Can Mahindra build India’s own ChatGPT?

Real estate stocks rally, green orders rise, and UPI reaches Japan.

🗓 Morning, folks!

Markets made a spirited comeback on Wednesday, with the Nifty soaring to a one-month high, crossing its recent peak of 25,331.

The rally was powered by broad-based buying, upbeat global cues, and renewed optimism over a potential Fed rate cut.

Every sector joined the party, with realty, financials, and metals leading the charge and keeping the market mood firmly bullish.

💡 Spotlight: Fed Chair Powell sparks realty rally

Real estate stocks including Sobha, DLF Industries were on the move as optimism built that the U.S. Federal Reserve could deliver more rate cuts later this year.

The Nifty Realty index jumped 3%, staging a smart recovery from Tuesday’s dip after Fed Chair Jerome Powell hinted that monetary easing may be on the horizon.

When the Fed cuts rates, it sets off a chain reaction, liquidity surges, borrowing costs ease, and home loans get lighter on the wallet.

The result? A boost in property demand, investor confidence, and valuations across India’s rate-sensitive real estate space.

Let’s hit it!

1 Big Thing: Tech Mahindra builds trillion-parameter AI model 🤖

Tech Mahindra is developing an indigenous sovereign Large Language Model (LLM) with 1 trillion parameters under the IndiaAI Mission.

Think of 1 trillion parameters as 1 trillion tiny switches inside the AI’s brain that learn patterns from data. The more switches, the smarter and more accurate the model gets.

The deets: the homegrown model is part of a government-backed project to build AI systems in India. Alongside Tech Mahindra, seven others, including Fractal Analytics and BharatGen, an IIT Bombay consortium have been picked to develop the project.

The numbers: a 1-trillion-parameter model is the scale of global heavyweights like GPT-4 or Gemini 1.5. Parameters are the “neurons” of an AI model, the internal variables that help it understand and generate human-like text. The more parameters, the more nuanced the understanding.

Why you should care: for the common man, this means smarter AI tools made for India, in India. Think chatbots that understand Hinglish, local dialects, or government forms explained in your language. It could power better customer support, healthcare helplines, and education apps, all tailored to how Indians actually speak and search.

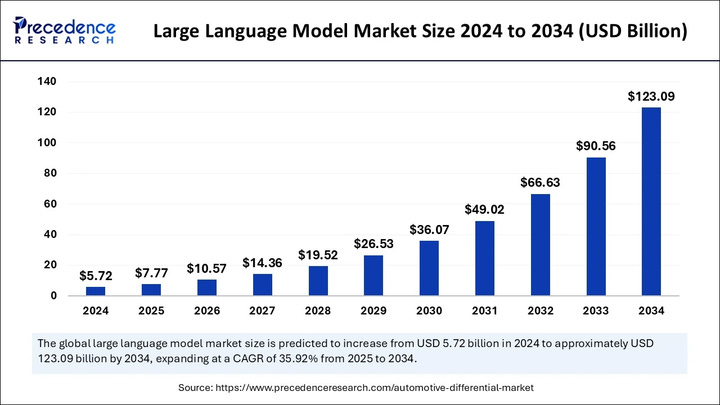

Zoom out: the global Large Language Model (LLM) market is set to explode from $5.7 billion in 2024 to $123 billion by 2034. That’s a 35.9% annual growth rate, driven by AI adoption across industries.

As LLMs power everything from chatbots to copilots, demand for smarter, faster models is surging.

2. Airtel, IBM team up for AI-ready cloud boost ☁️

Bharti Airtel has teamed up with IBM to supercharge its Airtel Cloud, blending telco-grade reliability with IBM’s AI and infrastructure muscle. The update helped the stock gain more than 1%.

The deets: under this partnership, Airtel Cloud customers will get access to IBM Power Systems-as-a-Service, powered by AI-ready servers.

These systems can run heavy, business-critical software like SAP and help companies shift from old-school IT setups to faster, cloud-based systems.

Why it matters: this move gives Airtel an edge in catering to regulated sectors like banking, healthcare, and government, areas where data security and compliance are non-negotiable.

Big theme: experts estimate India’s cloud market will touch $18 billion by 2027, driven by AI adoption, 5G rollout, and data localisation rules.

As enterprises move workloads to the cloud, they’re looking for platforms that can handle AI, analytics and automation seamlessly while meeting data sovereignty norms.

While we are on deals,

TCC Concept has acquired a 95.2% stake in furniture marketplace Pepperfry for ₹659.4 crore.

TCC Concept is a technology holding firm focused on e-commerce, data centres and AI-powered real estate solutions besides offering traditional real estate services.

The why: the companies expect the deal to create efficiencies in merchandising, sourcing, supply chain, and marketing, while further expanding Pepperfry’s footprint across India.

It also gives Pepperfry a long-term, stable home under a well-capitalised, publicly listed parent.

3. Drone startup Airbound flies high with $8.6M funding boost ✈️

Airbound has raised $8.6 million in seed funding round by Physical Intelligence co-founder Lachy Groom.

Founded in 2023, Airbound builds carbon-fibre drones to cut logistics costs and enable fast, reliable delivery across all sectors, including underserved regions.

Breaking it down: in India, most small deliveries, usually under 3 kilograms, are made using electric scooters that weigh about 150 kilograms & cost around ₹2 per kilometer in energy.

Airbound’s delivery drone could bring delivery costs down to just 10 paise per kilometer, and cut the total transport weight by about 30 times.

FYI: the company has started its first pilot program with Bengaluru’s Narayana Health, to deliver medical logistics for three months, aiming to complete 10 deliveries a day of medical tests, blood samples, and other critical supplies.

With logistics costs still at 7.97% of GDP, startups like Airbound are driving innovation in low-cost, faster, and more accessible delivery, especially for rural regions.

4. Stocks that kept us interested

1. Power Mech gains after bagging order worth ₹2,500 crore from BHEL ⚡️

Power Mech Projects announced that it has bagged orders worth ₹2,500 crore from Bharat Heavy Electricals (BHEL).

Power Mech Projects is a construction and engineering company that executes critical power plants and provides services in mining, power plants, and other infrastructure projects.

The deets: under the contract, Power Mech will design, buy, and build all the supporting systems for a new 800 MW coal-based power plant in Telangana. It will also provide related services like inspection, testing, commissioning and transportation.

Why it matters: India is the third largest producer and consumer of electricity globally. While there is a steady shift towards renewable sources, the country still relies on coal-based thermal power plants to meet 50% of its electricity needs.

Orders like these would thus also help improve that capacity and strengthen India’s electricity grid.

2. Satvik Green Energy secures ₹639 crore solar orders 🌅

Satvik Green Energy’s materials arm Satvik Solar Industries has received orders worth ₹639 crore for supplying solar PV modules.

Satvik Green Energy manufactures solar modules and related services like EPC (Engineering, Procurement, and Construction) in the sustainable energy domain.

The deets: the orders were placed by three independent, undisclosed power producers and will be implemented by June 2026.

Big picture: the market for solar PV modules is growing at a 9.4% rate. Add to this, the government’s pledge to achieve 500GW of renewable energy capacity by 2030 and the Saatvik Green Energy sits at a massive opportunity to become a key supplier in this rapidly expanding market.

What else are we snackin’ 🍿

🇮🇳 Export momentum: Despite steep US tariffs, India’s goods exports rose 6% in September to $36.3 billion, showing resilience amid global trade tensions.

💉 Medtech move: Everstone-backed Integris Medtech filed for ₹925 crore IPO, combining fresh issue and an offer-for-sale.

💸 Going global: NTT Data teamed up with NPCI to launch UPI payments in Japan, marking UPI’s East Asia debut and easing travel spends for Indians.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.