Gold Run ⚡

Clean energy bets, IPO wins, and China dam.

Morning!

🗓️ Last Monday of 2024 and what a year it has been!

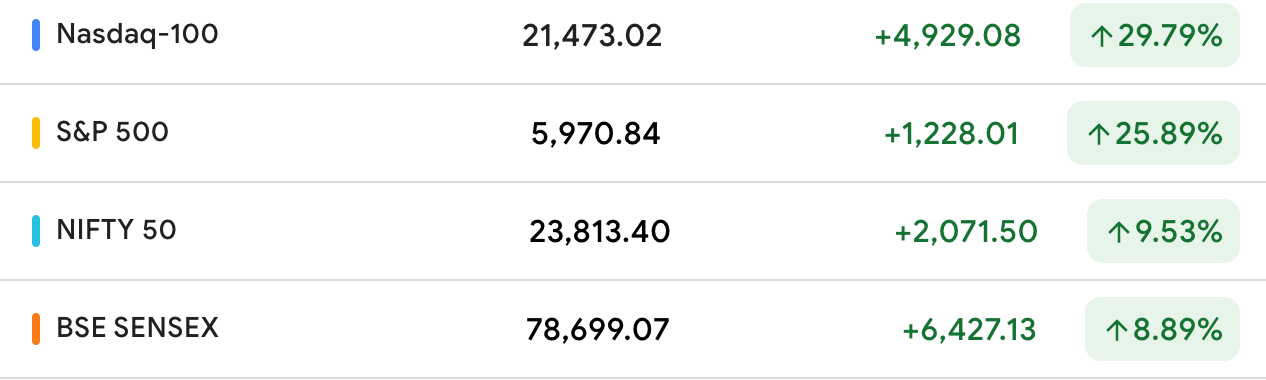

📈 Although India’s market rally was dented, the S&P and Nasdaq crushed it, thanks to AI.

👑 The Indian gold buyer though must be happy, with a 25% YTD move up in the yellow metal. Quite solid against the 8% gold delivered on average for the last 50 years.

Let’s hit it.

1 Big Thing: Korea plane crash leaves hundreds dead 🚨

An airplane run by Jeju Air, a budget carrier in Korea, crashed leaving 179 people dead, in what is turning out a rough year for aviation safety.

The plane was returning from Bangkok. Pilots called a bird strike and requested instant landing. The plane’s landing gear failed to activate.

After overshooting the runway, the plane crashed into the concrete barrier at the end of the runway, bursting into flames. 2 flight attendants survived.

Authorities are now evaluating the exact cause of failure.

Zoom out: global air traffic at all time highs, stressing out safety systems. This year, nearly 9.5 billion passengers flew worldwide.

2. Another big clean energy acquisition 🔆

JSW Energy signed a ₹12,000+ crore deal to acquire renewable energy assets of 4.7GW from another power company O2 Power.

This is one of the largest deals in India’s renewable energy space.

The hype: O2 power is one of the fastest growing renewable energy companies in India.

They own 3 major underdevelopment projects across nearly 7 states.

Half of the capacity is expected to be operational by 2025, and rest by 2027.

The company is backed by Temasek as well as big name PE giants.

Why it matters: as India ramps up on clean energy, legacy energy companies as well as disruptive startups are rushing to get a piece of the pie.

JSW plans on owning 20GW of clean energy capacity by 2030, aligning itself with the government’s push in that direction. Stock has seen quite the run.

Zoom out: the government is doubling down aggressively on clean energy, with a goal to take renewable capacity to 500 GW by 2030.

3. Game of IPOs kept markets going 📈

2024 was a blockbuster year for IPOs in India, edging out even China, with $11.2 billion raised across over 91 listings.

That’s more than 3x times the $5.5 billion raised in 2023, showing that investor confidence is stronger than ever.

When you place that against the Sensex’s modest 9% rise this year, the numbers stand out even more.

Quick look at some of the largest bids

Hyundai India stole the show, raising over ₹27,000 for the largest IPO in Indian history. Its dominance in the SUV market, which makes up 63% of its sales, helped it stand out.

Swiggy rode the quick-commerce momentum to pick up ₹12,000 crore.

The next big theme was renewables, with NTPC Green Energy raising ₹10,000 crore. Stock is up 26% since.

Other noticeable bids included retail giant Vishal Mega Mart, which raised ₹8,000 crore, with shares jumping 30% on debut, as broad organized retail remains a hot hot theme.

And lastly, Bajaj Housing Finance raised ₹6,500 crore, with subscriptions topping ₹4 lakh crore and a 135% gain on listing day — signaling strong demand for emerging economy financing needs.

Looking ahead: the IPO momentum is expected to continue into 2025, with fundraising set to surpass $23.4 billion.

Big trend: Retail participation is booming too, with 3.5 million new investors joining in 2024, pushing the total to 108.5 million.

Pop quiz of the week ⚡

This company is a leading supplier of automotive components specializing in lighting systems, electronic components, alloy wheels and more.

They’re a Tier-1 supplier to major OEMs, with a market capitalization of nearly ₹60,000 crore.

Which company is this?Answer to last week's quiz: Avanti Feeds.

What else are we snackin’ 🍿

⚡ EVs abandoned: Apple pulled the plug on its autonomous electric car project, shifting focus to AI.

💧 Mega dam: China is planning the world’s largest dam, a $137B project on the Brahmaputra River, raising regional concerns.

🔌 Ola’s push: Ola Electric plans to open 3,200 stores to boost its footprint and repair brand value.

That’s a wrap! Don’t let the Monday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.