🗓 Morning, folks!

Markets mostly traded sideways on Wednesday, with the Sensex and Nifty adding roughly 0.2%. Investors are taking a measured approach, digesting the rapid run up immediately post-war.

Back in the west, the S&P has shrugged off all Trump tariff losses and is now back to adding more green on the year.

💡 Spotlight: India’s wholesale inflation just cooled to a 13-month low. WPI grew just 0.85% in April, down from 1.26% in March, driven by a sharp drop in food inflation from 4.66% to 2.55%.

Wholesale Price Index (WPI) tracks wholesale prices before goods hit retail shelves offering early signs of cost trends across the economy.

Inflation stayed mildly positive due to rising prices in food manufacturing, transport equipment, chemicals, and machinery.

Let’s hit it!

1 Big Thing: Samsung buys the FläktGroup ❄️

Samsung Electronics will pay $1.68 billion to buy a data center cooling supplier, FlaktGroup, from European investment firm Triton.

Fläkt supplies high-performance heating and cooling systems to large facilities, especially data centers. As you all know, with GPUs and AI processing demands growing, which tend to be power hungry, the data center cooling space has been on fire lately.

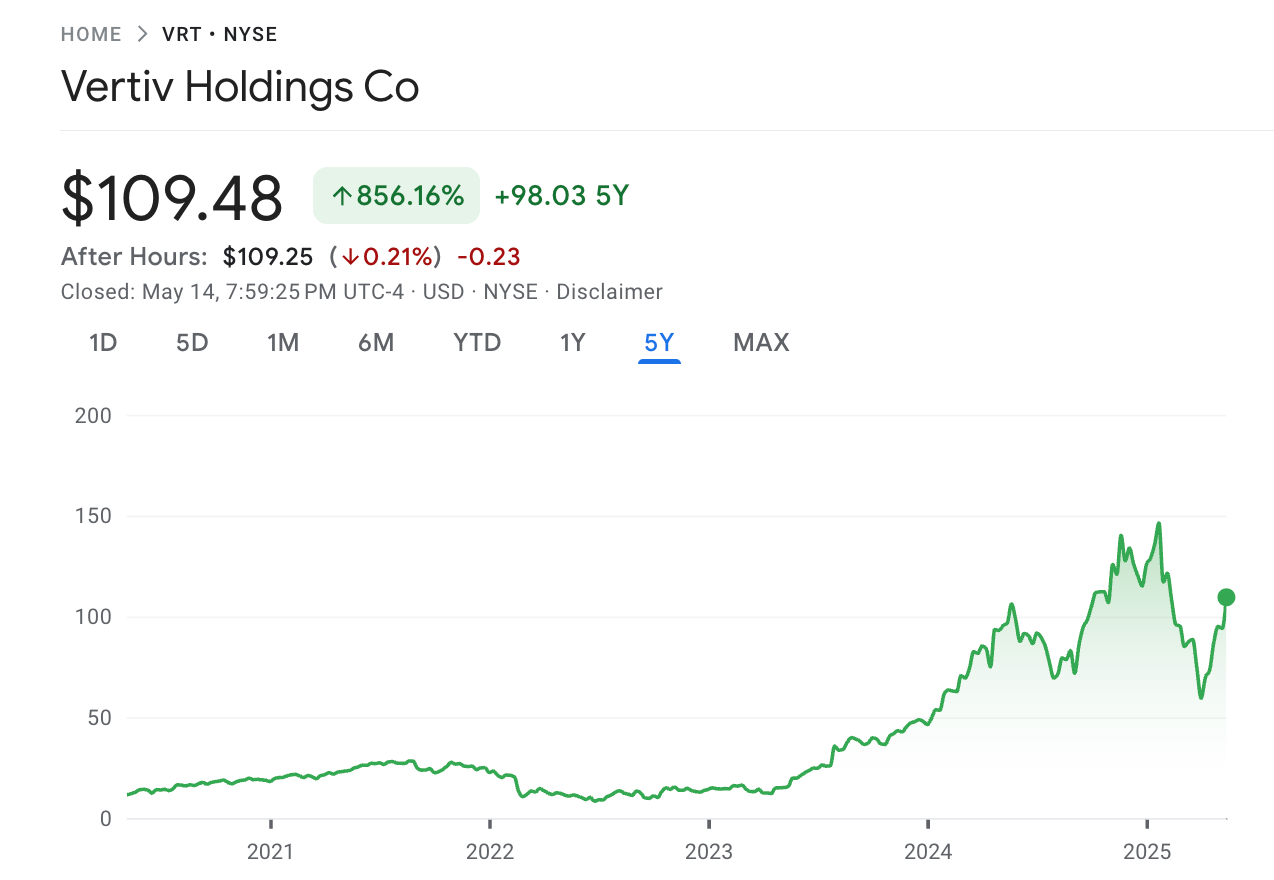

One of the largest cooling systems provider, Vertiv, has seen it’s stock run up heavily and in sync with Nvidia since ChatGPT went live. Samsung clearly wants a piece of the market for itself.

Outside of data centers, the deal also gives Samsung exposure to the industrial Heating, Ventilation, and Air Conditioning (HVAC) market, where it’s looking to compete head-on with rivals like LG Electronics.

2. Quick earnings in focus 🚨

1. KPI Green’s clean energy bets pay off ⚡

KPI Green wrapped up its Q4 with profits more than doubling and revenue nearly hitting the ₹570 crore mark.

The company’s aggressive renewable push, spanning solar, wind, and hybrid parks, is expanding its project pipeline to 3.9 GW.

Margins dipped slightly, but strategic land grabs near substations and fresh MoUs in Odisha, Rajasthan, and MP are keeping growth steady.

Investors liked the story, the stock surged 28% in just three days.

2. Airtel’s Q4 printed some serious cash 📶

Airtel’s net profit jumped 432% YoY to ₹11,022 crore, riding on higher prices for plans, premium users, and a solid broadband push.

India’s mobile business led the charge, while Homes quietly added 2.4 million new connections.

On the flip side, Airtel Business segment had a muted quarter, with revenue dipping 2.7%. But the drop was intentional as the company is phasing out low-margin deals in favour of a more strategic, high-value portfolio.

Rural users now make up over half of India’s internet base. Airtel’s focus on this market has been their distinct advantage.

3. Jubilant shows fast food is still profitable 🍕

Jubilant FoodWorks, which runs popular brands like Domino’s, Dunkin’, and Popeyes in India, beat expectations in Q4, reporting a surprise ₹49 crore profit.

Revenue rose 34% to over ₹2,100 crore, driven by demand recovery and new store momentum across metros and Tier-2 cities.

Domino’s massive scale helped cushion cost pressures, while other brands like Popeyes continued to expand.

3. Retail giant More files for a ₹2,000 crore IPO 🛒

More Retail, the food and grocery player, is looking to raise around ₹2,000 crore through an IPO.

What’s cooking: the company plans to raise the fund by diluting 10% through an IPO in the next 12–18 months. Plans are to expand aggressively and wipe out debt.

More wants to scale its store count from 775 to up to 3,000 stores in the coming years. FY26 alone will see it cross 1,000 stores.

The brand has good reach, consumers continue to favor hyper-marts, which could both be factors driving tailwinds.

But the disruption of everyday grocery by quick commerce is likely to be a hurdle — one that could discourage investors from going all in.

While we are on IPOs,

Greaves Electric Mobility, the EV arm of Greaves Cotton, got the nod from SEBI for its IPO. The offering includes a ₹1,000 crore fresh issue

The EV maker best known for its Ampere e-scooters and Ele e-rickshaws plans to use the funds for new product development, battery assembly, capacity expansion, and tech upgrades across its three plants in Tamil Nadu, Uttar Pradesh, and Telangana.

Greaves Cotton ended nearly 3% higher following the news.

4. Flam raises $14M 🕶️

AI marketing company Flam secured $14 million in Series A funding to ramp up its mixed reality (MR) and enterprise offerings.

The company builds backend systems for large-scale AI and immersive MR—where users can interact with virtual objects in real time.

Flam already works with 100+ brands including Google, Samsung, Flipkart, Emirates, and even the US Presidential Elections.

The fresh funds will fuel global expansion across North America, Europe, the Middle East, and deepen growth in Asia.

5. Stocks that kept us interested 🚀

1. HBL Engineering will build Kavach 4.0

HBL Engineering jumped 11% after becoming the first company to receive approval for Version 4.0 of its Kavach train collision avoidance system.

Version 4.0 of HBL’s Kavach system is the latest upgrade of India’s automatic train protection technology. HBL will start deliveries from its ₹3,763 crore order book over the next 24 months.

Zoom out: despite cooling off from its all-time high, the stock has delivered monster returns of 441% over two years.

2. MTAR Tech secures global deals worth ₹34 cr

MTAR Tech gained over 2% after securing ₹34 crore worth of orders from US & Israel in the clean energy and aerospace sectors.

The deets:

The clean energy order comes from US-based Bloom Energy, valued at ₹21 crore.

The aerospace order is from Israel-based Rafael Advanced Defense Systems, worth ₹12.98 crore.

MTAR will supply high-precision components critical to energy systems and defence-grade aerospace platforms.

3. Sterling Tools spins into EV action ⚙️

Sterling Tools jumped 4% after its EV arm, Sterling Gtake, signed an exclusive licensing deal with UK-based AEM for magnet-free traction motors.

The deets: with this deal, the company is stepping into the world of magnet-free traction motors for electric vehicles.

These motors skip rare-earth materials, cutting costs without compromising performance, and are a smarter alternative to traditional EV designs.

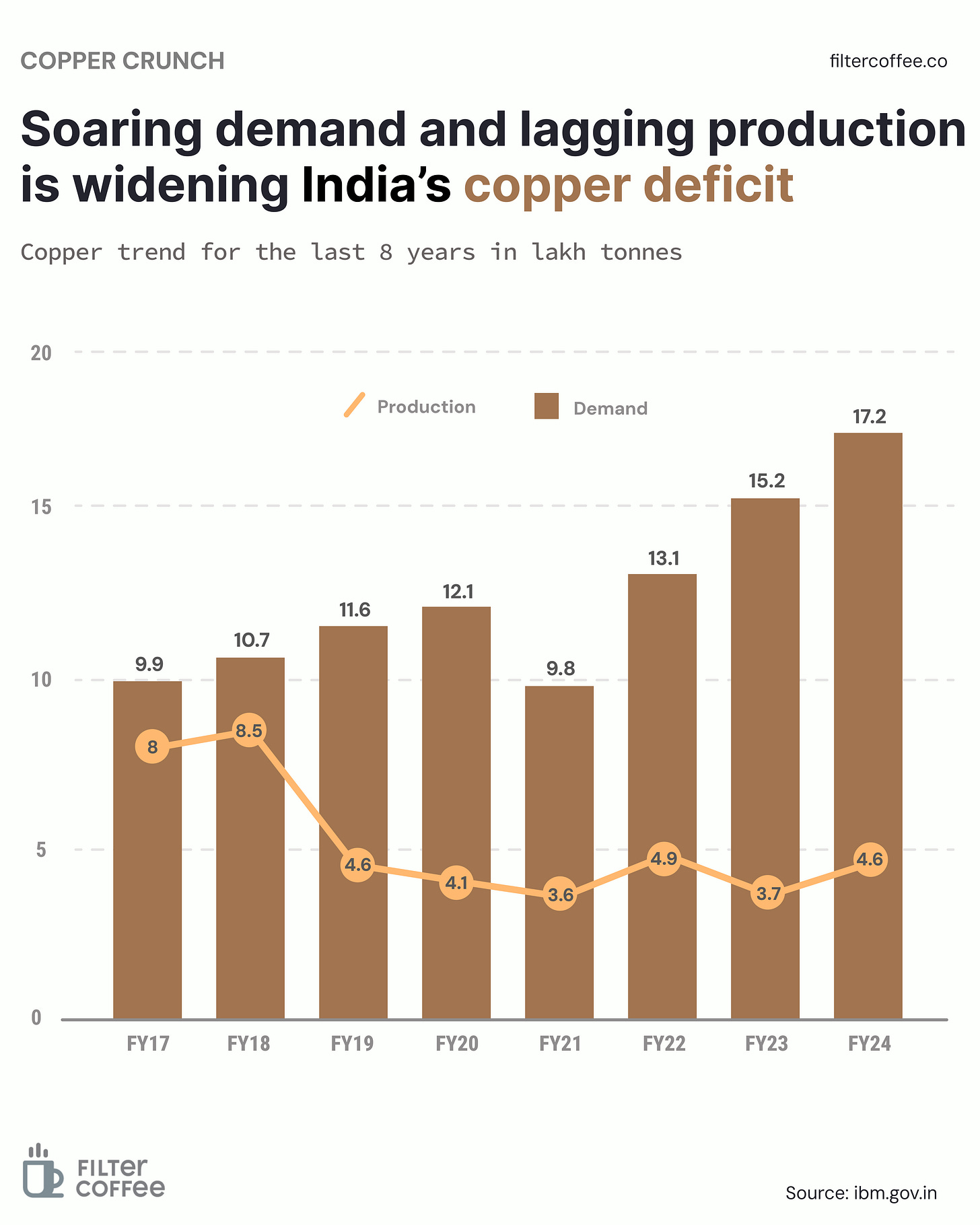

With copper demand surging and production stagnating, India’s supply gap has widened sharply—just as global industries double down on electrification.

What else are we snackin’ 🍿

🪨 Coal crunch: coal imports dipped 9.2% between April ’24 and Feb ’25, down to 220.3 million tonnes, compared to 242.6 MT last year.

🛸 Sky slayer: India just successfully tested Bhargavastra, a homegrown counter-drone system designed to neutralise modern aerial threats like groups of enemy drones.

🥇 Glitter check: Gold prices cooled off by ₹540 to ₹96,060 per 10 grams after US-China trade tensions eased.

That’s a wrap! Don’t let the weekday blues get to you.

And if you’d like to place your brand on this newsletter, let us know.

Hit that 💚 if you liked this issue.