🗓️ Morning, folks 👋

The weekend is almost here!

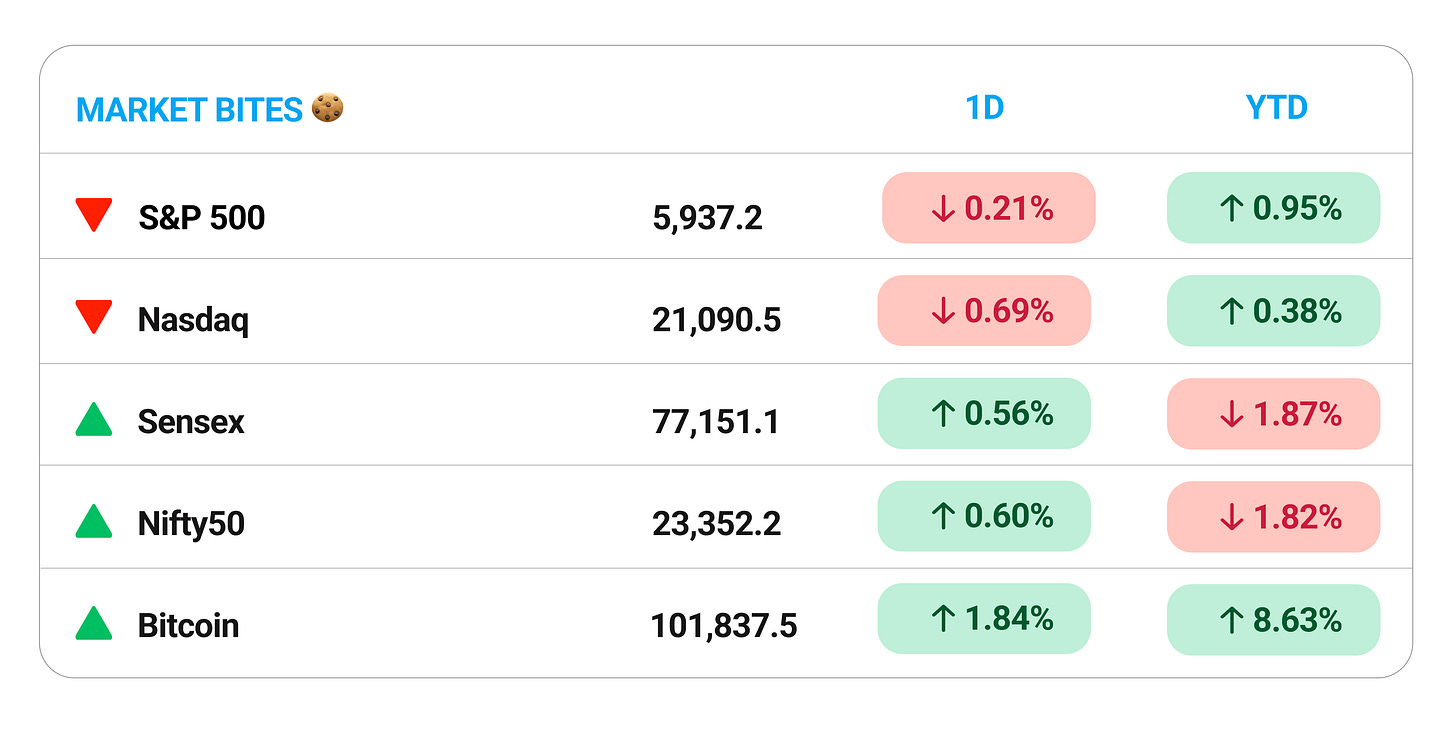

📈 Markets held steady yesterday, with Sensex and Nifty both rising around 0.42%.

💡 Spotlight: India is set to surpass 900 million internet users by 2025, all thanks to growing rural connectivity.

Also, India hit a huge milestone yesterday, becoming the fourth country to achieve unmanned satellite docking in space with ISRO’s SpaDeX mission.

The mission docked two satellites in low-earth orbit, joining the ranks of the U.S., Russia, and China.

A couple of things went down today.

Let’s hit it.

1 Big Thing: Hindenburg calls it quits 🔥

Adani can finally sleep easy tonight.

Hindenburg Research, the short-seller that terrorized markets and wiped billions off Adani Group’s valuation, is shutting down.

Nate Anderson, the founder announced the decision in a lengthy blogpost, which highlights the humble beginnings of Hindenburg. Here’s a link.

Backstory: Hindenburg gained global notoriety in 2023 after its report accusing Adani Group of stock manipulation and improper use of offshore tax havens came out.

The fallout erased over $100 billion from Adani companies and triggered regulatory investigations worldwide.

And while the Adani-short may have hogged all headlines, some of Hindenburg’s work was actually quite on point — including the short report on EV company Nikola, which ended up being spot on.

Here’s a quick look at their track record:

Why it matters: over seven years, Hindenburg’s reports led to nearly 100 regulatory charges and wiped billions from overvalued companies.

Critics accused it of profiting from chaos, but supporters saw it as a necessary watchdog.

Anderson plans to open-source Hindenburg’s investigative methods over the next six months, offering a rare glimpse into their playbook.

Adani stocks partied hard today, jumping up to 9% after the news hit the street.

2. Big daily movers 🚀

1. Sun Pharma’s subsidiary, Taro Pharma, is acquiring 100% of Antibe Therapeutics.

Antibe is a Canadian biotech firm specializing in pain and inflammation drugs.

The acquisition aligns with Sun Pharma’s strategy to expand its healthcare portfolio.

Sun Pharma’s stock rose over 0.50% following the announcement.

2. Bharat Dynamics Limited (BDL) surged after securing a contract worth ₹2,960 crore to supply Medium Range Surface to Air Missile (MRSAM) systems to the Indian Navy.

BDL specializes in manufacturing missiles, torpedoes, and advanced defense systems for India’s armed forces.

The deets: the contract enhances the Navy’s air defense capabilities and strengthens BDL’s standing as a key player in India’s defense sector.

Why it matters: this deal supports India’s drive for self-reliance in defense manufacturing. In FY24, the sector’s production value reached ₹1.3 trillion, highlighting its growing importance and potential.

Mr. Market liked the optimism, stock climbed nearly 6% today.

3. Deals that made noise 💰

Amazon is acquiring Axio, a buy-now, pay-later startup, in a deal worth over $150 million.

The deets: Axio provides credit at checkout on platforms like Amazon and MakeMyTrip, with a loan book of $260 million and over 10 million customers.

The deal comes after six years of partnership, with Amazon holding an equity stake in Axio since 2017.

Amazon had previously acquired MX player in June. This makes Axio its second acquisition in India in a year.

With integrated credit, Amazon can cut deeper into financing high value purchases in India, something that players like Flipkart do quite robustly.

Google has agreed to buy 100,000 tons of carbon removal credits from Indian startup Varaha by 2030.

Varaha produces biochar from invasive plants to remove carbon from the atmosphere and improve soil health.

Biochar is a carbon-rich solid created from organic waste and used to improve soil health, fertility, and water retention.

Why it matters: each ton of biochar generates 2.5 carbon credits, with Google’s purchase supporting Varaha’s goal of reaching 1 million credits annually by 2030.

The deal, Google’s first carbon credit partnership in India, is part of its commitment to net-zero emissions by 2030.

For Varaha, it’s a major validation of its tech-driven carbon removal efforts across Asia and Africa.

4. Meta Faces India’s Antitrust Heat 🔥

Meta is fighting an Indian antitrust ruling that bans WhatsApp from sharing user data with Meta for advertising.

The company warns it may have to pause or roll back features in India.

What happened: the Competition Commission of India (CCI) fined Meta $24.5 million and imposed a five-year ban on data sharing, accusing the company of coercing users into accepting its 2021 privacy policy.

Meta argues the ban could hurt its ability to offer personalized ads on Facebook and Instagram, which it claims impacts its commercial viability.

BTW: India is Meta’s top country by users, with 378 million people. The United States is a far second, with 193 million users.

What else are we snackin’ 🍿

🚀 Space upgrade: India approved ₹3,984 crore to build ISRO’s third launch pad at Sriharikota, supporting next-gen rockets and human space missions.

🛸 Web3 push: Jio partnered with Polygon Labs to boost Web3 adoption and improve digital experiences in India.

🛵 Rapid Commerce: Delhivery launched Rapid Commerce, offering sub-2-hour delivery for brands to meet rising consumer demand.

📱Dethroned: Apple is no longer China’s top smartphone seller, with Vivo and Huawei taking the lead in 2024.

And that’s a wrap. Pour yourself an extra one this weekend.

We’ll be back like clockwork on Monday!

Hit that 💚 if you liked this issue.