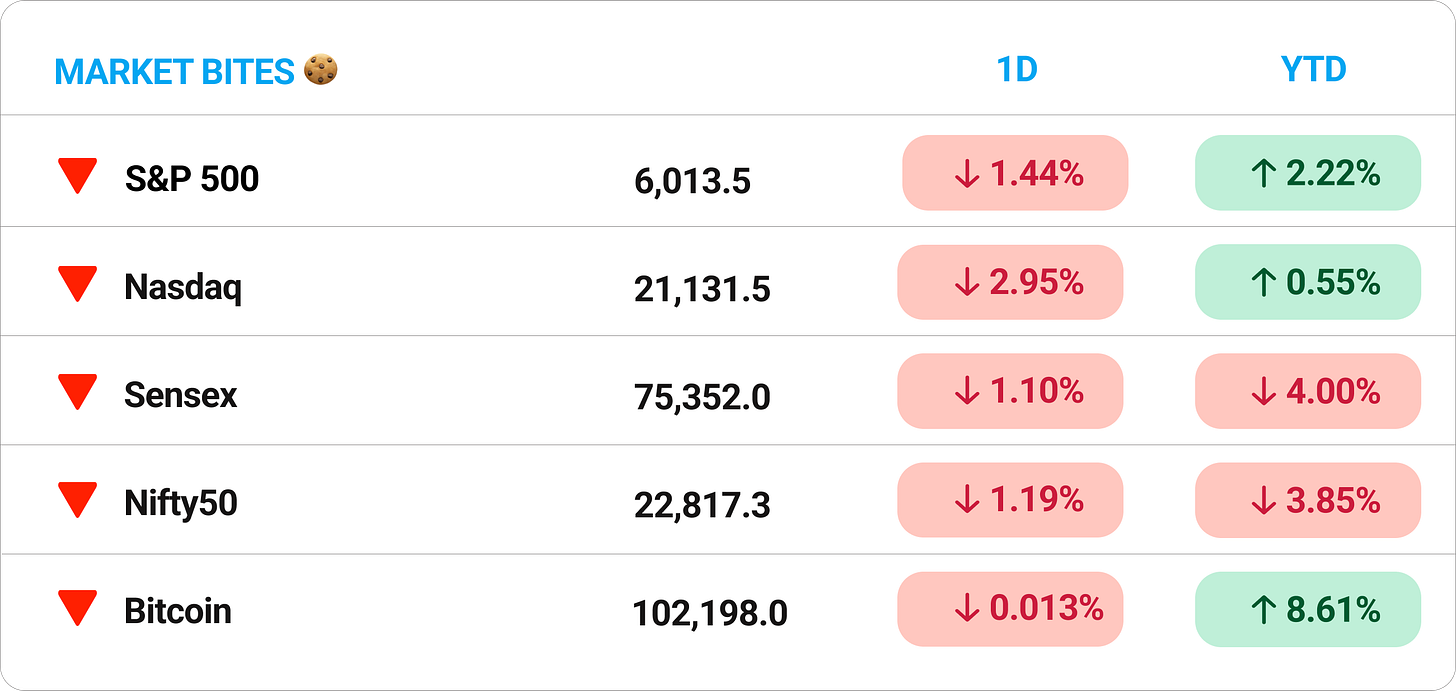

🗓️ Morning, it is a beautiful day. Unless of course you’re all-in on stocks.

📉 Indian markets continued their downward slide yesterday, with both the Sensex and Nifty50 dropping over a percent right off the gate. The Nifty has now fallen below 23,000—levels last seen in June 2024.

🔫 Back in the U.S., a goddamn bloodbath. More on that below in our first story.

1 Big Thing: The big AI unwind 🌀

Nvidia lost nearly $600 billion in market cap yesterday, plunging 17%, as the AI trade unraveled following China’s DeepSeek breakthrough.

Forbes says this is the single greatest one-day wipeout for a stock in history.

For context: DeepSeek, a China-based startup spun out of a quant hedge fund, unveiled a model trained for just $6 million, that outperforms state-of-the-art reasoning models from OpenAI.

Investors are now questioning the enthusiasm of US Big Tech, which recently announced investments of hundreds of billions in chips to build large-scale AI infrastructure.

Chip stocks were brutally crushed — beyond Nvidia, AI chip names like Broadcom, AMD, as well as memory names like Micron were down over 10%.

Data centers — beaten similarly, as questions around ROI for large computing facilities mounted.

Power — the power/utility guys had just gotten invited to the AI party. Companies like Vistra, Constellation were brutally hammered — down 20-30%.

In total, over a $1 trillion was wiped off stock market valuations in yesterday’s trading.

Some argue markets are overreacting, suggesting that cheaper AI could fuel faster adoption, boosting demand for AI inferencing hardware.

Simply put, training is when AI models are taught to become intelligent, while inferencing is when they respond to your questions. Each use case has unique hardware requirements.

The surprise: there is also a thesis that as AI models gets commoditized, companies operating the software and owning the application layer is where most opportunity will be locked. Cloud computing and SaaS stocks were actually popping off yesterday.

Watch out: the sell off could easily extend to the Indian market today. Several Indian data center stocks had rapidly gained in the recent times, including Anant Raj, NetWeb, and more.

2. Shine like a diamond 💎

Private equity and its insatiable appetite for India consumer.

ET reported that global PE giant, Advent International, will buyout up to 75% stake in Orra Jewellery, valuing the business at up to ₹1,750 crore.

The deets: founded by the Rosy Blue Group in 2004, Orra specializes in diamond, gold, and platinum jewellery, mostly appealing to the mid to high wallet urban young audience. Last year, the business made somewhere in the range of ₹1,100 crores in revenue.

Advent plan is to scale Orra and eventually take it public.

The big trend: India’s jewellery market is buzzing with activity. Last year, Tata shelled out ₹4,621 crore for CaratLane. Similarly, Bluestone is cooking IPO ambitions.

Last year, Indians spent nearly $50 billion on gems and jewellery, and probably tens of billions more in unorganized markets. The market is expected to go up to $140 billion by 2030.

3. Unicorns are back baby 🦄

Private markets are singing a different tune.

First up, Juspay, a fintech infrastructure firm, is raising $150 million in its latest funding round led by Kedaara Capital, with WestBridge and SoftBank also participating — at a billion dollar valuation, making this company the first unicorn of 2025.

The company offers end to end payment orchestration platform, and one of the key projects they worked on, included GOI’s BHIM UPI app.

Last year, the business made ₹319 crore in revenues, growing 50% YoY, while still losing money. The company has raised over $230 million in capital to date.

While we are on fundraises,☝️

Good ol’ Tiger is up and roaring.

Meesho, on its way to go public, has raised nearly $550 million from Tiger, Peak XV, and a few others in fresh funding, valuing the business at roughly $4 billion.

Last year, Meesho made an impressive ₹7,600 crores in revenues, up 33% YoY, while losing some ₹53 crores. The IPO is likely to happen in 2026, hopefully with significant profitability.

4. Closing out on some positive news 🙌

If you missed our social media update, we announced yesterday that Filter Coffee officially joined one of India’s fastest growing financial services companies, Raise Financial.

I am thrilled beyond words.

To each one of you that opens this email, this lil moment is as much yours as it is mine and this team’s.

If you love our work, bring us a friend. Share Filter Coffee with your circles.

And, react to our social posts — on X and on Linkedin.

Thank you for giving us your attention and trust.

- Tanvi

What else are we snackin’ 🍿

🏨Hotel debut: ITC Hotels will list on January 29, with ITC retaining 40% ownership and 60% distributed to shareholders.

🔄 Zoho shuffle: Zoho founder Sridhar Vembu steps down as CEO to become Chief Scientist, with Shailesh Kumar Davey taking over as Group CEO.

☀️ Powering up: Tata Power's TP Solar bagged a ₹455 crore contract to supply 300 MWp of solar modules to Maharashtra State Power Generation.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

Congratulations. Keep brewing............

Congratulations on the funding!!