☀️ Morning and Happy Thursday. This week flew by fast.

🗓 Markets stayed in cruise control as Sensex and Nifty ended flat after some mid-day volatility.

Bank stocks shod off IndusInd fiasco—HDFC Bank gained 1.5%, while Kotak Bank climbed 2.3%, lifting Nifty Bank into the green.

💡 Spotlight: Reliance Jio added 3.9 million new users in December, tightening its grip on India’s telecom market. Bharti Airtel followed with 1 million new subscribers.

Vodafone Idea and BSNL saw 1.7 million and 322K users walk away respectively.

Let’s hit it 🚀

1 Big Thing: Inflation tanks, finally revealing a slowdown 📉

For the first time in months, your grocery bill might not make you do a double take.

Inflation in India (also called CPI) cooled to 3.61% for the month of February— the lowest level in nearly seven months.

At these levels, inflation is now below RBI’s target of 4%.

Basically, CPI is a measure of how much prices (for food, rent, transportation, and other things) have grown over the past year. Too much makes things hot, too little makes the economy cold.

The February number isn’t particularly great news. It means consumption is coming down fast, which is bringing prices of products down too.

But for the markets it could be good news. Because now the RBI can take some more measures to simulate the economy, such as cutting RBI’s repo rates.

Some trends to watch: the biggest relief came from vegetable prices, which plunged from 11.3% to -1.07%.

Rural inflation eased to 3.7% from 4.6% in January

Urban inflation moderated to 3.3% from 3.8% (MoM)

The food index also eased to 3.7% from 6%.

Zoom out: this cool-off comes right after India’s GDP growth hit 6.2% in Q4, narrowly missing estimates as well.

Big picture: India’s vast economic engine sends mixed signals, often creating confusion. However, mounting evidence suggests that consumers are pulling back—a troubling sign.

2. Meta’s AI chip gamble 🧠

Meta is testing its first in-house chip for training AI systems, in collaboration with TSMC, per Reuters.

Zuck is making sure to reduce reliance on Nvidia and bring more of its AI infrastructure in-house.

Why this matters: the chip is designed specifically for AI tasks, which makes it faster and more efficient than traditional GPUs used for AI workloads.

While making own chips isn’t anything new for Meta, so far the company has only designed inference chips. Going after training pits it directly against Nvidia’s dominance.

3. Temasek gets a handful of chakna 🍟

Temasek acquired a 10% stake in Haldiram's snacks business for $1 billion valuing the business at $10 billion.

The deets: Haldiram’s founders, the Agarwal family, were seeking a valuation of ₹85,000–90,000 crore, and this deal marks the company’s first external investment.

By the numbers: Haldiram’s pulled in ₹14,000 crore in revenue for FY24, growing at 16% annually,

Context: India’s snacks market is worth ₹42,600 crore, and expected to grow to ₹95,000 crore by 2032. Haldiram dominates this space with its vast product portfolio and deep-rooted brand loyalty.

Worth noting: just weeks ago, PepsiCo was also in talks to acquire 10–15% of Haldiram Snacks, trying to outbid Temasek.

4. Quick commerce now owns online grocery 🛒

Bain and Co.’s latest report says Quick commerce now powers 75% of online grocery orders in India, a massive jump from just 35% in 2022.

To keep up with demand, companies are setting up "back" dark stores—larger warehouses that stock 3,000-4,000 premium products and supply multiple forward dark stores for ultra-fast delivery.

Dark stores now handle over 1,000 orders daily, significantly more than an average kirana. Better logistics have cut delivery costs by roughly 25% in 2024 compared to 2023.

Simultaneously, profits per store are growing. More product categories have increased order sizes by 40% in the last two years.

India’s quick commerce industry is on track to hit $5.3 billion in revenue by 2025, growing at 16.6% annually and set to reach $9.9 billion by 2029.

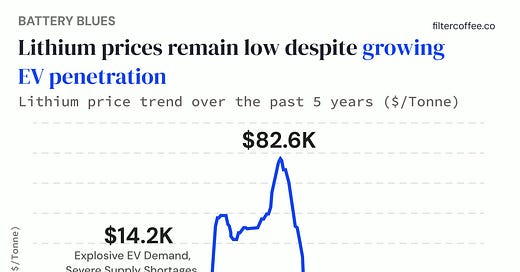

5. Story in data: What powers your EVs? 📊

Lithium went from the hottest EV commodity couple years ago to a total market meltdown.

Reasons are simple, miners stockpiled too much of the commodity during COVID, EV demand collapsed a bit in mature markets like the US, and recycling is growing.

Moreover, new battery technologies are also expected to change how much lithium is needed.

6. Big daily movers 🚀

1. RVNL gains on new infra deal 🚆

RVNL jumped 3%+ after securing a ₹554.6 crore order from the National Highways Authority of India (NHAI).

The deets: the project involves constructing a 12 km, 6-lane road connecting Visakhapatnam Port to Sheelanagar junction. RVNL’s order book now stands at ₹97,000 crore as of December 2024.

Meanwhile, RVNL signed an MoU on March 10 with Abhinav Strategic Partners for railway projects in Saudi Arabia and bagged a ₹156 crore order from South Western Railway.

2. BEL secured a mega defence deal 🔥

Bharat Electronics Limited (BEL) bagged a ₹2,463 crore contract from the Ministry of Defence (MoD) to supply Ashwini Radars to the Indian Air Force (IAF).

Context: Ashwini radars track fast fighter jets, drones, and helicopters and it can identify whether an aircraft is friendly or an enemy. They are also built to withstand electronic warfare attacks.

With this deal, BEL’s total order book for the year has hit ₹17,030 crore.

The deal failed to impress and stock was down over 5%.

What else are we snackin’ 🍿

🍔 New player: Rapido is revving up for a food delivery debut. The bike-taxi platform is in talks with restaurants to expand beyond rides.

🚫 Deal off: Uber’s Foodpanda Taiwan acquisition is officially dead after regulators blocked the deal in December.

📊 February dip: SIP inflows hit a 3-month low at ₹25,999 crore, slipping from ₹26,400 crore in January and ₹26,459 crore in December.

That’s a wrap! Don’t let the weekday blues get to you.

Markets are closed on Friday for Holi, so we’ll be back like clockwork on Monday.

If you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

It's disinflation