2026 gets its first unicorn 🦄

India-EU pact, India’s chip push, and JSW steel shines.

🗓️ Morning, folks and Happy Tuesday! ☀️

India and the EU are close to sealing a long-pending trade deal, with an announcement expected at today’s summit.

EU leaders are calling it the “mother of all deals”. The urgency has also been sharpened by rising US tariffs, pushing both India and the EU to secure stable trade partners beyond Washington and Beijing.

India is reportedly willing to slash import duties on select EU-made cars:

Current tariffs: 70–110%

Proposed cut: down to 40% initially, tapering toward 10% over time

Likely quota: ~200,000 cars a year (ICE vehicles only)

EVs excluded for five years to protect domestic investments

Meanwhile, India wants better EU access for textiles, garments, leather, gems and jewellery, engineering goods, plus easier rules for IT services, pharma, and skilled professionals.

The EU, meanwhile, is eyeing lower duties on wines and spirits (currently 150–200%), machinery, chemicals, and medical devices, along with stronger investment protections.

Let’s hit it!

1. Welcome to India, Micron 🇮🇳

US chipmaker Micron Technology is set to start commercial semiconductor production at its $2.75 billion plant in Sanand, Gujarat, by the end of February.

The deets: speaking at the World Economic Forum in Davos, IT Minister Ashwini Vaishnaw said pilot production is already underway at multiple approved chip facilities.

Four chip firms are on track to start commercial production in 2026, with projects backed by Micron, Tata, Kaynes, and CG Semi currently in pilot and trial phases.

Why it matters: India wants to become a reliable hub for global chip supply chains and reduce its dependence on imported semiconductors.

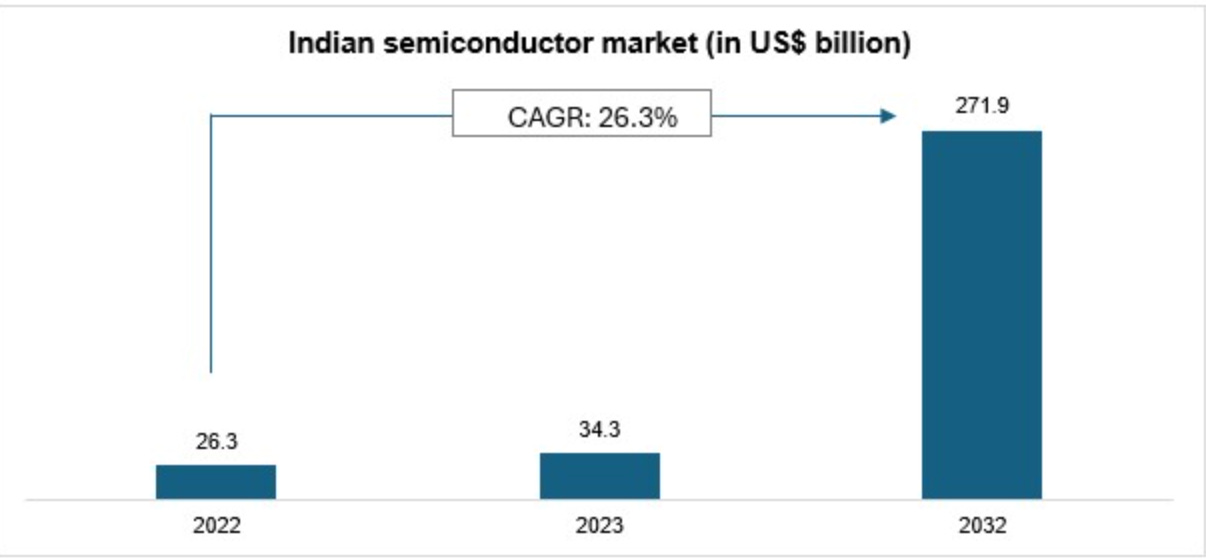

In 2022, the Indian semiconductor market was valued at $26.3 billion and is projected to expand at an annual rate of 26.3% to $271.9 billion by 2032.

2. Marico goes popcorn shopping 🍿

PVR INOX is selling its entire stake in Zea Maize Pvt Ltd. in a ₹226.8 crore deal, the company behind the popcorn brand 4700BC, handing it over to Marico and officially moving a cinema-born snack into the FMCG play.

This also ends PVR INOX’s nearly 10-year association with 4700BC.

PVR had bought a 70% stake in 4700BC in 2015 for around ₹5 crore, and is now cashing out to strengthen its balance sheet, cut debt, and focus on theatres.

For Marico, it’s a neat add-on: a fast-growing premium snacking brand in a market that’s getting bigger and more ‘upgrade’ friendly.

3. JSW Steel: Q3 profit soars ⚡️

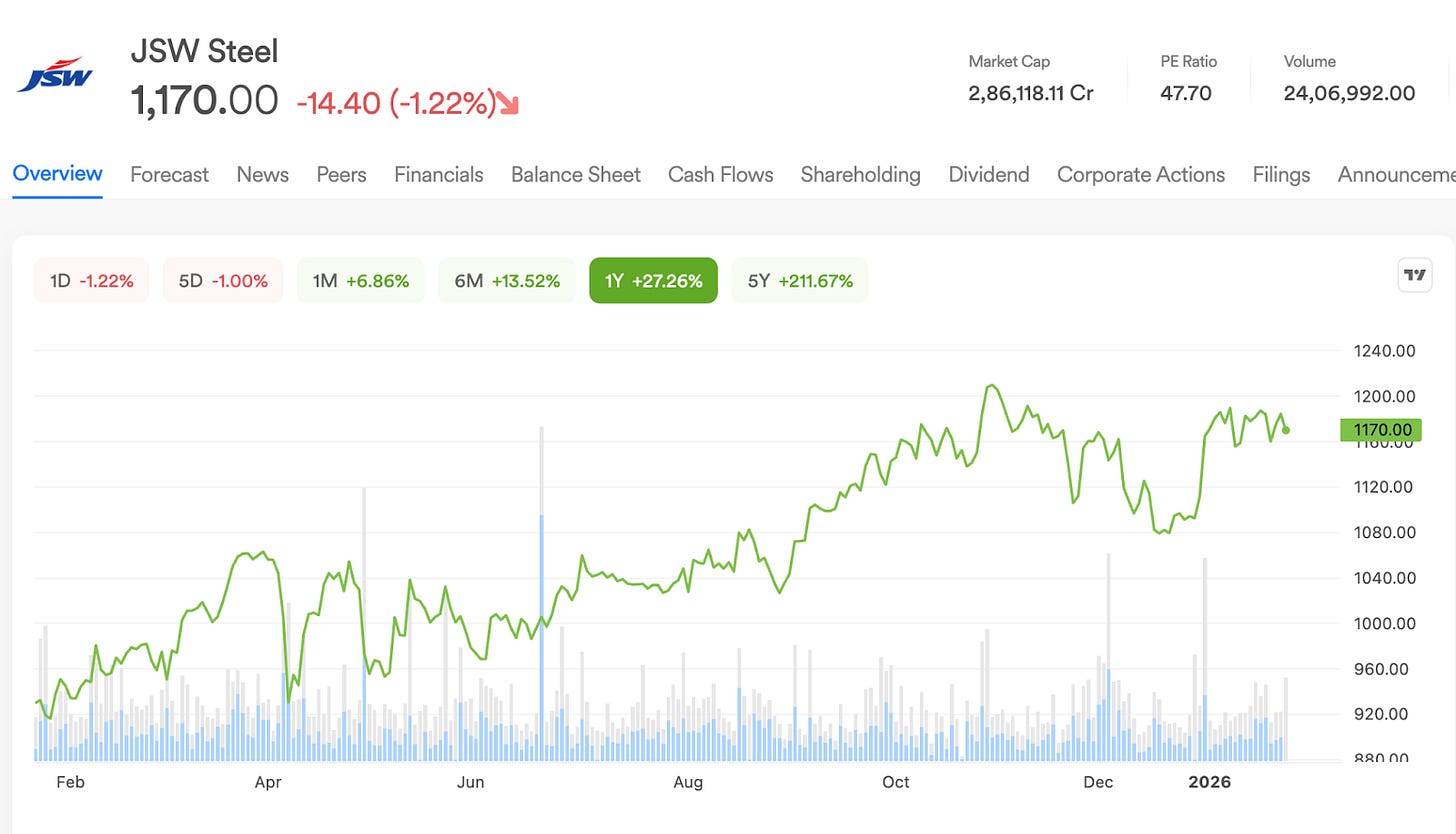

JSW Steel posted a strong quarter, beating expectations across almost all parameters.

Some key numbers:

Net profit: up 198% YoY to ₹2,410 crore vs ₹719 crore

Revenue: up 11.1% YoY to ₹45,991 crore vs ₹41,378 crore

What drove it: the company sold more steel, volumes rose 14% to 7.64 million tonnes, and its India plants ran at 93% capacity, meaning operations were close to full speed.

Profit was also boosted by a one-time tax benefit of ₹1,439 crore linked to Bhushan Power and Steel.

Crude steel output rose 6% to 7.48 million tonnes, helped by the ramp-up at the Vijayanagar Metallics project.

4. Juspay kicks off 2026’s unicorn club 💸

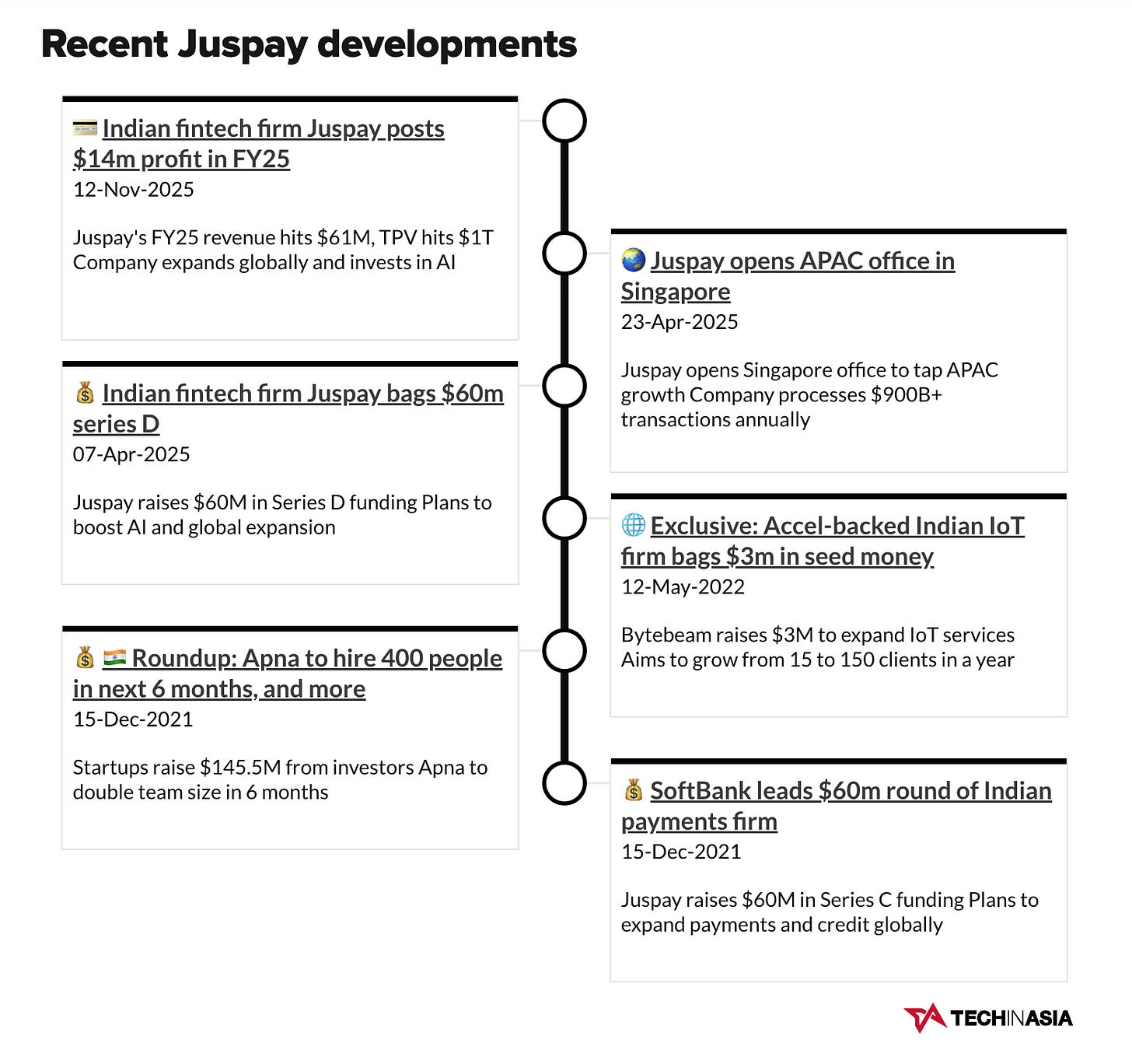

Juspay bagged $50 million in a Series D round led by WestBridge Capital, valuing the company at $1.2 billion and making it one of the first unicorns of 2026.

Bengaluru-based Juspay builds payment technology that helps enterprises and banks handle large volumes of digital transactions.

The why: this is the company’s second liquidity event in the past year and funds will be used for global expansion and product development.

Since July last year, several fintechs including Cashfree, Amazon Pay, BillDesk, PayU and Razorpay have received RBI’s cross-border payment aggregator (PA-CB) licences.

The licence lets them serve more online merchants and access new customer segments.

Earlier, SMEs depended on players like PayPal or global banks for cross-border payments. Non-bank aggregators could route transactions through banks, but low limits and heavy paperwork often caused delays.

PA-CB licences change that, allowing regulated fintechs to directly serve online exporters and global merchants.

While we are on fundraises, 💰

Optimist has raised $12 million in a seed round led by Accel and Arkam Ventures, with participation from prominent angel investors.

What’s the hype: Optimist is building technology-led air conditioners designed for Indian climates, aided by strong R&D and real-world testing to serve India’s diverse weather conditions.

5. India’s rubber industry clocks a strong FY25 🛞

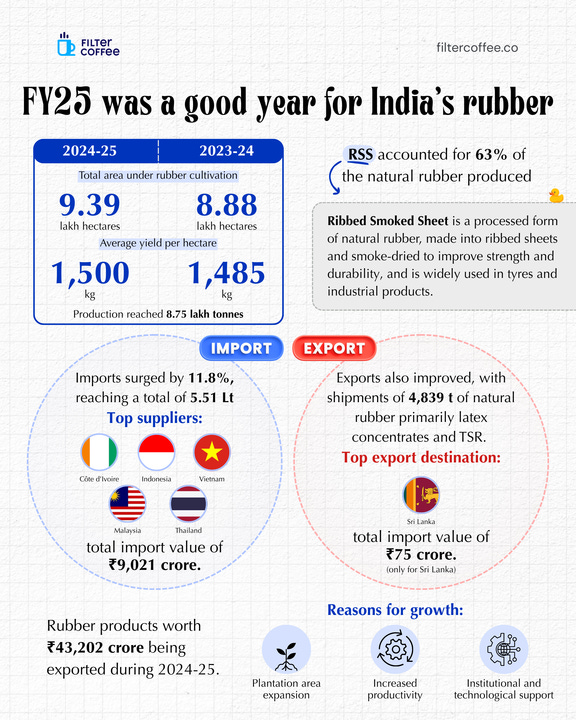

India’s rubber sector had a solid FY25. Area under rubber cultivation rose to 9.39 lakh hectares, yields improved to 1,500 kg per hectare, and total production touched 8.75 lakh tonnes.

A big chunk of this came from Ribbed Smoked Sheet, which made up 63% of natural rubber output.

In simple terms, better farming practices and higher productivity helped the sector grow without dramatic expansion.

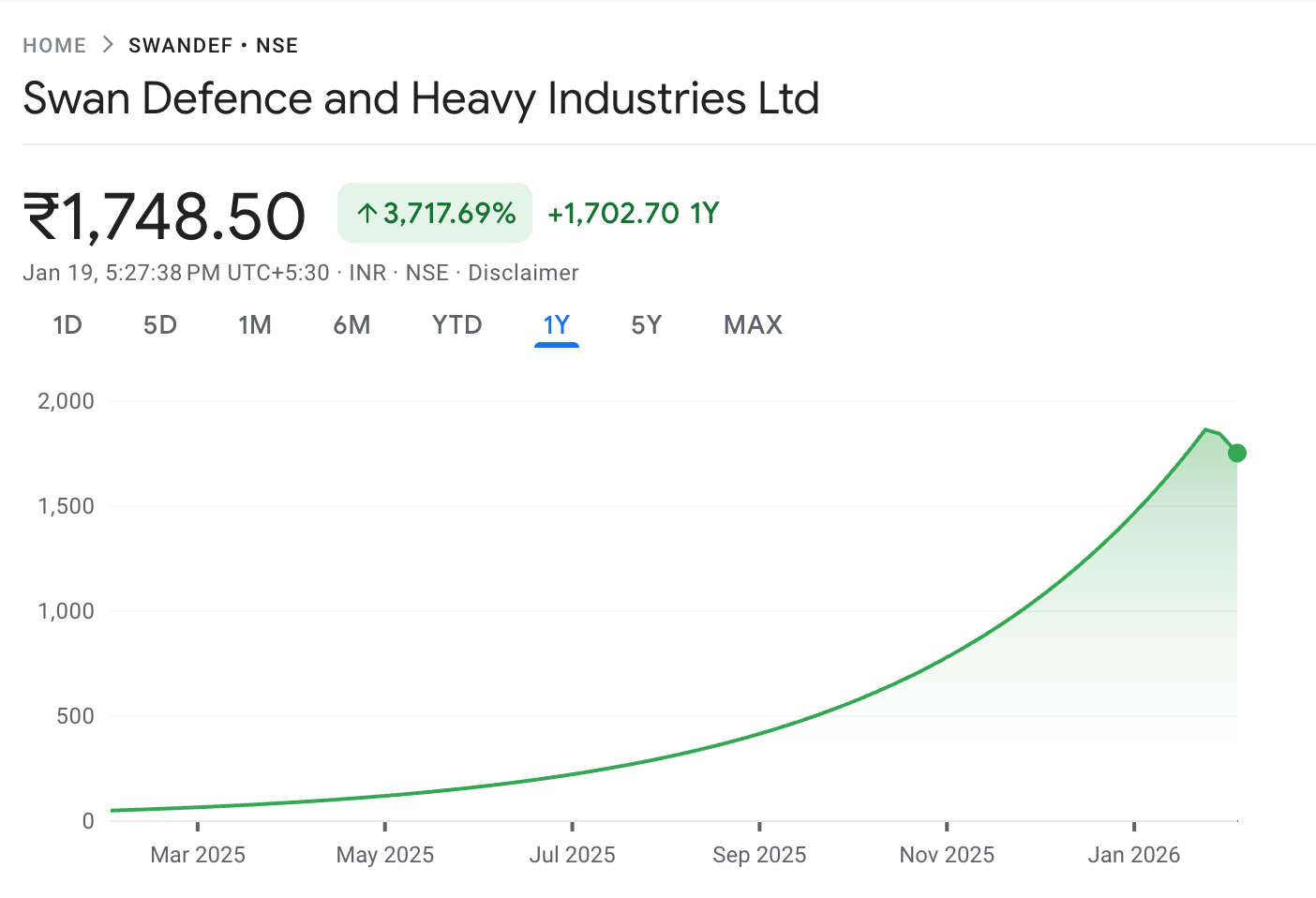

6. Stock that kept us interested 🚀

1. Swan Defence secures $227M Europe tanker order 🚢

Swan Defence and Heavy Industries (SDHI) bagged a $227 million order to build six chemical tankers for European shipowner Rederiet Stenersen AS.

Note: this marks the company’s first new-build contract since the revival of its Pipavav shipyard in Gujarat.

About the deal: the order is for six IMO Type II chemical tankers, each with 18,000 DWT, with an option for six more sister vessels.

What else are we snackin’ 🍿

💼 Layoff wave: Amazon is set to lay off thousands more in a second round of job cuts within three months, with reports suggesting announcements could come in late January.

📈 PMI bounce: India’s flash PMI rose to 59.5 in January from 57.8 in December, with both manufacturing and services seeing similar growth momentum.

🏏 RCB bid: Adar Poonawalla said he will put in a “strong and competitive” bid for IPL franchise Royal Challengers Bengaluru in the coming months.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚if you liked this issue.