☀️ Morning, folks!

Markets played tug-of-war all day yesterday. Sensex and Nifty opened strong but couldn’t hold their gains.

💡 Spotlight: February auto sales were a mixed bag. Maruti Suzuki kept its No.1 spot, while Tata Motors saw a dip in passenger vehicle sales. Hyundai’s domestic numbers slipped, but exports jumped nearly 7%.

Mahindra & Mahindra’s exports nearly doubled, and it overtook Hyundai to become India’s second-largest passenger vehicle seller last month.

Markets took notice—shares of M&M, Eicher Motors, and Escorts Kubota rose up to 3% following the sales numbers.

1 Big Thing: Trump’s crypto reserve — serious business or grift? 💰

Donald Trump just made a game-changing move in the crypto world.

The President announced the creation of a U.S. Cryptocurrency Strategic Reserve — a fund backed by taxpayer money, that will hold digital assets like Bitcoin, Ethereum, XRP, Solana, and Cardano.

What went down: the announcement caught the markets off guard, and the reaction was immediate. Bitcoin shot past $94,000, Ethereum climbed over $2,500, and the total crypto market added a cool $300 billion overnight.

Yes, but: reactions to the move were mixed. Crypto boys cheered their potential exit liquidity. Serious thinkers questioned why those specific assets were chosen, and how specifically does a nation state holding these tokens advance cyrypto’s decentralized mission.

But otherwise, Trump’s crypto pivot has some heavyweight backers too. Musk, a long-time crypto advocate, has been actively pushing for deeper integration of digital currencies into the U.S. financial system.

Meanwhile, SEC head Paul Atkins, known for his crypto-friendly stance, is another key player in shaping a more accommodative regulatory approach.

Whether this move cements the U.S. as the "Crypto Capital of the World" or just adds more fuel to an already volatile market remains to be seen. But for now, the market is loving it.

On another note: A moon landing with a selfie 📸🌕

NASA quietly made history with Firefly Aerospace’s Blue Ghost lander, which successfully touched down on the Moon.

The lander carried 10 science instruments, including tools to study lunar soil and temperature—key data for preparing future human landings.

In true 2025 fashion, it also took some Moon selfies. Here’s one

The mission is part of NASA’s plan to kickstart a lunar economy with private companies. Launched in mid-January from Florida, the lander carried 10 experiments to the moon for NASA.

The agency paid $101 million for the delivery and $44 million for the tech onboard.

2. India’s OG online grocer is going public 🛒

BigBasket has kicked off its IPO process, aiming to hit the markets within the next 18 to 24 months. Backed by Tata, the company has managed to make a rapid pivot to quick commerce.

The financials back it up: BigBasket is targeting $3 billion in annual revenue while pushing for profitability with an EBITDA margin of 4-5%. Quick commerce already fuels 80% of its revenue.

But groceries aren’t the only thing on the menu. BigBasket is doubling down on its SaaS solutions business, which helps optimize supply chains and warehouse management—a play that could turn into a high-margin revenue stream.

Big picture: the company has big expansion plans, aiming to double its presence to 70 cities by 2026.

And category expansion is in full force. Beyond groceries, the company is expanding into electronics, pharma, and fashion, moving towards becoming a one-stop digital retail giant.

While we’re on IPOs…

Onix Renewable, a solar manufacturer and power producer, is eyeing a ₹1,000 crore IPO at a massive ₹10,000 crore valuation. The company operates nearly 3,725 MW of power production capacity, in addition to a thriving solar manufacturing and contracting business.

Onix plans to use the IPO funds for PPAs and grid integration. India is targeting 500 GW of non-fossil fuel capacity by 2030. Onix wants a bigger slice of the green energy boom.

3. GST meter keeps ticking 💰

February’s GST collections hit ₹1.84 lakh crore, up 9.1% from last year.

More business activity and tighter tax enforcement are keeping the tax numbers high. Domestic transactions grew by 10%, with Tripura leading the charge at 21%.

By the numbers: the Centre collected ₹33,370 crore (CGST), while states got ₹41,410 crore (SGST). IGST, driven by imports, hit ₹87,940 crore, with cess collections up 7% to ₹21,940 crore. Net GST revenue stood at ₹1.63 lakh crore.

Why it matters: rising GST collections signal a healthy economy. When businesses sell more, the tax pot swells. Better compliance and stricter tax enforcement are also playing a role, ensuring that money keeps flowing in.

4. Stocks that kept us interested 🚀

1. Cafe Coffee Day hit the 20% circuit after the NCLAT paused bankruptcy proceedings against its parent company.

A quick rewind: Cafe Coffee Day has been drowning in debt for years, and a ₹228.4 crore default landed it in deeper trouble. IDBI Trusteeship, which manages loans for lenders, took the company to NCLT (National Company Law Tribunal), pushing for bankruptcy proceedings.

Last week, the case moved forward after NCLAT (the appellate tribunal) missed the Supreme Court’s Feb 21 deadline to review the matter. But CCD’s board pushed back, leading NCLAT to hit pause on the proceedings.

For now, CCD has a temporary breather, but its financial troubles are far from over.

2. L&T (Larsen & Toubro) surged almost 2% after bagging power transmission and distribution orders worth ₹2,500–₹5,000 crore across India and the Middle East.

For context, L&T is one of India’s largest infrastructure players, handling projects across energy, construction, and engineering.

The deets: the company will install 765 kV and 400 kV transmission lines for Uttar Pradesh’s renewable energy zone.

It also won an order for a 380 kV gas-insulated substation in Saudi Arabia and a 220/330 kV grid station in Abu Dhabi.

Multiple order wins broke the stock’s four-day losing streak

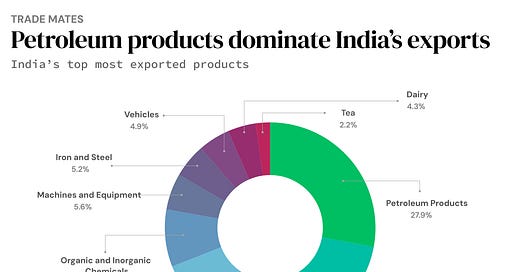

5. Story in data — Fuel dominance ⛽

Petroleum products made up nearly 28% of India’s total exports, solidifying their position as the country’s top exported commodity.

With India aiming for a greener future, the heavy reliance on petroleum exports raises key questions about diversification and long-term trade strategy.

What else are we snackin’ 🍿

🚨 Regulatory heat: ED issued FEMA violation notice to Paytm’s parent over its subsidiaries Little Internet & Nearbuy.

⚡ Fired: Ola Electric is laying off 1,000+ employees and contract workers as it battles rising losses.

🎬 Reel spilt: Instagram is planning to spin off Reels into a separate app, aiming to take on TikTok directly.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.