: ₹2,192 crore, up 5.6% YoY

Full-year FY25 profit: ₹162 crore vs loss of ₹249.2 crore in FY24

Annual revenue: ₹8,932 crore, up 10% YoY

What’s working: Delhivery’s profitability was driven by strong cost control and operational efficiency, especially in its Partial Truckload (PTL) segment. Better mid-mile utilisation helped expand margins, even as the e-commerce segment remained steady.

Zoom out: the stock is still 24% off its 52-week high but it has staged a comeback as it is up 15.5% in May.

Also in focus: its pending acquisition of eCom Express is expected to strengthen the company’s express parcel business and support long-term scale in logistics.

Why it matters: investors have long viewed Delhivery as an infrastructure proxy for India’s e-commerce boom. With volumes rising and margins improving, now might finally be its moment.

While we are on earnings,

Defence electronics player Data Patterns clocked a solid Q4, with both profit and revenue more than doubling year-on-year.

By the numbers: the company reported a net profit of ₹114 crore, up 60.5% from ₹71 crore in the same quarter last year.

Q4 revenue more than doubled, rising 117.3% year-on-year to ₹396.2 crore.

With defence tailwinds strong and order books fattening, Data Patterns looks well-aligned for high-growth in India’s booming defence-tech sector.

3. Colorbar is planning for an IPO 💄

Makeup player Colorbar is planning to go public by early 2027.

The deets: Colorbar is a part of the ₹1.5 trillion Modi Enterprises group & it is valued between ₹25,000–35,000 crore. The brand is built around high-quality, cruelty-free makeup and skincare.

Colorbar has a moderate presence among Gen Z, driven by its accessible pricing and trendy packaging. However, the initial buzz around the brand has tapered off in recent years, making room for newer, influencer-led entrants in the beauty space.

Worth noting: Colorbar has its sights set on doubling revenue to ₹1,000 crore in FY26, and is betting big on premiumisation from luxe packaging to store upgrades.

Zoom out: with Nykaa and Mamaearth already listed, India’s beauty IPOs have had mixed results. Despite buzzy launches, both stocks have faced pressure from high competition and thin margins. Colorbar will need to show that it can scale profitably, not just prettily.

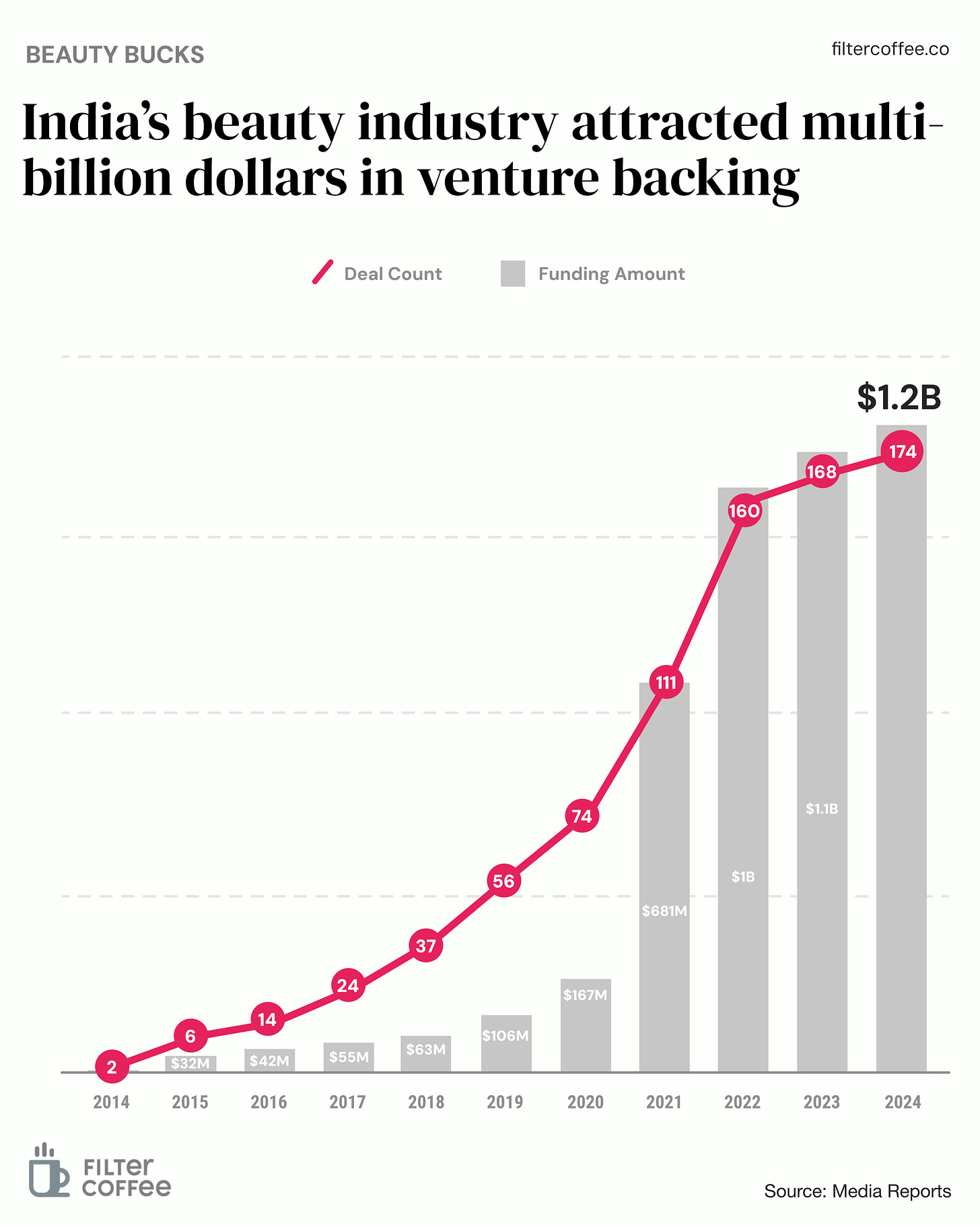

That said, Colorbar’s IPO timing could still work, India’s beauty industry is booming, with deal counts and venture funding touching all-time highs.

While we are on IPOs,

Logistics unicorn Shiprocket is prepping for a confidential IPO filing.

Backed by Temasek and Zomato, the company is looking to raise ₹2,000–2,500 crore via a mix of fresh issue and OFS.

Shiprocket handles ₹25,000 crore+ GMV for nearly 1.5 lakh sellers, with 60% of business coming from non-metro markets. The funds will go toward tech upgrades, warehousing, and acquisitions.

4. Stocks that kept us interested 🚀

1. India’s graphite giants shine as Japan steps back ⚡

Shares of HEG and Graphite India surged up to 15% after Japan’s Resonac Holdings announced it’s closing graphite electrode production in China and Malaysia.

Graphite electrodes are essential components used in electric arc furnaces to melt scrap metal during steel production.

Resonac, a top global supplier, is trimming nearly a third of its global capacity, scaling back operations to improve margins amid intense local competition.

After the cuts, only four plants will remain, in Japan, the US, Austria, and Spain.

Why India’s cheering: with a major player stepping back in Asia, Indian giants like HEG and Graphite India gain both pricing power and export tailwinds. HEG already exports 70% of its output to over 30 countries, while Graphite India brings global exposure through its German unit.

2. Reliance Power’s Bhutan solar leap ☀️

Reliance Power signed an agreement with Bhutan’s Green Digital to develop the country’s largest 500 MW solar power project in a ₹2,000 crore joint venture. The stock ended over 1% higher following the announcement.

A 500 MW solar power project can generate enough electricity to power nearly all of Bhutan during peak demand.

The deets: the deal is structured as a 50:50 partnership and marks Bhutan’s biggest private-sector solar FDI yet, under the Build-Own-Operate (BOO) model.

In addition to the solar project, the two companies will jointly execute and run the 770 MW Chamkharchhu-I hydroelectric project, further boosting Bhutan’s renewable energy push.

Stock trend: Reliance Power shares climbed as much as 3.6% and are now up nearly 16% in May alone.

What else are we snackin’ 🍿

🛒 Kirana callout: India’s FMCG distributors’ body AICPDF has announced an indefinite boycott of all Turkish-origin consumer goods, impacting over 1.3 crore kirana stores nationwide.

🥤 Rasna’s Jumpin start: Rasna has entered the ready-to-drink market by acquiring Jumpin from Hershey’s India.

🧬 Gene deal: Regeneron is buying 23andMe for $256M via bankruptcy auction and says it will stick to privacy rules when handling genetic data.

🍎 iPhone shift: Apple supplier Hon Hai (Foxconn) is pumping $1.5B into its India unit to ramp up iPhone production as Apple doubles down on its China-to-India shift.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.