☀️ Good Morning, its Thursday!

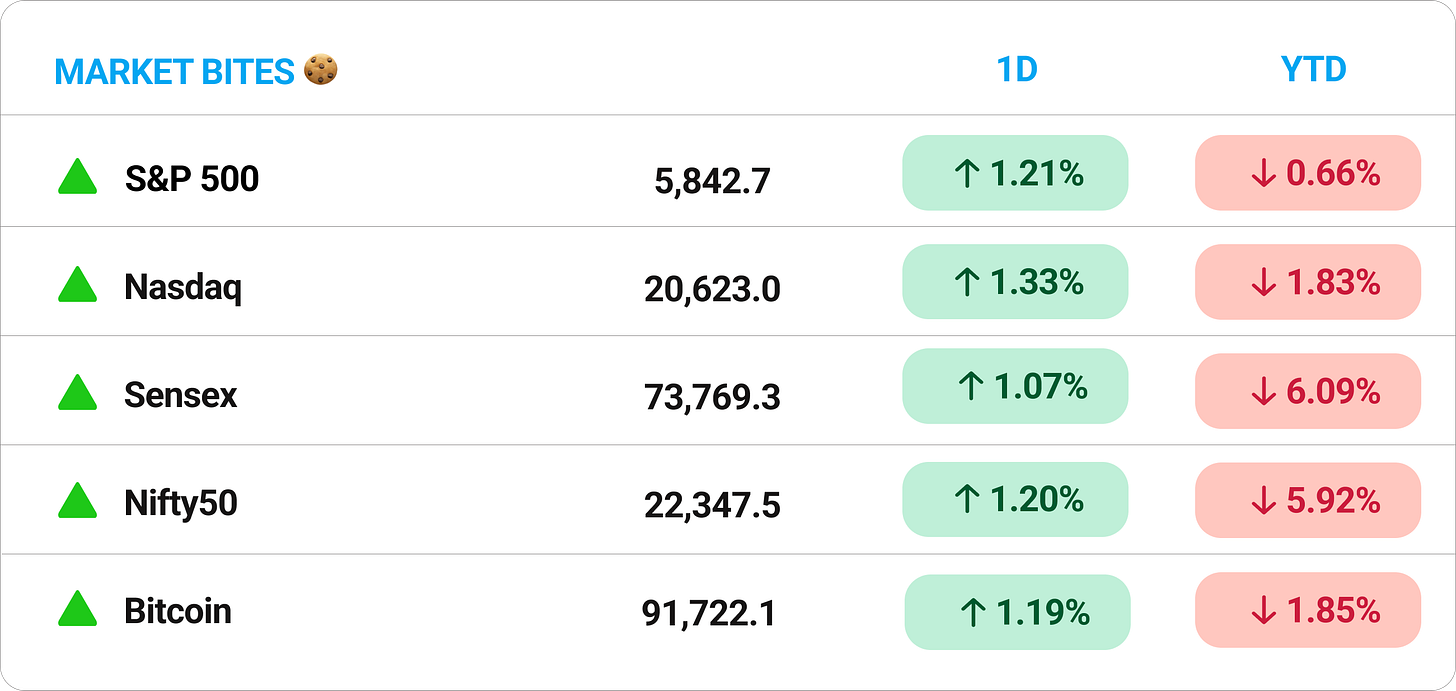

Markets bounced back big on Wednesday, snapping Nifty’s 10-day losing streak with its biggest single-day gain in a month. Despite tariff concerns, key indices climbed over 1%.

💡 Spotlight: India’s services sector rebounded sharply in February, after hitting a two-year low in January. The HSBC India Services PMI jumped to 59.0 from 56.5, signaling stronger business activity and demand.

Faster output expansion and a hiring boost drove the recovery.

Meanwhile… the Rupee had a big day

The Indian rupee posted its best day in over three weeks, appreciating over 30 paise at close on March 5. A rare moment of strength in a volatile currency market.

1 Big thing: Who run the world?💰

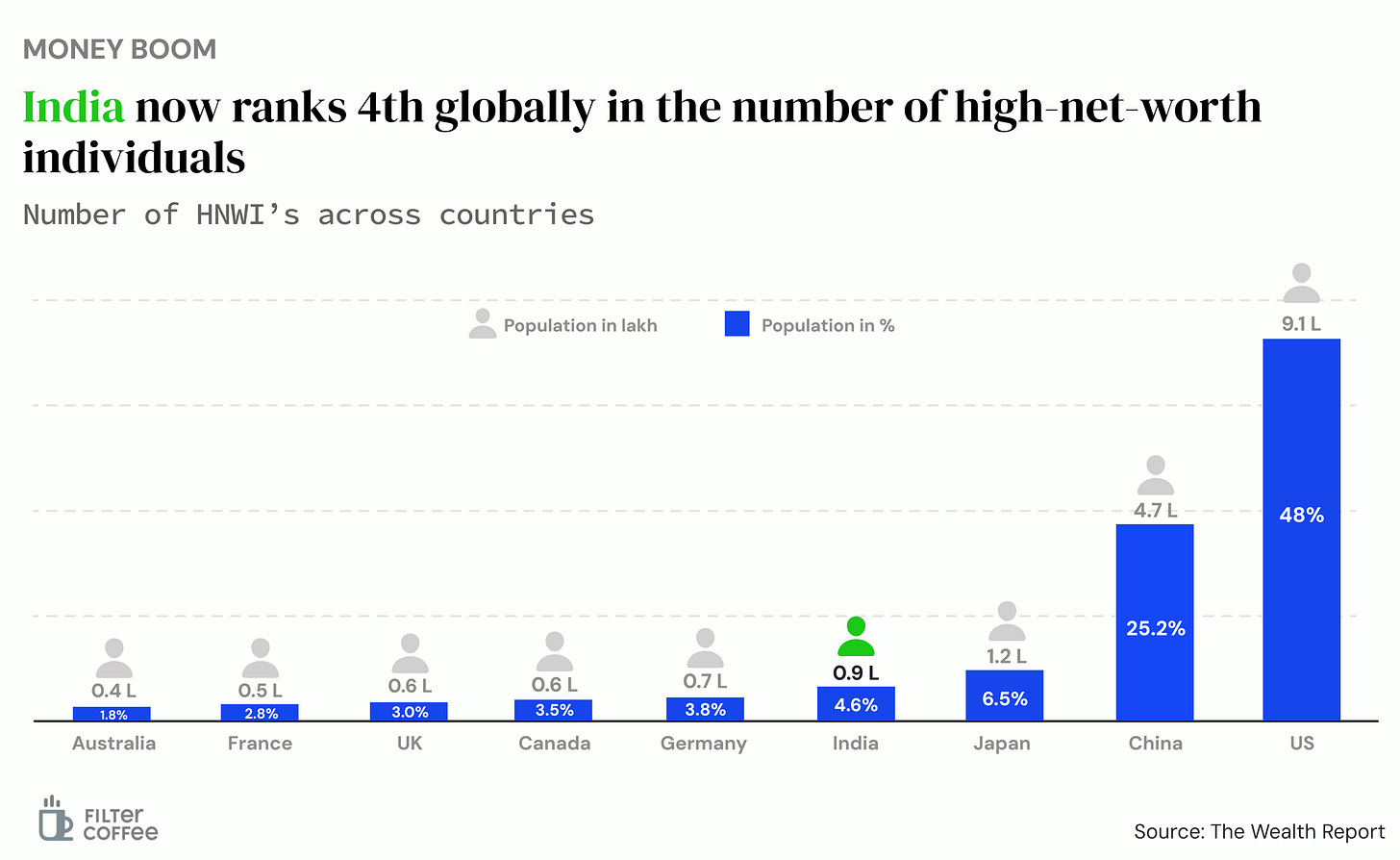

India’s wealthy are multiplying fast, and it’s no longer just old money calling the shots.

India now has 85,698 High Net-Worth Individuals (HNWIs), making it the 4th largest wealth hub globally, right behind the US, China, and Japan.

HNWIs are those who have at least $1 million to invest, excluding their homes and daily expenses.

Meanwhile, India’s billionaire count jumped 12% last year, reaching 191.

Worth noting: 26 new billionaires out of this were minted in 2024 alone, up from just 7 in 2019.

What’s fueling this: a booming startup ecosystem, growing entrepreneurship, and a strong economy are creating a new generation of wealth. Risk appetite is also rising, particularly in emerging markets, which accelerates the momentum even further.

Big picture: globally, the number of HNWIs grew by 4% in 2024, now crossing 2.3 million people. The UHNWI club, which includes those with over $100 million in assets, also crossed 100,000 for the first time—a sign of rising wealth across the board.

India is firmly securing its place among emerging wealth powerhouses like France, Brazil, and Russia.

2. Darwinbox takes on HR-tech giants 💼

HR-tech startup Darwinbox just secured $140 million in a funding round led by Partners Group and KKR.

The deets: the company operates a cloud-based HR platform that handles recruitment, payroll, employee engagement, and people analytics. With this fresh capital, Darwinbox is doubling down on AI-driven product innovation and expanding its footprint in the U.S.

By the numbers: while growth is in motion, Darwinbox isn’t in the green just yet. In FY24, revenue stood at ₹392.9 crore, while net loss was ₹191.8 crore.

Nearly 60% of the company’s customers are in markets outside India.

While we’re on fundraises…

D2C home appliances brand Nuuk raised $5 million in a Series A round led by Vertex Ventures SEAI.

Founded by ex-Noise Chief Growth Officer Shalabh Gupta, Nuuk designs stylish, functional home appliances like fans, vacuum cleaners, and juicers, targeting modern households looking for alternatives to old school brands.

The company aims to manufacture over 50% of its products in India by FY26.

3. Amazon bets big on India 🤝

AWS is investing $8.3 billion in Maharashtra, pushing India further into the global cloud ecosystem.

The deets: this investment is part of AWS’ $12.7 billion India Cloud infra commitment by 2030.

Amazon plans to deploy cutting-edge GPUs, AI tech, and cloud management services to meet the country’s cloud and AI needs.

Why it matters: AWS first set up shop in Mumbai in 2016, followed by an expansion to Hyderabad in 2022. This latest $8.3 billion push was signed at Davos through an MoU with the Maharashtra government.

The expansion is projected to add $15.3 billion to GDP and create over 81,300 jobs annually across data center supply chains.

Zoom out: India’s public cloud market is set to hit $12.7 billion in 2025, growing at 23.5% annually through 2029.

4. ONGC’s joins the green race ☀️

ONGC, India’s largest government-owned oil producer, acquired clean energy firm PTC Energy for ₹925 crore.

In February, ONGC announced a ₹1,200 crore investment in ONGC Green to fund this acquisition. The move helps the company de-risk its business, and make strategic bets on energy transition.

As a reminder: just recently ONGC had acquired Ayana Renewable Power in a $2.3 billion joint deal with NTPC Green Energy.

Now, with PTC Energy, which operates 288 MW of wind power, ONGC is expanding into the wind arena. The company will add ₹322 crores in new revenue.

Why it matters: through its unit ONGC Green, the company aims to build a 10 GW renewable energy portfolio by 2030.

Big picture: India aims to install 500 GW of non-fossil fuel capacity by 2030. With oil demand uncertain in the long run, ONGC is hedging its bets for the future

While we are on acquisitions, Adani cant seem to get enough of FMCG.

Adani Wilmar, the Adani Group’s FMCG play, paid ₹603 crores to acquire GD Foods, a company which makes Tops sauces and condiments.

The deets: Adani Wilmar is looking beyond edible oils. Tops, already a top-three brand in ketchup and pickles, will now get a major distribution boost under Adani’s network.

Why GD Foods: GD Foods has a stronghold in seven North Indian states, with a retail presence across 1.5 lakh outlets. In FY24, it reported ₹386 crore in revenue, making it a solid addition to Adani Wilmar’s portfolio.

5. Big Daily Movers 🚀

1. Coforge shares soared 10% after it bagged 2 deals and announced a stock split.

The deets:

$1.3B Sabre deal – Coforge to manage Sabre’s software and AI operations for 13 years.

Acquisitions – Bought Rythmos ($30M) & TM Labs to strengthen data, IT, and automation capabilities.

1:5 stock split – Shareholders get 5 shares for every 1 held, boosting liquidity and accessibility.

Coforge snapped its four-day losing streak as markets recorded their biggest single-day surge in a month.

2. RVNL jumped over 7% after winning a ₹729 crore order from the Himachal Pradesh electricity board. The contract, to be completed in 24 months, will focus on developing power distribution infrastructure under the RDSS scheme.

The RDSS (Revamped Distribution Sector Scheme) is a five-year government plan launched in July 2021 to improve India’s power supply, ensuring reliability and affordability.

RVNL had dropped 30% in February as global tensions dragged markets lower, but this fresh order helped the stock make a minor recovery.

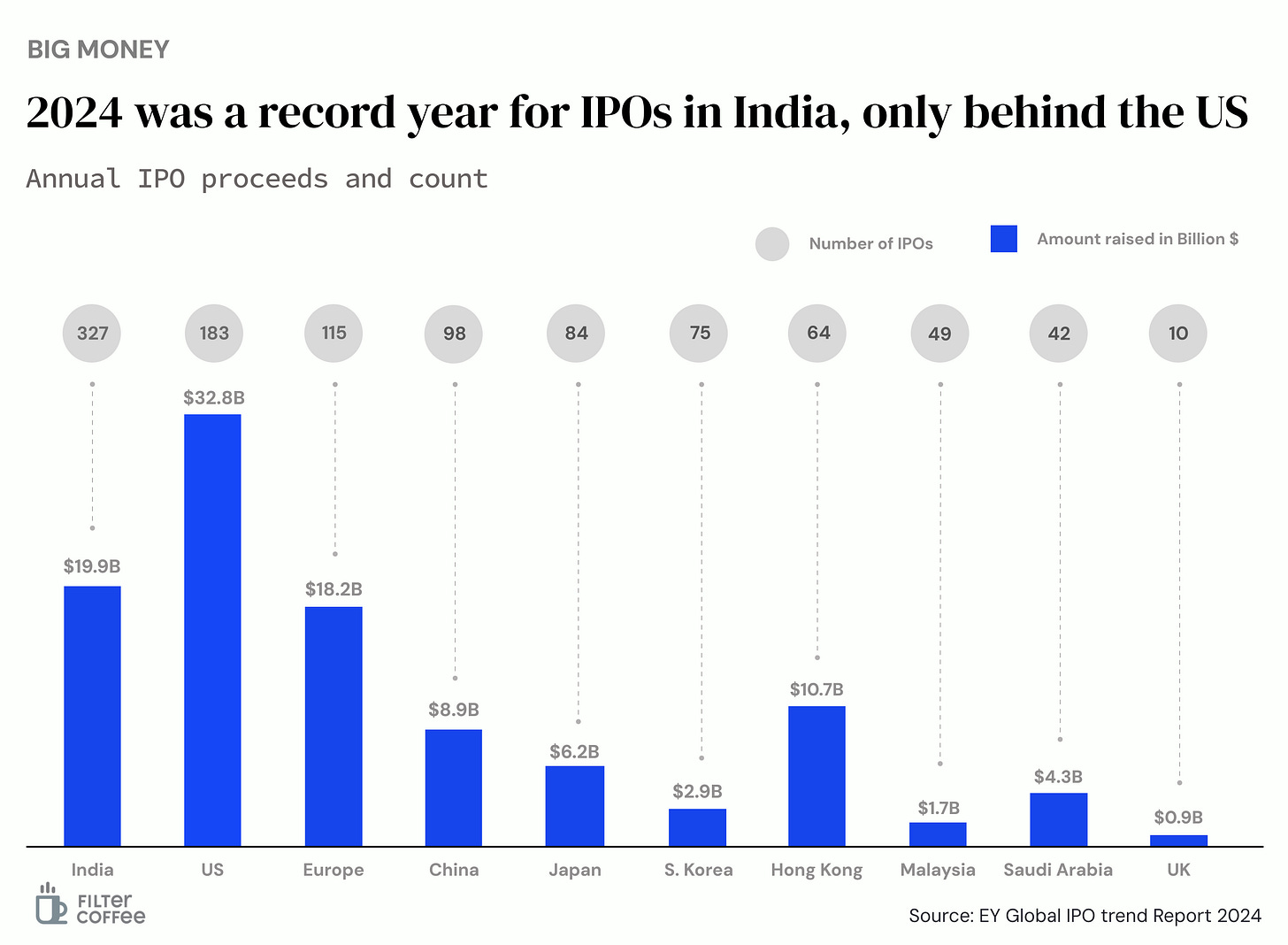

6. Story in data — India’s IPO Frenzy 📈

India saw the highest number of IPOs in 2024, but the U.S. dominated in capital raised—underscoring the gap in deal sizes.

But relative to markets like Europe, India clearly punches above its weight—a testament to its deepening capital markets.

What else are we snackin’ 🍿

👗 Luxury shake-up: Prada is closing in on a deal to buy Versace from Capri Holdings for nearly $1.6 billion.

🚡 Ropeway rush – Kedarnath & Hemkund Sahib get a ₹6,811 crore ropeway, cutting travel time to 36 minutes. Pilgrims can now glide instead of trek.

🛂 Visa boom – India’s visa applications jumped 11% in 2024, surpassing pre-pandemic levels. Demand for doorstep visa services has surged 6x since 2019.

✈️ Takeoff: IndiGo launched direct Mumbai-Krabi starting with six weekly flights.

🤝 Cemented: Ambuja Cements got CCI’s approval for the acquisition of a 46.8% stake in Orient Cement.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.

The news about Adani is incorrect...fact is that adani is exiting FMCG space by divesting its stake in Adani Wilmar