Hi 👋, Tanvi here.

Filter Coffee hits your inbox every morning with notable tech and business news scoops to jump start your day.

Sign up below for free. 👇

Let’s go ahead and get started:

Market summary: 📊

Aight, decent bounceback on Tuesday — which is putting India back in all time high territories. US markets showed decent strength too, drawing some confidence from earnings.

US:

S&P 500 - up 0.82%

Nasdaq - up 0.65%

India:

Nifty 50 - up 1.55%

Sensex - up 1.65%

What’s brewing hot? ☕

✅ How we hanging? — Airtel managed to grow its revenue by 4.3% for last quarter, but Profits came down 63% sequentially — as COVID 2.0 expenses piled up. Average revenues per user stayed flat, thanks to freebies offered to low-income subscribers to keep them activated and from churning. Expectations from telco companies aren’t exactly too high right now, and the stock was up 2.5% during the day merely on relief. 🥱

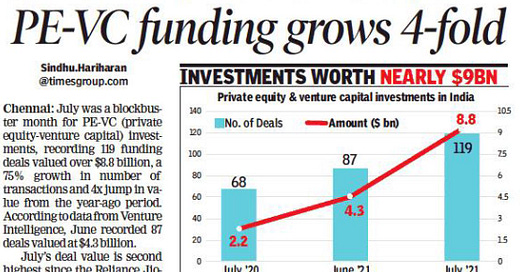

✅ Venture game bussssin’ — July 2021 saw 119 venture and private equity deals in India, a 75% jump vs. last year. Deal volume exploded, up 4x to $8.8 billion during the month — as big money keeps chasing category leaders. Early stage market is lit AF too, with $300M+ deployed in over 80+ deals in seed, Series A, B, says the Times. Money rolling in from big IPO exits, and global investor enthusiasm for emerging markets should further light up this party! 🎉

Make yo own chips ✋

What happened — Google will rely on its homegrown technology to power its Pixel lineup of phones going forward — starting with the Pixel 6 due for October 2021, abandoning Qualcomm’s processors.

Google’s chip, called Tensor — an 8-core, 5nm processor, built on ARM architecture, is particularly designed to deliver top notch video and image processing tech, leveraging the best of the Tensor Flow machine learning framework.

Why care — this is a growing trend industry wide, where software giants, to juice the last bit of performance, are looking to take control of silicon design. Apple recently launched its M-series of chips, designed for advanced machine learning capabilities, and users unanimously agree to a phenomenal performance boom!

Big picture — as hardware becomes commodity, software enabled performance enhancements are the way of the future. Win for Taiwan Semi, Global Foundries, and bad for Intel, AMD, Nvidia.

What’s poppin’ in Startup land? 💰

Couple raises and acquisitions incoming, here’s a quick rundown…

UpGrad, the Coursera-like MOOC service, acquired KnowledgeHut for $35 million. KnowledgeHut offers short upskilling and certification courses, mostly to a corporate working base across categories like AI, Cloud Infra, Machine Learning, serving 250K professionals and making $40 million in revenues. $35M price kinda seems low, no? Anyway, UpGrad had stowed away a $250 million pot to chase acquisitions for the next 2 years, and this deal was part of that mandate.

Construction goods and services marketplace Infra.market pulled in another $125 million from Tiger Global, more than doubling valuation to $2.5 billion. Founders told ET that the business is on its way to $750 million in revenue this year, which is INSANE! COVID put a hard reset to the construction market, which is now recovering in favor of digitization. 👏

Lastly, among the emerging fighters, Skill-Lync, a YC-backed technical edtech play, raised $17.5 million for its Series A from Iron Pillar, Binny Bansal and a few others. Skill-Lync matches engineering students in mechanical, civil, electrical and computer science engineering with relevant online courses. Like an expensive NPTEL! 🥂

Closing the loop with e-RUPI 💳

What happened — another promising product came out of GOI’s tech innovation camp last night, the e-RUPI — a gift-card-like benefit-distribution mechanism, primarily aimed at plugging leakages in getting doles delivered to citizens.

In simple language, benefits (social, financial, healthcare) issued by the government through a barrage of schemes, often get lost in the distribution chain — many times with middle men or institutions (like banks) not doing their best to ensure fair delivery.

e-RUPI will basically assign a unique identifiable e-voucher, delivered via a QR code or a text message directly to citizens, and when a person collects their benefits, the loop will be closed via a QR code scan.

Now some folks would’ve loved to hear “blockchain” mentioned here, but for now this is what we have, and its pretty cool that GOI has kept the program open-ended, supposedly to expand the scope of the functionality over time.

Pilots are being tested with a bunch of banks and corporate organizations.

Here’s an elaborate writeup from Mint.

Closing out — drooling over Nykaa 🔥

Nykaa’s IPO prospectus dropped last night and the underlying stats couldn’t be more exciting! The business looks to raise about $500 million from the public markets.

Quick look at the fundamentals:

Made ₹2,452 crores in sales last year, up 38% YoY — sweet for pandemic year while everybody else is going down

Churned ₹62 crores of profits, swinging to profitability for the first time — will help please some traditionalists

85%+ of volumes come from mobile app, which has 40M+ downloads

The business has its tentacles in not only cosmetics, but fashion as well as an import and distribution, a self-owned beauty product line up (Kay Cosmetics), and categories such as Maternity Care, Jewellery, Baby products, you name it.

Here’s Moneycontrol with a sneak.

Bottomline — profitable, nicely growing, founder led, strong brand recognition, online savvy, and operates amidst strong tailwinds in favor of digitization in the cosmetics space! What more do ya want? 🤗

What else are we snackin’ 🍿

👀 Gimme middle ground - Spotify is testing a $1/month cheaper pricing tier to get some of its free users to pay up something, and appease increasingly nervous investors.

Hit that 💚 if you liked today’s issue.

You can forward this email or share FC on social media by clicking the button below. Thanks and Ciao! 😀

You guys are doing such an amazing job! Worth the read every day for the past several months! Keep it up!