India faces an oil squeeze

Solar IPO, Meta's geothermal bet, and Shriram dives into advanced chemicals.

🗓 Morning, folks!

Crude-sensitive stocks tumbled on Friday as oil prices surged 13% after Israel launched airstrikes on Iran, sparking fears of a wider Middle East conflict.

Shares of oil marketing companies (OMCs) like HPCL and BPCL fell up to 5%, along with paint and tyre stocks which are sectors that use oil or oil-based materials and get hit when crude prices go up.

When oil prices rise, it gets more expensive for companies to buy oil or oil-based products. This hurts profits for companies like OMCs that sell petrol/diesel, or paint/tyre makers that use oil as a raw material.

Meanwhile, ONGC and Oil India shares rose up to 3%.

ONGC and Oil India produce oil, when prices rise, they can sell at higher rates and make more money.

As far as the conflict goes, Israel’s surgical elimination of key Iranian military personnel and nuclear scientists, received strong Iranian response, with Iran blasting Israeli mainland with hypersonic missiles. The conflict continues to drag out and will be top of mind for markets this week.

Let’s hit it!

1 Big thing: Rayzon Solar eyes ₹1,500 cr IPO ☀️

Solar panel maker Rayzon Solar is preparing to file draft papers with SEBI by the end of the month for a planned ₹1,500 crore IPO.

The deets: the IPO will be a fresh issue of shares, with proceeds earmarked for the company’s expansion plans.

Surat-based Rayzon has grown rapidly, scaling from 40 MW initial capacity to a current 6,000 MW across two Gujarat plants including Karanj and Sava, with further expansion likely.

Simply speaking, the company makes photovoltaic (PV) solar panels, which it sells to infrastructure developers, solar EPC firms, and utility-scale power projects for use in rooftop, commercial, and industrial solar installations.

The why: Rayzon is looking to capitalise on strong tailwinds in India’s domestic solar manufacturing market, driven by import restrictions and the global push for non-China supply chains.

With demand for solar PV modules soaring, the company’s expansion play is well-timed.

2. DCM Shriram dives into advanced chemicals 🧪

DCM Shriram is acquiring 100% of Hindusthan Specialty Chemicals for ₹375 crore.

A diversified agri and chemicals firm, DCM Shriram operates across agri-inputs, chlor-vinyl, sugar, cement, and now, advanced materials.

On the other hand, Hindusthan Specialty Chemicals is a manufacturer of advanced epoxy resins and formulated products, catering to sectors like aerospace, electronics, EVs, defence, and renewables.

The why: DCM Shriram is making this acquisition to expand and diversify its chemicals portfolio. The move aligns perfectly with its plan to build a strong presence in epoxy and advanced materials, leveraging synergies with its existing chemical operations.

Background: this acquisition follows DCM’s earlier commitment of ₹1,000 crore to set up an epoxy and advanced materials business under its chemicals SBU.

3. Meta bets big on geothermal energy 🌋

Meta teamed up with XGS Energy to build a 150 MW geothermal power plant in New Mexico, aiming to power its data centres with clean, always-on energy.

A 150 MW geothermal power plant can generate enough electricity to power roughly 1.5 to 2 lakh homes continuously, perfect for running large data centres that need constant energy.

The deets: geothermal energy taps heat from deep underground to produce electricity 24/7, without emissions. It’s seen as a perfect fit for energy-hungry tech firms, who need reliable green power to run their data centres.

Why it matters: as demand for AI and cloud computing explodes, companies are looking for cleaner ways to meet their growing power needs.

While most geothermal players use open-loop systems, where water flows through underground cracks and some is lost, XGS uses a closed-loop system circulating water through a sealed pipe to capture heat more efficiently, with minimal water loss. They also inject a special proprietary mud to boost heat transfer.

Zoom out: advanced geothermal could meet two-thirds of new US data centre demand by 2030. With its round-the-clock power and zero emissions, geothermal is fast becoming a key pillar of clean energy strategies for hyperscalers like Meta.

4. Stocks that kept us interested 🚀

1. Hyundai stock rises on EV magnet relief 🚗

Hyundai Motor India stock climbed over 1% after reports suggested it is unlikely to face any near-term EV production disruption despite a global rare earth magnet shortage.

The deets: Hyundai is tapping into its global parent’s supply chain to secure rare earth magnets which are critical components for EV motors and other advanced auto systems.

The move comes as China’s tighter export rules have disrupted shipments to Indian manufacturers since April.

Good news: Hyundai’s parent company has reportedly stocked up enough inventory to keep production running through the rest of the year. That boosted investor confidence, sending the stock higher even as the broader market remained cautious.

Zoom out: the rare earth magnet supply crunch is a global issue.

China, which controls 90% of global supply, has made it mandatory for exporters to provide end-use certificates, slowing shipments.

2. Dixon, Signify light up OEM play 💡

Dixon & Signify will form a 50:50 joint venture to make lighting products in India.

OEM simply means making products that are sold under another brand’s name. For example, Dixon might manufacture LED lights that are branded and sold by Signify or other brands.

Dixon Tech is one of India’s largest electronics manufacturing companies, making products for major brands across mobiles, TVs, lighting, and appliances. Meanwhile, Signify Innovations is a global lighting company (formerly Philips Lighting), known for its advanced LED and smart lighting solutions.

The deets: in this partnership, Dixon will transfer its existing lighting business including full ownership of its lighting-focused subsidiary Dixon Technologies Solutions into the new JV. this will be its contribution in exchange for its 50% stake. Signify, on the other hand, will bring in capital.

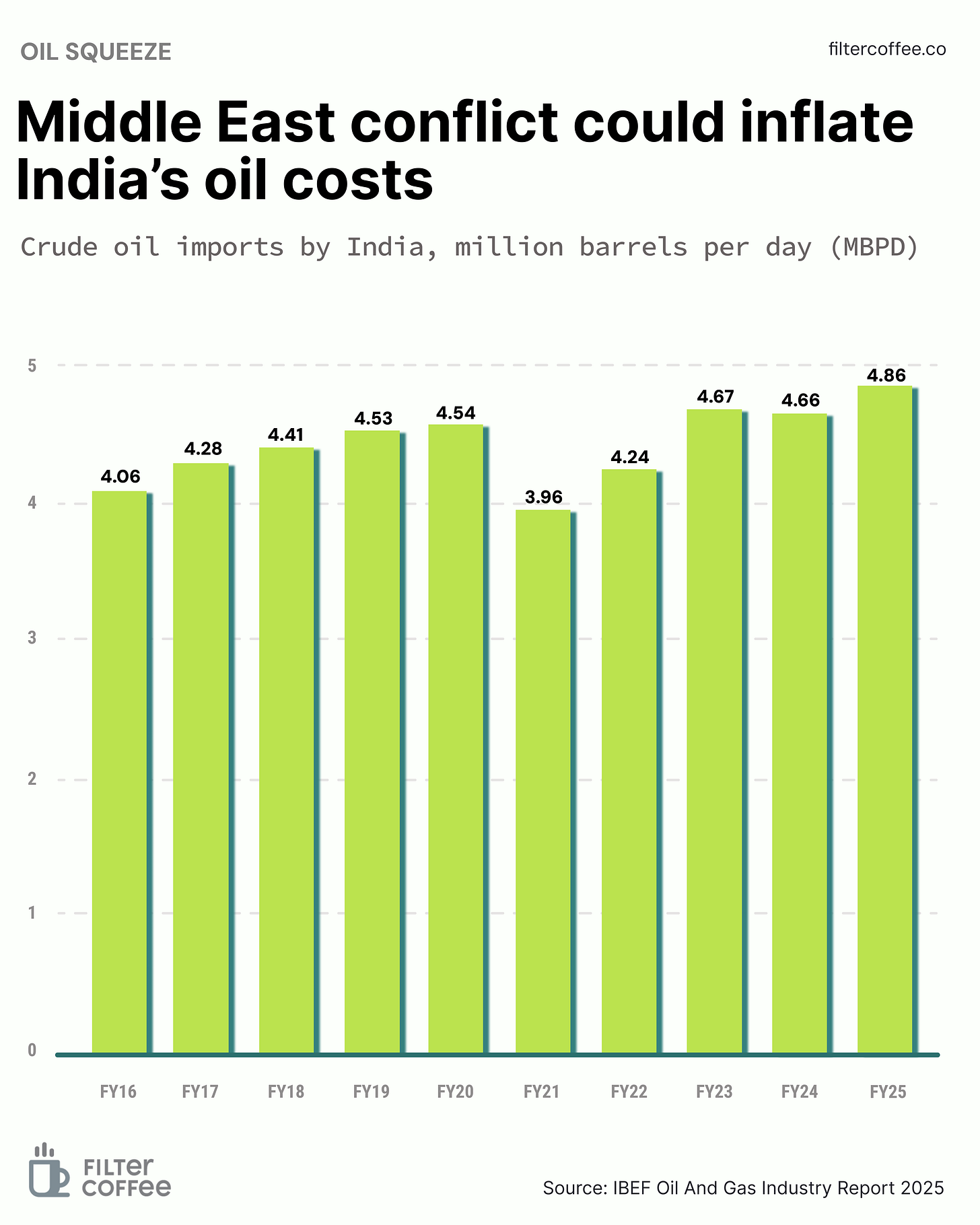

5. Story in data: India faces an oil squeeze 📊

India’s crude oil imports have climbed to a record 4.86 million barrels per day in FY25, the highest in a decade.

While FY21 saw a sharp dip due to pandemic-related demand collapse, imports have steadily risen since.

This growing reliance on foreign oil leaves India vulnerable to global shocks, especially tensions in the Middle East, which supplies a large share of India’s crude.

With conflicts escalating in the region, global oil prices could spike, making energy imports more expensive.

That spells pressure on India’s trade balance, inflation, and fuel subsidies, just as domestic demand continues to rise.

And although clean energy investments are growing, they’re not yet enough to offset oil’s overall impact.

What else are we snackin’ 🍿

📉 Price relief: retail inflation hit a 75-month low of 2.82% in May as food inflation slipped below 1% for the first time in nearly four years.

🤝 Volvo tie-up: Volvo Cars picked HCLTech as a strategic engineering services partner, strengthening its global tech supply chain.

🇹🇼 Silicon Sanctions: Taiwan added Chinese chip giants Huawei and SMIC to its strategic export control list, tightening scrutiny on tech exports amid rising geopolitical tensions.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.