🗓 Morning, folks 👋

📈 Markets bounced back yesterday, with Sensex gaining 0.53% and Nifty climbing 0.58%.

Trump’s inauguration and earnings season seem to be fueling the optimism.

💡Quick spotlight: India’s IPO market is buzzing. Over 1,000 companies are expected to go public in the next two years, raising a whopping ₹3 lakh crore.

Let’s hit it.

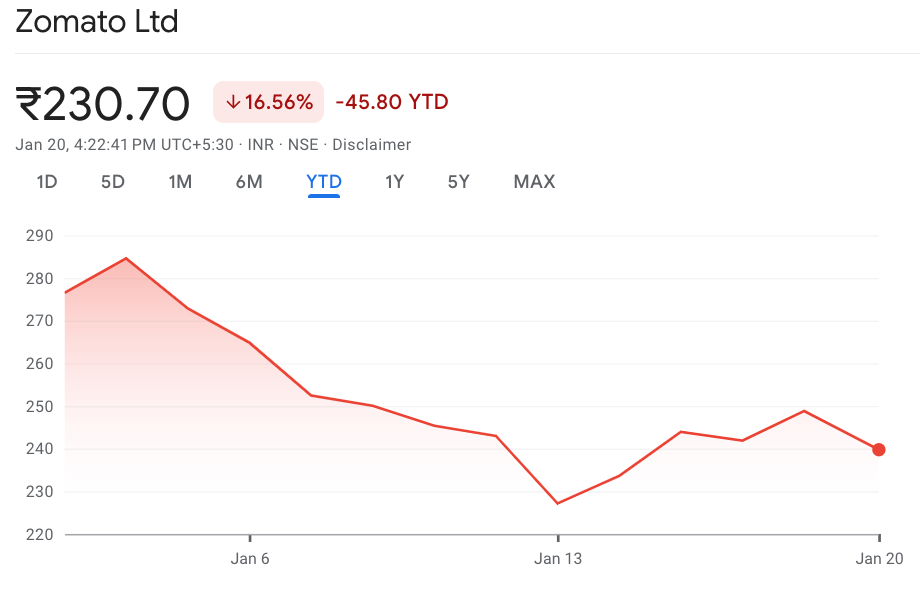

1 Big Thing: Zomato’s ambition disappoints investors 🍽️

Zomato’s December quarter earnings were a mixed bag. Growth investors may have loved it but the old school guys ran scared.

The company posted a 57% drop in net profit to ₹59 crore, down from ₹138 crore a year ago. Revenue, however, jumped 64% YoY to ₹5,404 crore, crossing the ₹5,000 crore mark for the first time.

Context: Zomato’s core business, food delivery, saw Gross Order Value (GOV) rise 17% YoY, though growth was a muted 2% quarter-on-quarter, reflecting a maturation in demand.

But all the oomph now comes from Blinkit, which continues to hold its blitzscale growth trajectory, with revenues growing 117% YoY. Too early to ask for profits though — the unit lost ₹103 crore for the quarter, eating into Zomato’s overall profits.

What’s new: Blinkit added 368 dark stores in six months, crossing 1,000 total stores by December, now planning to hit 2,000 stores by December 2025, a full year ahead of its previous target.

Mr. Market wasn’t too thrilled with the news, particularly given the capital investment it would take, sending the stock down 7.5% to ₹230 yesterday.

2. Go First's final descent 🛫

Go First is officially grounded. On Monday, the NCLT ordered the airline’s liquidation after 20 months of insolvency proceedings, marking the end of its troubled run.

The deets: Go First, which filed for voluntary insolvency in May 2023, owed creditors ₹6,200 crore. Major lenders like Central Bank of India and Bank of Baroda had claims exceeding ₹1,700 crore each.

Despite trying, the airline's Committee of Creditors (CoC) failed to present a viable resolution plan and said liquidation was the only way out.

What happened: Go First’s troubles began with grounded planes due to faulty engines. It filed for insolvency in May 2023, triggering a moratorium that initially retained aircraft assets.

By May 2024, all 54 aircraft had been deregistered and returned to lessors, effectively sealing the airline's fate.

Zoom out: the bust of the airline is a stark reminder of the volatility in India’s aviation sector.

Bottomline: India is expected to overtake China and the United States as the world's third-largest air passenger market in the next ten years, by 2030.

The market power of airlines like Indigo continue to get stronger. Not good.

Range anxiety? Not anymore ⚡

The EV revolution in India is picking up speed, but a question lingers: kitna door jayegi?

Solving range anxiety is at the core of Bounce’s mission.

Powered by advanced LFP (Lithium Iron Phosphate) battery technology, the scooter offers a practical range of up to 85 km. Its fast-charging capability delivers 60 km of range in just 15 minutes, ensuring every rider finds their perfect match.

What sets Bounce apart? Convenience. These scooters are equipped with standard type-6 connector, allowing users to fast charge using any public EV charging station and the portable battery offers a convenience of charging it at nominal speed using a standard 5A socket.

They’re also backward-compatible, meaning existing customers can upgrade without investing in an entirely new ride.

Plus, the scooters are already swapping integrated, making it even easier for users to switch to EVs.

So, the next time you’re on the road, imagine this: a cleaner, quieter, more efficient future that’s already within reach.

3. Big daily movers 📈

United Breweries stock surged 6% after the company said it would resume beer supplies to Telangana.

The company had halted supplies earlier this month, citing stagnant pricing since 2019 and unpaid dues.

Telangana has now assured overdue payments will be cleared in installments over 12–13 months, with price revisions promised within 30–45 days.

For context: Telangana’s refusal to revise liquor prices in recent years strained relations with major alcohol manufacturers.

4. Flotus joins the party 🫡

The first lady of the United States joined the meme coin party and launched $MELANIA, her own meme coin.

The coin debuted with a bang, surging over 42% to trade at $10.3 just hours after its launch.

Meanwhile, the TRUMP coin plummeted over 50%, dropping from an all-time high of $75.3 to a low of $35, erasing nearly $5 billion in market value.

$TRUMP briefly ranked among the top meme coins, overtaking Shiba Inu and PEPE, but the sharp sell-off pushed it back to third place.

In other news: Jio partnered with Polygon Labs to launch JioCoin, a blockchain-based reward token.

Now live on the JioSphere browser, JioCoin lets users earn tokens by engaging with Jio apps, tied to India-based mobile numbers.

5. Chart of the day 📈

Growing number of expats coupled with a strong dollar has meant more $ is being sent home by NRIs.

2024 was a record year. Remittances play a huge role in India’s regional economy, with some states like Kerala being highly sensitive to the dollar.

What else are we snackin’ 🍿

📞 TikTok resumes: TikTok is back in the U.S., hours after going dark, with Trump assuring no penalties for service providers.

📷 Meta’s edits: Meta is launching Edits, a new video editing app, after ByteDance’s CapCut was removed amidst the TikTok ban.

🔔 IPO prep: Groww has picked JPMorgan and Kotak for its $750M IPO, eyeing a $7–8B valuation.

🐦 Video win: X is rolling out a vertical video tab in the U.S., aiming to capture users amid ByteDance’s struggles.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.